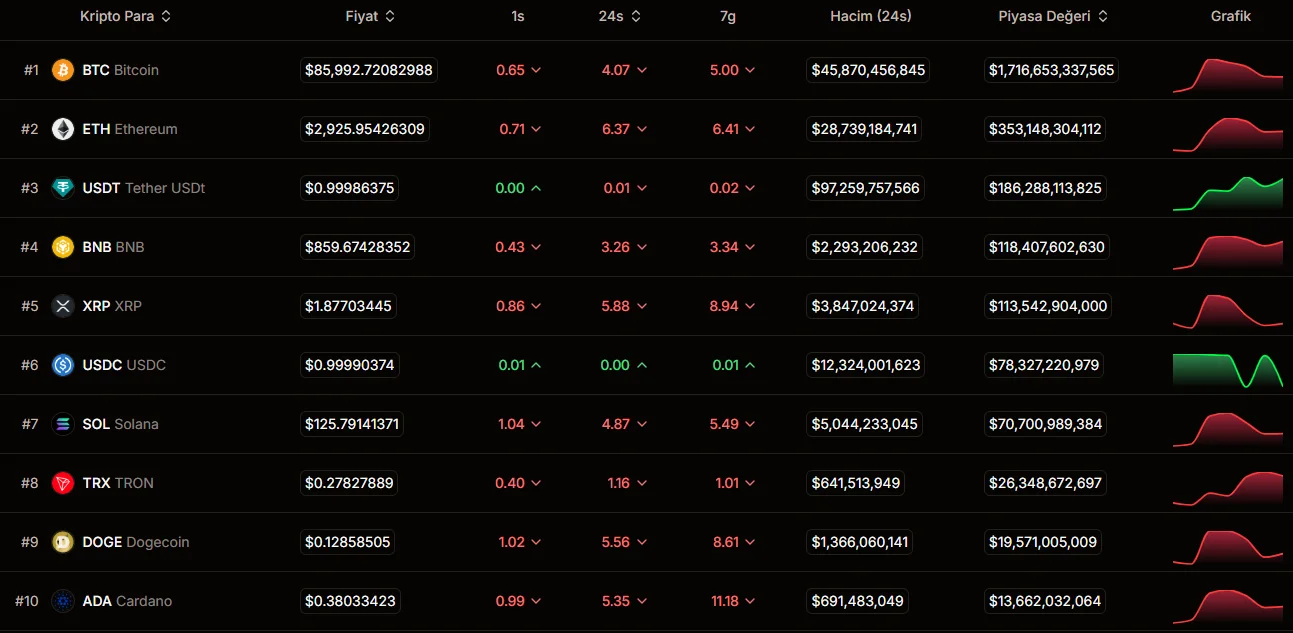

Bitcoin and the cryptocurrency market started the week with a sharp sell-off. As risk aversion intensified in global markets, Bitcoin lost 4% in the last 24 hours, falling to $85,917, while Ethereum's decline was even more pronounced at 6.3%, dropping to $2,915. The sell-off wasn't limited to these two major crypto assets; a general market weakening was evident.

According to data, BNB fell by 4%, while XRP experienced a 6% loss. Solana also felt the effects of the selling pressure, declining by 4%. This decline in cryptocurrencies coincided with a negative start to the week for US stock markets. The S&P 500 opened down 0.16%, while the Nasdaq Composite fell 0.59% and the Dow Jones dropped 0.09%.

What's behind this decline?

Rick Maeda, a research fellow at Presto Research, said there wasn't a clear crypto-specific trigger behind the price pullback. According to Maeda, the main factor was the general pressure on risky assets as cash stock markets opened in the US. The weak start in stocks dragged down all risky assets, including cryptocurrencies. Maeda also pointed out that market liquidity has significantly decreased as the year draws to a close. Weakened liquidity makes price movements more volatile, especially during US trading hours. This means that even relatively limited sell-offs can lead to larger price drops. Vincent Liu, investment director at Kronos Research, pointed to a similar scenario. Liu stated that with the resurgence of macroeconomic uncertainties, risk aversion has rapidly intensified, and low liquidity is turning every small pullback into a wider sell-off. According to Liu, investors have turned to safer assets during this process. The 25 basis point interest rate cut by the US Federal Reserve last week had a limited impact on the markets and was not enough to change the cautious outlook.

Will there be no more "Christmas rally"?

Following the Fed's third interest rate cut this year, expectations of a "Christmas rally" have also weakened. Bitcoin's continued subsistence below critical resistance levels reduces the likelihood of a strong recovery towards the end of the year. It is stated that positions are being taken more cautiously before the US inflation data expected to be released this week, and therefore prices have become more sensitive to relatively small fund movements.

On the other hand, a different interpretation of the market decline came from China. Crypto trader "NoLimit," in a post on the social media platform X, suggested that the decline in prices may be linked to the slowdown in mining activities in China's Xinjiang region. According to Jianping Kong, Chairman of Nano Labs and former co-chair of Canaan, at least 400,000 mining devices in China have recently been taken offline. Kong stated that the total hash rate of the Bitcoin network dropped by approximately 8 percent, or around 100 exahashes per second, in a single day.

Min Jung of Presto Research said that mining activity in China has revived in recent months thanks to cheap energy and idle data center capacity, but this recovery is quite fragile. It is not surprising that such operations have accelerated after the People's Bank of China announced at the end of November that it would take tougher measures against illegal crypto activities.

Nevertheless, experts emphasize that there is no clear evidence that miners in Xinjiang have sold large amounts of Bitcoin. According to Liu of Kronos Research, pressure from China may affect hash rates and prices in the short term, but this is expected to be a temporary effect. Liu states that Bitcoin's fundamental dynamics remain strong regardless of such developments.