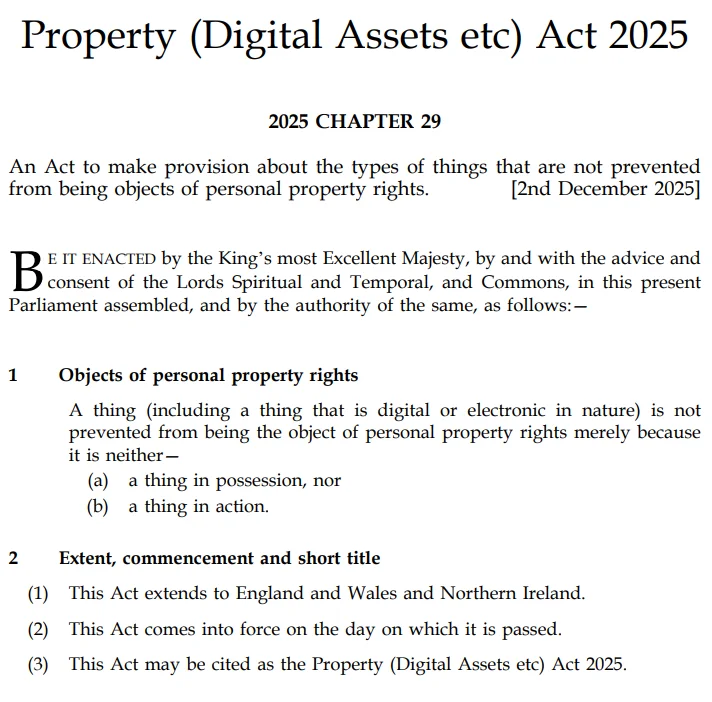

The United Kingdom has taken a historic step, putting years of debate surrounding crypto asset regulations behind it. The Property (Digital Assets etc.) Act 2025, which came into force on Tuesday, officially defines digital assets as a "third category of property." This gives Bitcoin, stablecoins, and other digital assets a distinct class of property under English law, separate from physical assets and contract rights.

Critical crypto legislation in the UK

The legislation passed both houses of parliament without amendment and was signed into law with the assent of King Charles III. This demonstrates the broad political consensus the process has enjoyed. CryptoUK, a leading UK industry organization, stated that this step provides a long-awaited "clear legal basis" for the crypto industry. The association emphasized that courts have considered crypto property for years, but that clearly codifying this principle into law would eliminate uncertainty in areas such as criminal investigations, asset recovery cases, and inheritance law.

Bitcoin Policy UK CEO Susie Ward commented on the decision as "now your satoshis are legally protected." The organization's policy director, Freddie New, described this development as "the biggest change to English property law since the Middle Ages." The statements indicate that the reform is a turning point not only for the crypto ecosystem but also for the English legal system.

This regulation was first proposed by the independent legal body Law Commission in 2023. The proposal was then brought before the House of Lords in September 2024 and, as a short draft bill, was finalized in 2025. The main purpose of the bill was to strengthen the legal definition of what digital assets are, how they are owned, and how they should be protected.

CryptoUK states that the new framework will be particularly effective in three areas: proof of ownership, recovery of stolen assets, and the treatment of crypto assets in bankruptcy and inheritance proceedings. Until now, a significant portion of crypto-related cases in the UK have been proceeded by judges' interpretations; Now, the written law provides a standardized approach to this area.

The UK isn't content with simply defining crypto assets; it's also working to accelerate financial regulation. The Bank of England (BoE) recently published a draft new regulatory framework for sterling-backed stablecoins. The bank emphasizes that stablecoin use will become widespread in payment systems in the coming years and that preparations should be made now. BoE Deputy Governor Sarah Breeden stated that the country doesn't want to lag behind the US, saying the new rules will come into effect "at the same pace as the US."

With this latest step, the UK has become one of the few countries that has moved closer to defining crypto assets in terms of both ownership and financial regulation.