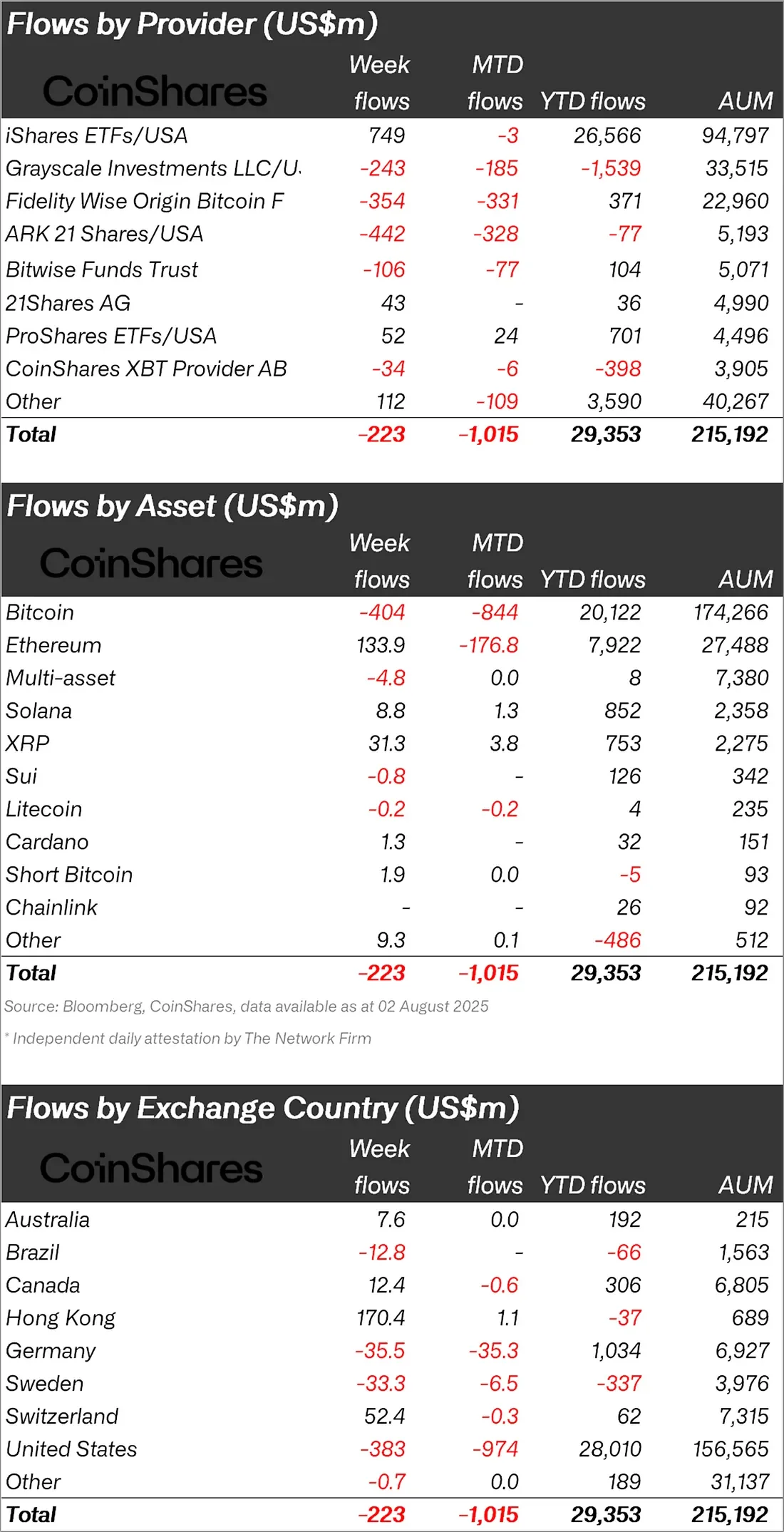

According to the latest data from CoinShares, there were net outflows of $223 million from digital asset investment products last week. This development marks the end of a 15-week streak of uninterrupted inflows. While funds experienced a strong inflow of $883 million at the beginning of the week, outflows in the second half of the week turned the overall picture negative.

According to experts, this wave of outflows is driven by the hawkish messages from the US Federal Reserve (Fed) and higher-than-expected economic data. CoinShares Research Director James Butterfill stated that the outflow, which exceeded $1 billion on Friday alone, stemmed from a "general risk-off" atmosphere. Butterfill noted that a total of $12.2 billion in inflows over the last 30 days constituted half of the inflows since the beginning of the year, and that the recent outflows could be interpreted as profit-taking.

Sharp decline in Bitcoin funds

Last week, $404 million in outflows from Bitcoin-based investment products occurred. This constituted the majority of the total outflows. US-based spot Bitcoin ETFs, in particular, played a leading role in this decline. Data shows that these ETFs saw $642.9 million in outflows on a weekly basis. Nevertheless, a total of $20 billion has flowed into Bitcoin funds since the beginning of the year, demonstrating high investor interest.

Positive sentiment continues for Ethereum and some other altcoins

Ethereum investment products, meanwhile, extended their positive streak to a 15th week. Last week, these products saw a total net inflow of $133.9 million. This consistent demand for Ethereum marks the longest uninterrupted inflow period since mid-2021.

Notable data also emerged on the altcoin front. XRP products closed the week with net inflows of $31.3 million, Solana $8.8 million, Cardano $1.3 million, and Sui $0.8 million. The largest outflows by fund provider came from the following institutions:

- ARK 21Shares/USA: $442 million

- Fidelity Wise Origin Bitcoin Fund: $354 million

- Grayscale Investments: $243 million

- Bitwise Funds: $106 million

In contrast, iShares ETFs led the way, closing the week with $749 million in inflows. However, monthly data shows this fund had a net loss of only $3 million.

The US Leads the Way by Country

Regional data, however, reveals that outflows largely originated from the US. US-based funds saw a total outflow of $383 million last week, followed by Germany with $35.5 million and Sweden with $33.3 million.

Additionally, significant inflows were noted in some regions:

Hong Kong: $170.4 million inflow

Switzerland: $52.4 million inflow

Canada: $12.4 million inflow

According to CoinShares data, total assets under management (AUM) in digital asset investment products reached $215.2 billion. While the majority of these assets are concentrated in US-based funds, iShares ETFs had the largest AUM at $94.8 billion.