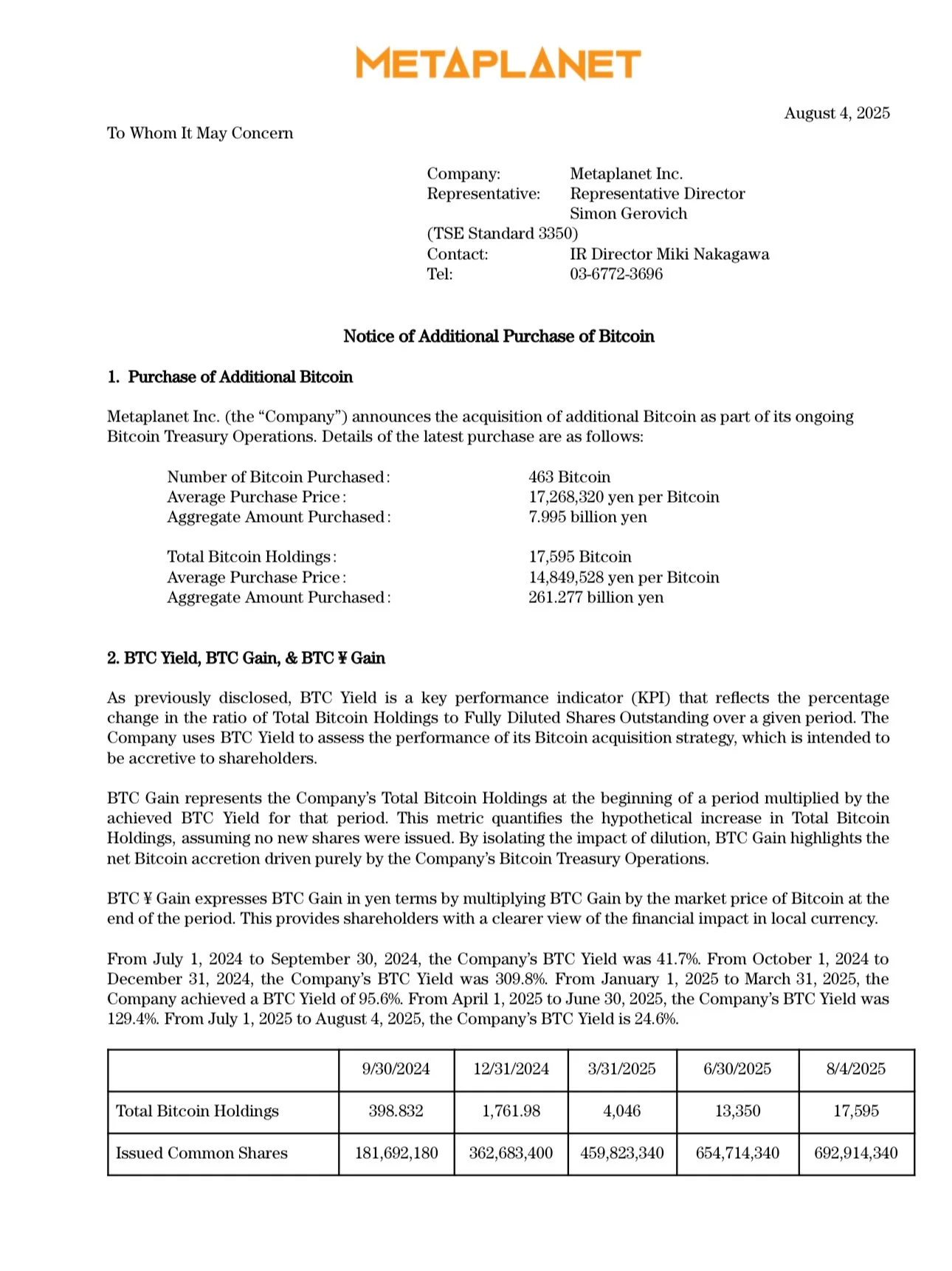

Japan-based investment giant Metaplanet capitalized on the recent Bitcoin market pullback. On Monday, August 5th, the company announced the purchase of an additional 463 BTC. This purchase, made at an average price of $115,895, amounted to approximately 8 billion yen ($53.7 million). This brings Metaplanet's total Bitcoin holdings to 17,595, making it the seventh-largest public Bitcoin holder globally, with over $2 billion in BTC holdings.

Institutional Company Launches In August

Metaplanet became the first public company to announce its Bitcoin purchase in August. This move followed a surge in institutional buying at the end of July, which saw a total of $7.8 billion in crypto assets added to its balance sheets. However, the beginning of August also saw a record daily outflow in spot Bitcoin ETFs: $812 million in outflows in just one day.

Despite this volatility, Metaplanet's aggressive strategy remained unchanged. The company's CEO, Simon Gerovich, clearly outlines its long-term goals: to reach 210,000 BTC by the end of 2027. This corresponds to 1% of Bitcoin's maximum supply of 21 million. With Monday's purchase, 8.4% of this target has already been reached.

MicroStrategy model being followed

Metaplanet's Bitcoin strategy is quite similar to the model pioneered by MicroStrategy. The company recently announced plans to issue $3.73 billion in perpetual preferred shares. This step stands out as a way to raise funds without needing to borrow or dilute existing shares to finance new BTC purchases. It has been stated that investors could be offered annual dividends of up to 6%, depending on market conditions.

Targets for 2025 and Beyond

Metaplanet is not only maintaining its current position but has also set ambitious targets for the coming years:

- End of 2025: 30,000 BTC

- End of 2026: 100,000 BTC

- End of 2027: 210,000 BTC

CEO Gerovich emphasizes that Bitcoin is seen as a hedge against the Japanese yen, positioning BTC as a strategic reserve against the country's rising public debt and weakening currency.

Metaplanet's shares demonstrate that this bold strategy is paying off with investors. The company's share price has increased by 179% since the beginning of 2025, with an increase exceeding 1,390% in the past year. In the first quarter of FY2025, the company reported record revenue and profit: 877 million yen (approximately $6.05 million) in revenue and 593 million yen ($4.09 million) in operating profit. Meanwhile, the corporate race, including Metaplanet, continues unabated. The number of publicly traded companies holding Bitcoin, which was 112 at the end of May, rose to 162 as of the beginning of August.