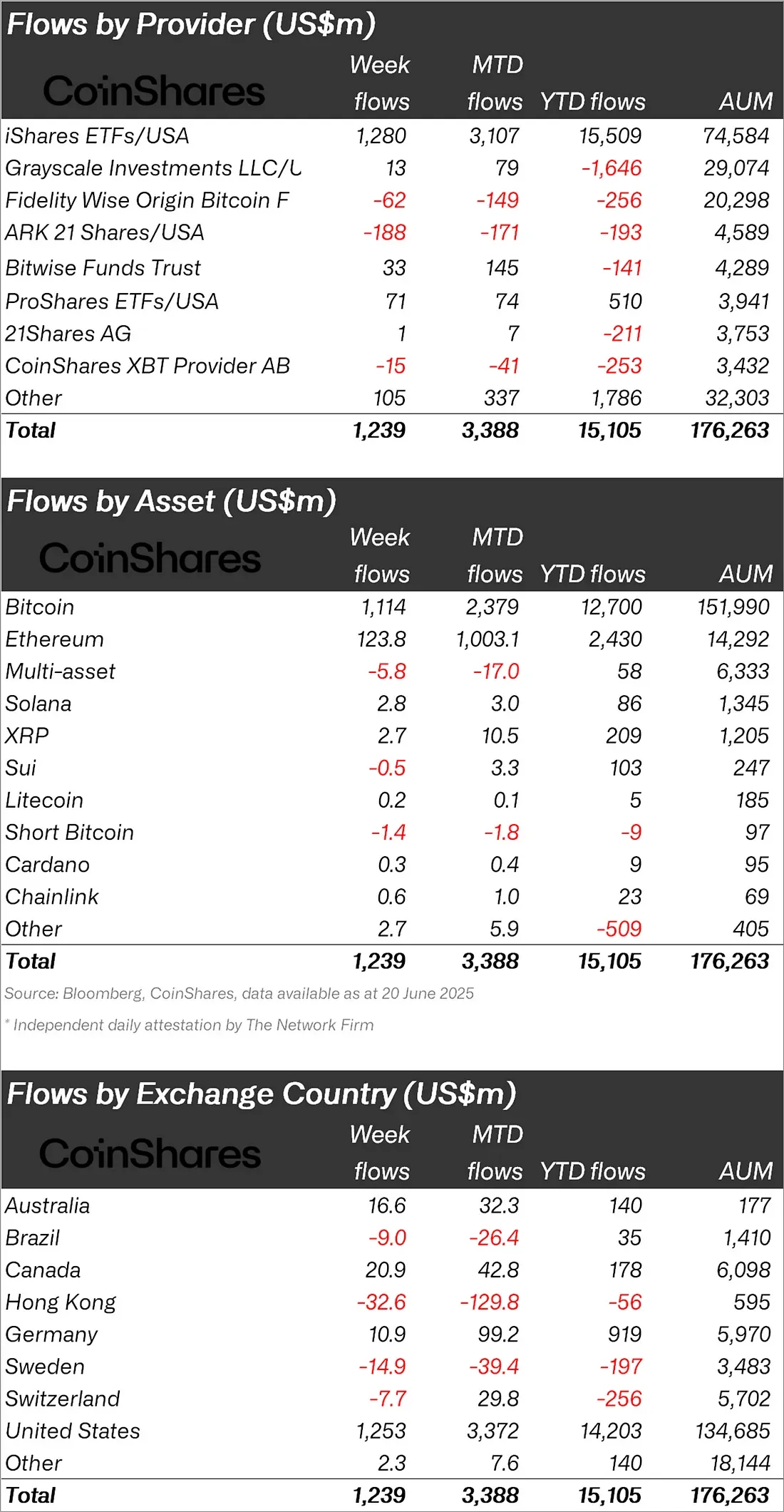

Crypto investment products continue to attract investor interest, even at a time when global markets are shaken by geopolitical tensions. According to asset management firm CoinShares’ data dated June 20, 2025, a total of $1.24 billion in net inflows were made into cryptocurrency investment products last week. This data shows that net inflows have moved to the tenth week in a row. Thus, the total net inflow since the beginning of the year reached a record level of $15.1 billion.

Bitcoin and Ethereum attract strong interest

The majority of weekly inflows were again made up of leading cryptocurrencies. Bitcoin-based products were the most preferred asset, attracting $1.1 billion in new investments. Ethereum, on the other hand, attracted attention with a weekly inflow of $123.8 million. This trend in Ethereum shows that the inflow series, which has been ongoing for nine weeks, continues and has reached a total of $2.2 billion.

Interestingly, there was an outflow of $1.4 million from Short Bitcoin (taking a position against the BTC price) products. This indicates that investors have confidence in Bitcoin in the long term despite price corrections and consider declines as buying opportunities.

Moderate interest in altcoins

More modest inflows were seen on the altcoin front. Solana closed the week with an inflow of $2.8 million, while $2.7 million flowed into XRP. While products based on the Sui network experienced a slight outflow of $0.5 million; Small-scale inflows were recorded in altcoins such as Cardano, Chainlink and Litecoin:

- Solana: +$2.8 million

- XRP: +$2.7 million

- Sui: -$0.5 million

- Litecoin: +$0.2 million

- Cardano: +$0.3 million

- Chainlink: +$0.6 million

- Multi-asset products: -$5.8 million

- Those in the "Other" category: +$2.7 million

The largest inflow is from the US, iShares is ahead

Regionally, the US led the entire market with a weekly inflow of $1.25 billion. Canada ($20.9 million) and Germany ($10.9 million) were also among the countries that experienced inflows. On the other hand, there was an outflow of $32.6 million from Hong Kong and $7.7 million from Switzerland. This situation shows that geopolitical risks are pushing investors to be cautious in some regions.

Among fund providers, BlackRock’s iShares ETFs led the way with $1.28 billion in inflows last week. Grayscale saw only $13 million in inflows, while some major players like Fidelity and ARK Invest saw significant outflows:

- iShares (BlackRock): +$1,280 million

- Grayscale: +$13 million

- Fidelity: -$62 million

- ARK 21Shares: -$188 million

- Bitwise: +$33 million

- ProShares: +$71 million

- 21Shares AG: +$1 million

- CoinShares XBT Provider: -$15 million