While institutional moves continue to attract attention in the crypto markets, Multicoin Capital has taken an ambitious step in the Worldcoin camp despite price pressure and declining individual interest. The company reportedly purchased 60 million Worldcoin (WLD) under an over-the-counter (OTC) agreement with the project team. This purchase came at a time when the WLD price had fallen by 21 percent in the last month and retail investor interest had weakened significantly.

According to data shared by the on-chain analytics platform Lookonchain, a wallet associated with Multicoin Capital transferred approximately 30 million USDC to the Worldcoin team. This transaction was soon followed by the transfer of 60 million WLD to the same wallet. This OTC transaction, carried out directly with the project team rather than on the open market, shows that institutional investors continue to take long-term positions regardless of price fluctuations.

Worldcoin Interest Significantly Low

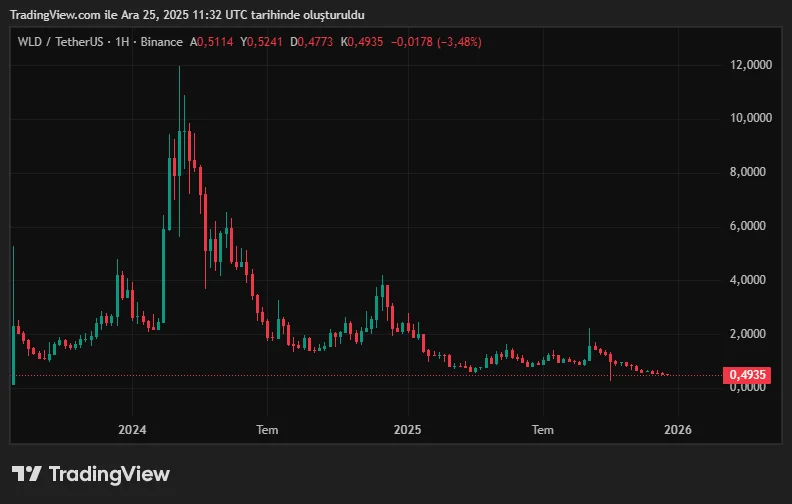

However, on-chain data reveals that individual interest in Worldcoin is not equally strong. According to Dune Analytics data, the number of newly active Worldcoin wallets has been in sharp decline since September. This indicates a decrease in the number of new users joining the project and a loss of momentum in retail demand. Search engine data also supports this trend. According to Google Trends data, there has been a significant decline in searches for "Worldcoin" since the peak seen in September. This peak coincided with the listing of WLD on the South Korea-based Upbit exchange. While the price and interest increase after the listing quickly subsided, search interest has fallen to very low levels in recent data. A similar picture is observed on the price front. The price of WLD has lost more than 21% of its value in the last month, trading at approximately $0.49 at the time of writing. The limited increase in the last 24 hours is in line with the overall recovery in the crypto market.

Worldcoin's challenges are not limited to market dynamics. The project is struggling with increasing regulatory pressure, particularly due to its biometric data collection model. At the end of November, Thai authorities ordered Worldcoin to halt its iris scanning operations in the country and delete biometric data collected from over one million people. This decision followed a raid in October on an iris scanning point used as part of the project. A statement from the Securities and Exchange Commission of Thailand emphasized a stricter stance against unlicensed digital asset operations. Authorities stated that such steps aim to protect users from a lack of legal protection, fraud, and money laundering risks. Worldcoin, which has previously faced similar regulatory hurdles in Indonesia and Kenya, continues to face uncertainty on a global scale.