Space ID (ID) Technical Analysis – Latest Outlook Before Unlock

$11.13 million (approximately 16.8% of the current market cap value) ID will be unlocked on Sunday, June 22nd. Find below a detailed technical analysis of ID coin in the eve of token unlock.

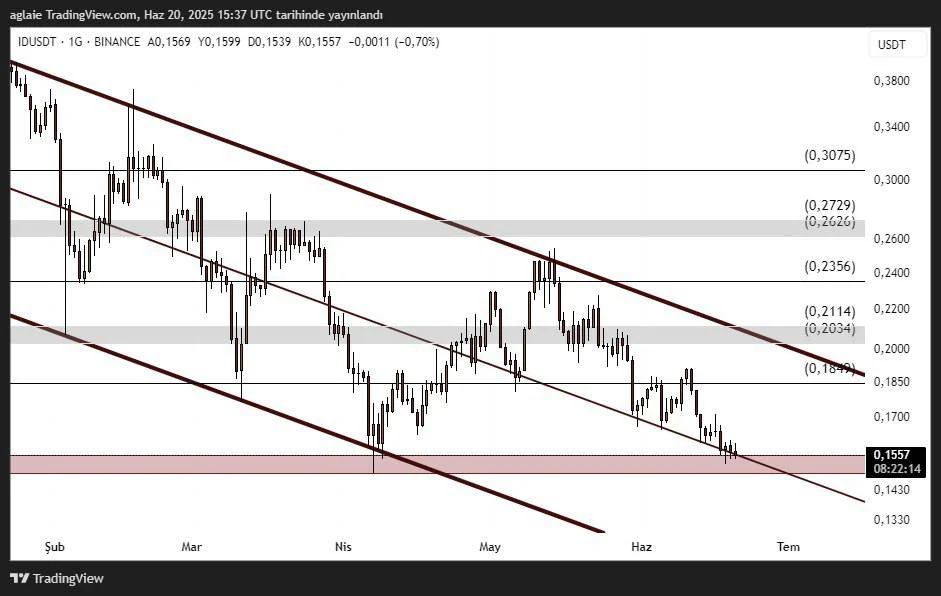

Looking at the daily chart of ID, one can clearly see that the price of ID has been trading within a descending channel for some time since February. The price has tested the upper band of this channel a few times; yet, it has failed to hold on to this level, which has caused the negative pattern to continue. The price is currently trading at the lower band of the channel, around the $0.155–$0.150 support area.

As clearly seen on the chart, the price has again tested the red area, which has worked as a support zone that has left liquidity. We have two scenarios within this support area, the first of which is that the price may form a double-bottom and then move from the middle band of the trend towards the upper band of it. According to the second scenario, which is not positive, the price gets the liquidity and then it may break down towards the lower band of the descending channel as buyers cannot hold.

To summarize, a possible strong reaction from the lower band of the descending channel could take the price to resistance levels and then maybe towards a breakout as the sell pressure on the resistance levels has decreased. Due to the weakness of the pattern here, the price could go down in search of a new bottom, where the level $0.13 appears as the lower band of the trend. Below the red area, we could see a reaction here. In case of a breakout of the price upwards, the strongest resistance zone would be the $0.2034–$0.2114 range, as this area is both the upper band of the trend and a strong Fibonacci resistance area.

These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, the user is responsible for their own actions and risk management. Moreover, it is highly recommended to use stop loss (SL) during the transactions.