Last week, cryptoasset investment products saw strong inflows again. According to CoinShares data, total net inflows globally reached $572 million. While weak US employment data triggered a $1 billion outflow in the early days of the week, the government's announcement that it would allow digital assets in 401(k) retirement plans led to a $1.57 billion inflow in the second half. Thus, the week closed on a positive note.

Ethereum Leads, Bitcoin Follows

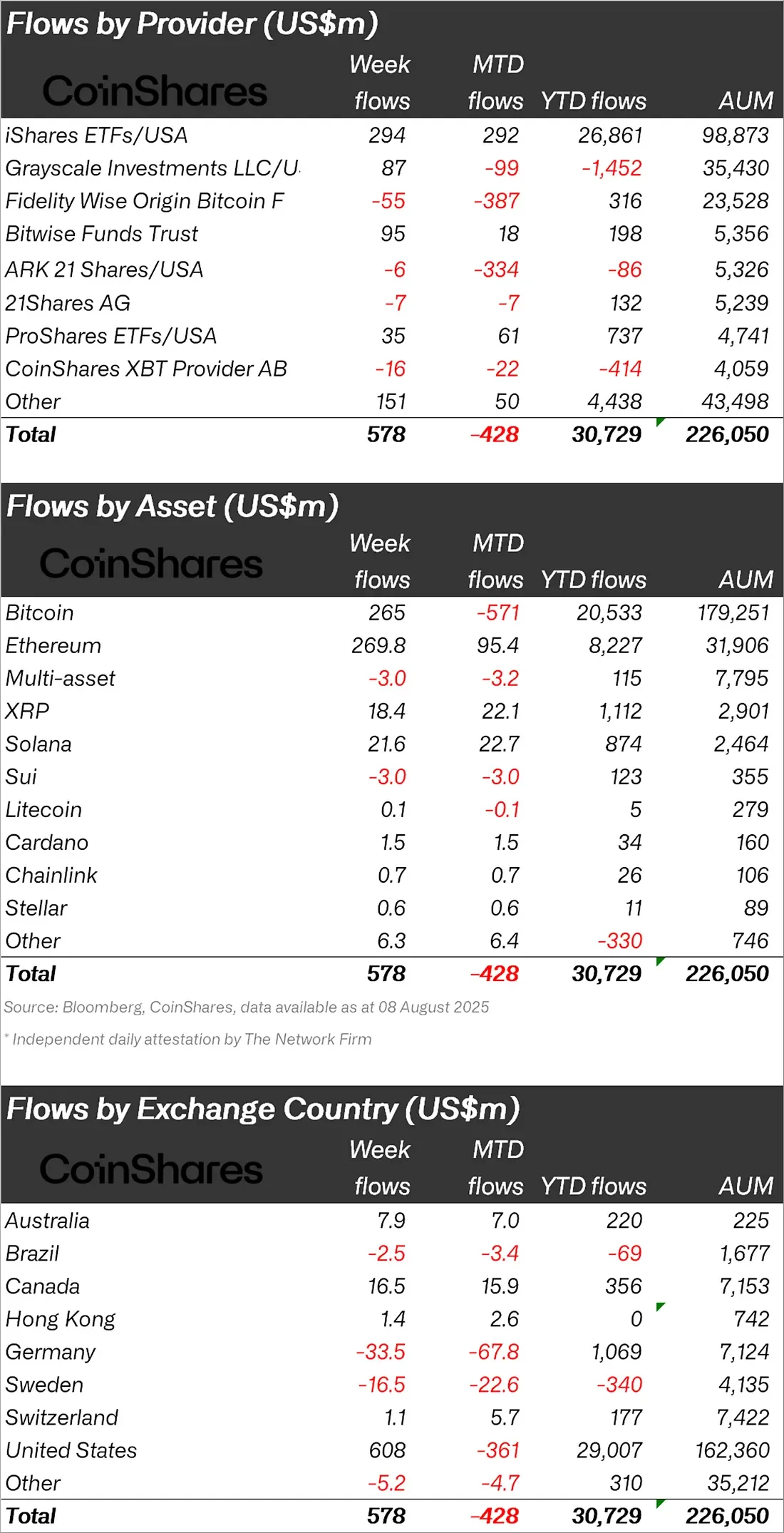

Ethereum-based investment products dominated the week with $268 million in inflows. With ETH surpassing $4,000 for the first time in eight months, total inflows since the beginning of the year reached $8.2 billion, and assets under management reached an all-time high of $32.6 billion. This represents an 82% increase since the beginning of 2025.

On the Bitcoin side, the two-week outflow streak ended. BTC investment products closed the week with $260 million in inflows. Spot Bitcoin ETFs in the US accounted for $253.2 million of this figure. Short Bitcoin products saw $4 million in outflows.

Notable activity in altcoins

Significant inflows were also seen in altcoin investment products. According to data provided by CoinShares:

- Solana (SOL): $21.6 million

- XRP: $18.4 million

- Near: $10.1 million

- Cardano (ADA): $1.5 million

- Chainlink (LINK): $0.7 million

- Stellar (XLM): $0.6 million

- In contrast, multi-asset products saw $3 million in outflows, and Sui saw $3 million in outflows.

Regional breakdown: US leads, Europe negative

The strongest regional inflows came from the US. The US led the week with $608 million in net inflows, followed by Canada with $16.5 million and Australia with $7.9 million. Hong Kong also contributed $1.4 million positively.

Europe, on the other hand, was more cautious. Germany, Sweden, and Switzerland saw a total of $54.3 million in outflows. Germany recorded net outflows of $33.5 million, Sweden $16.5 million, and Switzerland $1.1 million.

iShares Leads the Week Among Providers

By provider, iShares/USA took the largest share of the week with $294 million in inflows. Bitwise was in positive territory with $95 million, and Grayscale $87 million. ProShares saw $35 million in inflows, while Fidelity saw $55 million, ARK 21Shares $6 million, and CoinShares XBT Provider AB saw $16 million.

Overall, despite the quieter trading volume during the summer months, optimism brought on by 401(k) regulation significantly boosted investor appetite. Ethereum's record levels, Bitcoin's recovery, and new fund inflows into altcoins indicate that the market outlook may remain positive in the short term.