Crypto asset management giant Grayscale Investments has made a significant portfolio update to its DeFi, smart contract, and artificial intelligence-focused funds. The company removed the Maker (MKR) token from its portfolio and added new assets like Aerodrome Finance (AERO) and Story (IP). According to its own statements, the company aims to adapt to market trends and strengthen its thematic investment strategies with these changes to its fund composition. Let's take a look at the details of Grayscale's portfolio.

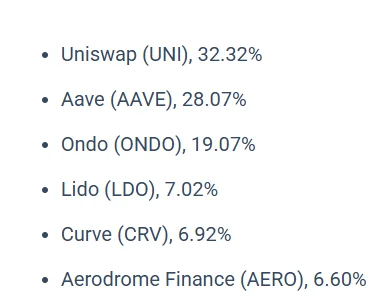

DeFi fund reshaped: UNI and AAVE take center stage

Grayscale's DEFG fund has reshaped its allocation in the decentralized finance (DeFi) space. Uniswap (UNI) leads the portfolio with 32.32%, followed by Aave (AAVE) with 28.07%, Ondo (ONDO) with 19.07%, Lido (LDO) with 7.02%, Curve (CRV) with 6.92%, and Aerodrome Finance (AERO) with 6.60%.

Maker (MKR) was removed from the fund's composition and replaced with AERO. This change recalibrated the fund's risk allocation while maintaining exposure to liquidity and staking. Grayscale thus shifted its focus to more established DeFi protocols. Such rebalancing can increase price differentials in the short term, but offers investors a more stable allocation in the long term.

Notable changes have also been made to the GSC fund. According to the updated allocation, Ether (ETH) accounts for 30.32%, Solana (SOL) for 30.97%, Cardano (ADA) for 18.29%, Avalanche (AVAX) for 7.57%, Sui (SUI) for 7.35%, and Hedera (HBAR) for 5.50%.

The nearly equal weighting of ETH and SOL demonstrates Grayscale's balanced focus on two major players in the smart contract ecosystem. Such weightings could indirectly impact demand, particularly for Layer-1 networks (Layer-1), staking returns, and derivatives market activity.

Story (IP) Surprise in AI Fund

The most notable innovation in Grayscale's AI Fund is the addition of the Story (IP) token to the portfolio. The new composition is as follows: NEAR 25.81%, Bittensor (TAO) 22.15%, Story (IP) 21.53%, Render (RENDER) 12.91%, Filecoin (FIL) 11.39%, and The Graph (GRT) 6.21%.

The addition of Story to the portfolio demonstrates that the fund is not limited to compute and storage projects, but is also expanding its focus to include content generation, data indexing, and distributed data infrastructures. Thus, Grayscale has established a more holistic structure that brings together data, storage, and processing power within its AI-powered blockchain ecosystem.

The company stated in a statement that these moves were made to "adapt to market dynamics and more accurately represent the funds' investment theses." It also noted that the funds do not generate any income and instead sell assets in the portfolio from time to time to cover operational expenses.