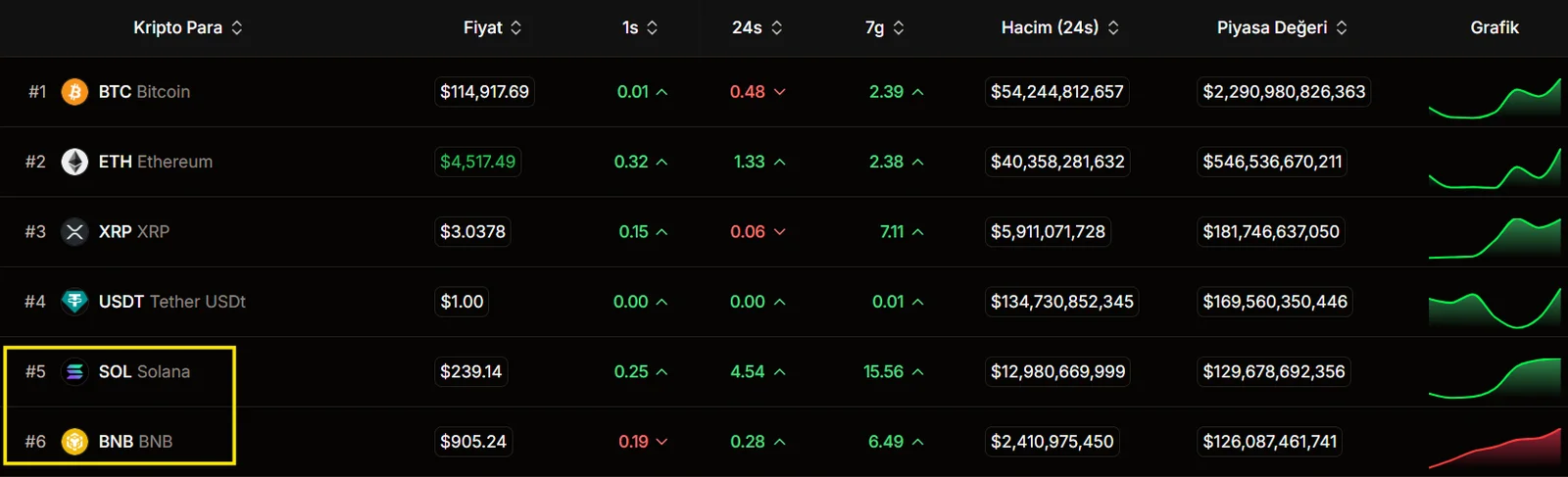

Solana is once again in the crypto market. According to data from blockchain analytics platform Arkham Intelligence, Galaxy Digital acquired a total of 2.31 million SOL from Binance, Bybit, and Coinbase wallets in the last 24 hours. This amount is equivalent to approximately $536 million. Following the transaction, Solana's price rose 6 percent to $236.83, surpassing Binance Coin (BNB) for fifth place with a market capitalization of $126.4 billion.

Galaxy's massive acquisition coincides with a significant investment the company recently announced. Galaxy, along with Jump Crypto and Multicoin Capital, led a $1.65 billion private equity investment (PIPE) in Nasdaq-listed Forward Industries. The company subscribed over $300 million under this deal. Forward Industries announced it would begin acquiring Solana with the funds raised, and its share price increased by 135 percent last week. These developments indicate that the trend toward institutional crypto treasury companies (Digital Asset Treasury (DAT)) is gaining momentum. These companies are pursuing a strategy of acquiring publicly traded companies and transforming them into crypto treasury companies. Forward Industries is one of the latest examples of this model. Galaxy and other investors aim to strengthen the company's Solana treasury holdings and become a major player in the ecosystem at an institutional scale.

However, it's noteworthy that it's not yet clear whether Galaxy's $530 million SOL acquisition is directly linked to Forward Industries. Blockchain analytics platform Lookonchain suggests that Galaxy acquired Solana on behalf of Forward Industries, but no official confirmation has been made.

"Solana season" has arrived

Galaxy Digital founder and CEO Mike Novogratz stated this week that "Solana season" has begun, highlighting the market momentum coupled with strong institutional buying. Similarly, Bitwise CIO Matt Hougan emphasized in a note published this week that institutional treasury strategies and the imminent approval of the Solana spot ETF are supporting the cryptocurrency's upward trend. According to Hougan, Solana, which offers faster and lower-cost transaction advantages compared to Ethereum, will continue to be on the radar of institutional investors in the coming period.

According to market data, publicly traded companies currently hold a total of 4.67 million SOL in their Solana treasuries. Galaxy's latest move is expected to further increase this amount.

This strong institutional support for Solana is being interpreted as a harbinger of a new era for the market. If ETF approvals and institutional treasury strategies proceed as planned, Solana is expected to be one of the most talked-about assets in the crypto market in the coming months.