USDT, the largest stablecoin in the crypto market, is poised for its sharpest monthly contraction in recent years. On-chain data points to a significant drop in supply, particularly due to increasing redemptions by large investors (whales).

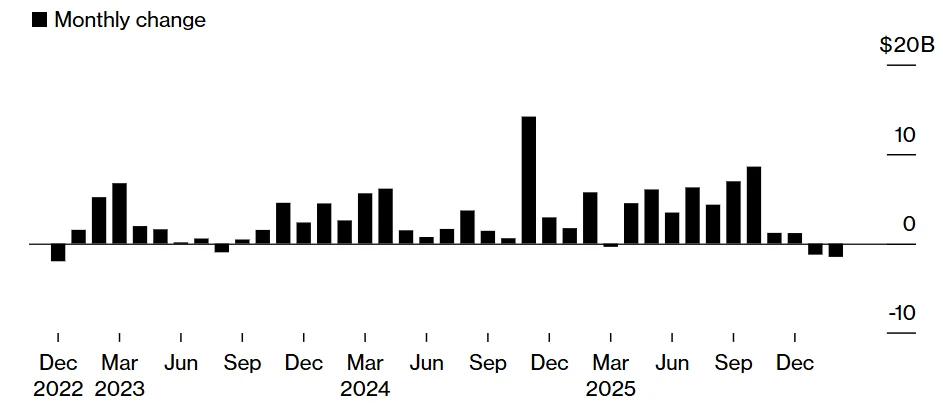

According to a Bloomberg report based on Artemis Analytics data, the USDT supply issued by Tether has decreased by approximately $1.5 billion so far in February. A $1.2 billion drop was also experienced in January. Thus, USDT is heading towards its largest monthly decline since the sharp contraction seen after the FTX exchange crash in November 2022.

As a reminder, the bankruptcy of FTX and more than 150 related companies led to a decrease of approximately $2 billion in the USDT supply in December 2022. At that time, the shock to investor confidence created a ripple effect in the stablecoin market. The current decline, however, is attributed not directly to a bankruptcy shock, but rather to position adjustments by large investors.

A Liquidity Signal?

The contraction in USDT is considered a significant indicator of liquidity conditions in the crypto market. This is because USDT is the most commonly used tool for investors to enter and exit crypto assets. With a market capitalization of approximately $183 billion, it represents 71% of the total stablecoin market, making it the clear leader among dollar-pegged digital assets. However, the decline in USDT does not indicate a general contraction in the overall stablecoin market. According to DeFiLlama data, the total stablecoin market capitalization increased by 2.33% in February, rising from $300 billion to $307 billion. In other words, the pullback in USDT has been partially offset by other players. USDC, issued by Circle, the second-largest player in the market, also declined by 0.9% in February. The decrease in USDT was 1.7%. In contrast, the market value of USD1, a stablecoin issued by World Liberty Financial, which is linked to the Trump family, increased by 50 percent in the last month, reaching $5.1 billion. This shows that capital has not completely left the stablecoin market; on the contrary, it has shifted towards some projects.

Whales are selling, new wallets are buying

Data from the on-chain analytics platform Nansen reveals that large investors have been reducing their USDT holdings in recent weeks. In the last week, a total of $69.9 million worth of USDT was withdrawn from 22 different whale wallets. The rate of selling by this group has increased 1.6 times compared to the previous period.

It is stated that the group of investors who are followed for their high-yield performance and are called "smart money" are also in a net selling position. On the other hand, new wallets created in the last 15 days made approximately $591 million worth of USDT purchases in the same week. This situation points to a striking split in the market.

On one hand, it is seen that large and experienced investors are withdrawing capital or shifting it to different assets, while on the other hand, new participants are accumulating USDT. The fact that the total stablecoin market continues to grow despite the supply contraction also supports this balance. Consequently, the sharp monthly drop in USDT is not being interpreted as a crisis signal in itself. However, changes in large investor behavior are being closely monitored in terms of market liquidity and risk appetite. Whether the supply trend continues in the coming weeks may provide clearer clues about the overall direction of the crypto market.