As cryptocurrencies increasingly come onto the radar of institutional investors, design software company Figma has made a noteworthy move. In the company's initial public offering (IPO) filing (Form S-1) submitted to the US Securities and Exchange Commission (SEC), it was revealed that Figma holds $69.5 million worth of spot Bitcoin ETF shares and has purchased $30 million worth of USDC stablecoins for direct Bitcoin purchases.

Pre-IPO strategic crypto investment

According to Figma's S-1 filing, the company purchased approximately $70 million worth of shares in the spot Bitcoin ETF BITB, managed by Bitwise. The purchase began with a $55 million investment approved by Figma's board of directors on March 3, 2024, and has since grown in value to $69.5 million. This represents an approximate 27% increase in value. The ETF investment was made shortly after the SEC approved spot Bitcoin ETFs in January 2024.

Figma did not stop there. On May 8, 2025, the board of directors approved a $30 million budget for direct Bitcoin investments. As part of this, the company purchased $30 million worth of USDC, a stablecoin. Although these stablecoins have not yet been converted to Bitcoin, Figma plans to convert these funds to Bitcoin in the future. By choosing this method, the company aims to protect itself against market fluctuations and evaluate investment opportunities without disrupting its operational cash management.

Bitcoin among the company's cash management tools

As of March 31, Bitcoin ETF shares account for approximately 4% of the company's total cash, cash equivalents, and securities, which amount to 1.07 billion dollars. Bitcoin thus joins Figma's holdings of money market funds, U.S. Treasury bonds, and corporate bonds.

Figma's move adds another name to the list of companies holding Bitcoin in their corporate treasuries, following well-known examples such as MicroStrategy, Tesla, and Square. According to the latest data, over 200 companies currently hold Bitcoin as a reserve asset in their portfolios.

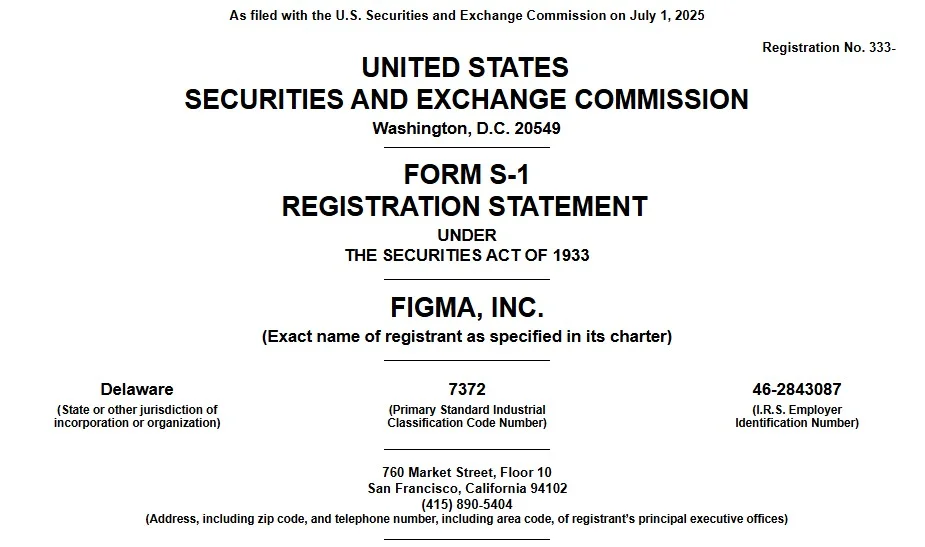

Figma's crypto investment is taking place concurrently with its initial public offering (IPO) process. The company was sought to be acquired by Adobe for $20 billion in 2022, but the deal was canceled by the end of 2023 due to objections from regulatory authorities in the U.S. and Europe. Figma had filed a confidential application for an IPO in April 2025. This new filing hints that the process has officially begun. However, it is important to note that the IPO timeline has not yet been disclosed. Time will tell what the future holds.