US President Donald Trump is preparing to announce the new head of the Federal Reserve (Fed) today. According to sources close to the White House, Trump's preference is largely clear, and markets expect Kevin Warsh to replace current Fed Chairman Jerome Powell. While the official announcement is expected later today, the strong predictions favoring Warsh are noteworthy. In a brief statement following his meeting with Kevin Warsh on Thursday, Trump described his chosen candidate for the Fed chairmanship as someone who "would surprise no one." The President concluded his statement by saying, "Someone who could have held this position a few years ago." These words pointed to Warsh, whose name has been circulating in the corridors of power for some time. Indeed, Bloomberg reported that the White House is preparing Warsh for the Fed chairmanship, but the final decision will not be considered final until the official announcement. Reuters also wrote that Trump's meeting with Warsh was quite positive.

The new Fed era is being priced into the markets

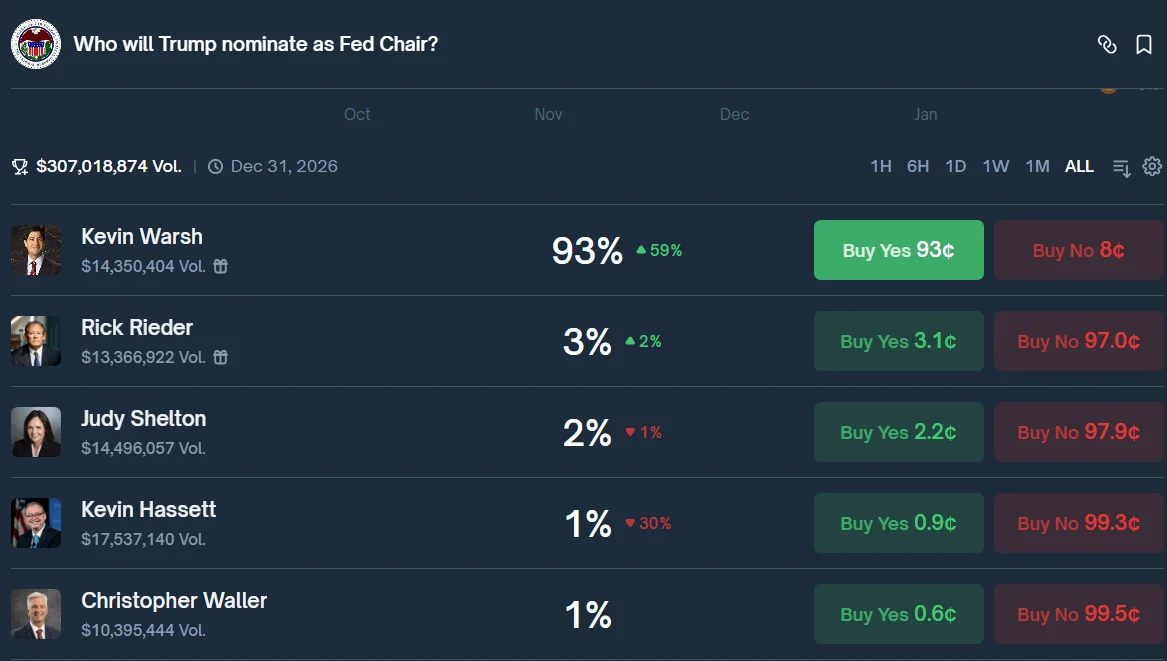

The shift in market expectations has also been quickly reflected in prediction platforms. According to Polymarket data, the probability of Kevin Warsh being appointed as Fed chairman quickly rose from around 30% to over 94%. During the same period, the probability of Rick Rieder, previously considered the favorite, sharply declined. A similar trend emerged on the Kalshi platform, where Warsh's probability was priced above 90%.

Kevin Warsh served on the Fed Board of Governors from 2006–2011 and was at the center of monetary policy debates during the most turbulent period of the global financial crisis. In recent years, he has been known more for his emphasis on tight monetary policy, fiscal discipline, and the fight against inflation. Analysts believe that if Warsh becomes Fed chairman, he will distance himself from quantitative easing policies and send a more "hawkish" message to the markets.

This expectation has already begun to show its effect in financial markets. As the probability of Warsh becoming chairman strengthened, the US dollar gained value, and Treasury bond yields rose. Investors have begun pricing in the expectation that monetary policy may shift to a more cautious and inflation-focused approach. From the perspective of the crypto markets, Warsh's approach holds particular significance. Jerome Powell has, until now, tended to view the role of Bitcoin and other crypto assets within the US financial system as limited. In contrast, Warsh has previously stated that he does not see Bitcoin as a threat to the Fed, but rather as a feedback mechanism that provides market discipline.

This approach is interpreted by crypto investors as a more constructive tone. On the other hand, the Fed kept its policy interest rate unchanged at this week's FOMC meeting. Having cut interest rates three times at the end of last year, the bank maintains its cautious stance due to inflation still being above targets. Trump, however, has increased pressure on the Fed to cut interest rates faster and more sharply. This tension is further exacerbated by the fact that Powell's term ends in May. If Kevin Warsh is formally nominated and confirmed by the Senate, this appointment could signal a significant shift in the Fed's rhetoric regarding digital assets and risky market instruments. While markets await Trump's announcement, uncertainty about the Fed's future direction is already being priced in globally.