The Ether.fi DAO has submitted a new proposal proposing to buyback up to $50 million of ETHFI when the token price falls below $3. The proposal will be activated immediately upon approval, making Ether.fi the newest DeFi protocol to implement buybacks to enhance liquidity and support price stability. Market data indicates that decentralized finance (DeFi) projects are actively using this method, with buyback programs exceeding $1.4 billion by 2025.

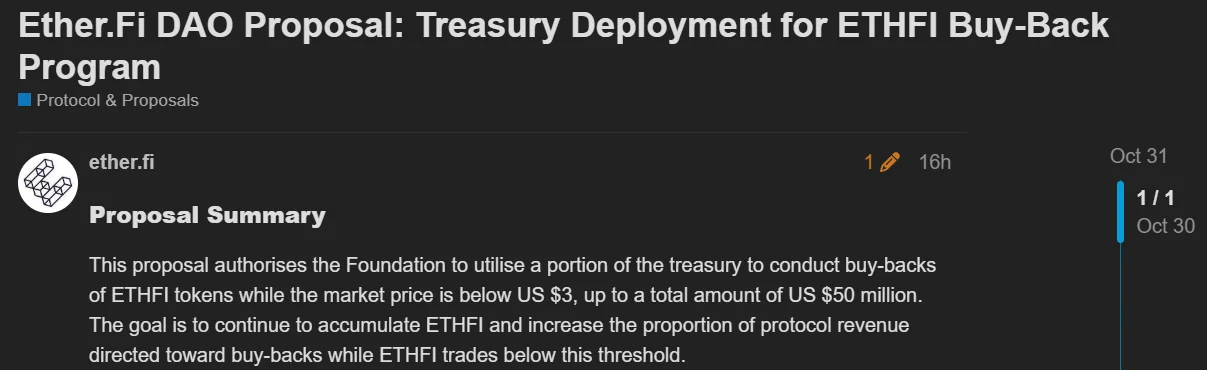

New proposal from the Ether.fi Foundation

According to the governance proposal published on Thursday, the Ether.fi Foundation will be able to make open market purchases as long as the price of ETHFI remains below $3. ETHFI's price is down 89% from its 2024 peak and was trading at $0.93 as of October 31st, indicating that the token is within the buyback range envisioned by the proposal.

Ether.fi is among the DeFi protocols that generate strong revenue but experience weak demand in the secondary market. The company's strategy is to use a portion of its protocol revenues to reduce the tokens in circulation, similar to share buybacks in the corporate world. However, this time, the buyback process will be tied directly to a price threshold rather than a specific timeline.

The plan will take effect upon approval and continue until one of three conditions are met: the $50 million cap is reached, the foundation deems the program complete, or a new governance vote is passed. The proposal states, "The Foundation plans to gradually increase the buyback capacity based on protocol revenue when the ETHFI price is below $3. This will effectively utilize excess revenue, strengthen market confidence, and reduce the circulating supply."

If the proposal is approved, following a four-day Snapshot vote starting Friday, this will be Ether.fi's third buyback attempt. Previously, liquidity support programs were implemented through Proposals #8 and #10. All transactions under the new plan will be transparently reported on-chain and shared on the Dune Analytics dashboard. Ether.fi is a non-custodial liquid restaking and staking protocol running on Ethereum. Users simultaneously acquire tradable tokens when staking ETH, allowing the assets to generate returns both within and outside of staking. Data indicates that the protocol's total locked value is around $10 billion, with annualized revenues of approximately $360 million.

Ether.fi's move signals the evolution of DeFi protocols toward a revenue-driven "protocol-company" model. Giants like Aave, Uniswap, and even NFT marketplace OpenSea are also participating in this trend. This month, the Aave DAO proposed a $50 million annual token buyback program, while OpenSea has allocated half of its revenue to buybacks for its SEA token, which will launch in early 2026.

According to a CoinGecko report, projects like Hyperliquid, Pump.fun, Aave, and Uniswap have repurchased over $1.4 billion in total tokens by 2025.