Spot Ethereum ETFs in the US are poised to close August with net inflows exceeding $4 billion. Meanwhile, Bitcoin ETFs are on track to close the month with net outflows this time, following their strong performance in previous months.

Ethereum's Rise

According to market data, spot Ethereum ETFs recorded net inflows of approximately $4 billion in August. This figure was the second-highest monthly performance for Ethereum funds, following the $5.4 billion record set by Ethereum funds in July. This trend, which accelerated since July 17th, paralleled the sharp rise in the price of Ethereum. While ETH had been in a year-to-date loss against BTC until mid-July, it quickly gained a 13.8% return advantage.

The chart over the last six weeks is particularly striking: Bitcoin ETFs outperformed Ethereum ETFs for only seven days during this period. In terms of net inflows, Bitcoin funds recorded $505 million in inflows during the same period, while a total of $7.1 billion flowed into Ethereum funds.

Headwinds for Bitcoin

Bitcoin ETFs maintained their lead in July with $6 billion inflows. However, things reversed in August. According to current data, $622.5 million in outflows from Bitcoin funds occurred during the month. This marks Ethereum products' largest monthly lead since they began trading in July 2024.

A look at the cumulative figures for the last two months reveals that Ethereum ETFs led with $9.5 billion in net inflows. Bitcoin funds recorded $5.4 billion in inflows during the same period. However, from a long-term perspective, it's worth noting that Bitcoin products still hold a clear lead: BTC ETFs topped the list in cumulative inflows at $54.6 billion, while Ethereum products remained at $13.7 billion. This is largely due to the fact that Bitcoin funds launched earlier, with a six-month advantage.

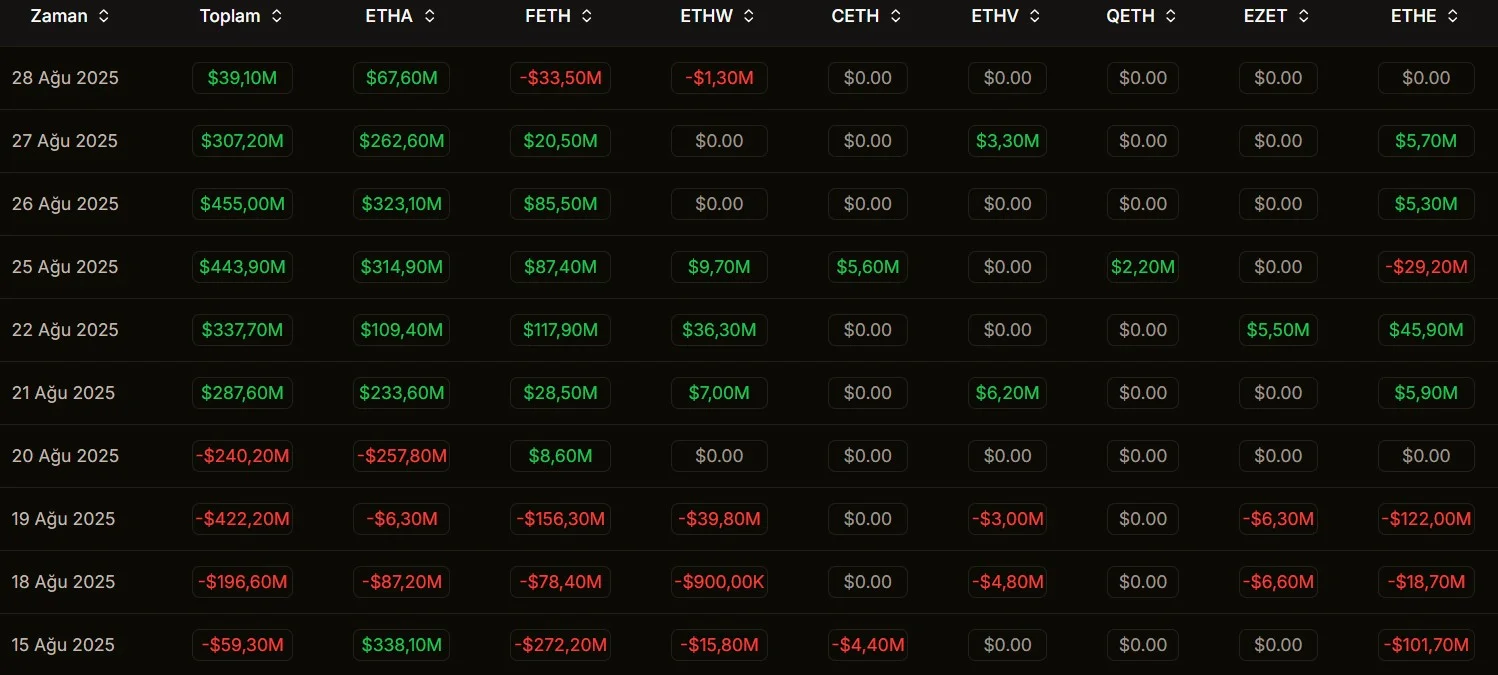

The seven-day daily inflow lead for Ethereum ETFs ended on August 28. That day, $178.9 million inflows into Bitcoin ETFs, while $39.1 million inflows into Ethereum funds were particularly notable. Ark Invest's ARKB fund attracted $79.8 million in inflows. BlackRock's IBIT fund received $63.7 million in inflows. On the Ethereum front, BlackRock's ETHA product led the way with $67.6 million.

Bitcoin ETFs still lead in trading volume. However, daily volumes for Ethereum funds are gradually approaching. On August 28, ETH ETFs generated $2 billion in volume, while BTC funds reached $2.5 billion.

Timothy Misir of BRN Research notes that ETF demand continues to absorb more than twice Bitcoin's daily supply. However, he states that BTC remains stuck around $111,000, suggesting a neutral outlook for the market. On the Ethereum side, a drop below the $4,500 support is considered a sign of short-term weakness.