Trade tensions between the US and China are back on the agenda with high-level talks to be held in London on Monday, June 9. The meeting, where topics such as export controls on rare earth elements and high-tech products will come to the fore, could be a critical turning point for both global trade balances and cryptocurrency markets.

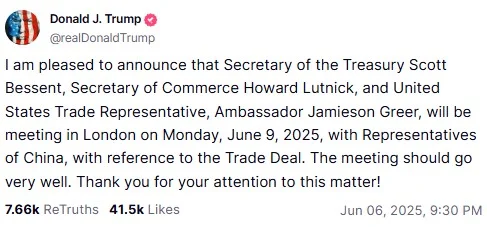

As we reported last week, following the phone call between US President Donald Trump and Chinese President Xi Jinping, the parties will sit down face-to-face for the first time. The talks will be chaired by US Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick and Trade Representative Jamieson Greer, while the Chinese delegation will be led by Vice Premier He Lifeng.

From tariff wars to diplomacy

As it will be remembered, the tariff wars between the two countries started in February and reached tariff rates of up to 145% with mutual retaliations. This situation created serious uncertainty not only in trade but also in global markets. With the temporary compromise reached in Geneva in May, the US tariffs were reduced to 30% and China's to 10%. However, both sides continue to accuse each other of backtracking from this agreement.

Trump expressed confidence that the talks in London would “go very well” on his social media account Truth Social, while China said it had received a “warm welcome” from Trump for Chinese students in the country.

The start of a “volatile” week for cryptocurrencies?

The impact of trade talks on cryptocurrency markets is also being closely monitored. Especially in similar periods of global uncertainty in the past, investors have turned to Bitcoin and other digital assets in search of a safe haven. If the talks in London are successful, this could lead to expectations of stabilization in the crypto markets. On the other hand, if the talks fail or tariffs are raised again, it could cause sharp fluctuations in crypto assets.

Deflation problem in China

The Chinese side continues to use export restrictions on rare earths as leverage. Although some export applications have been approved, it is not clear which countries and sectors have benefited from these approvals. Although China's rare earth exports rose 23% to 5,864 tons in May, the highest level in a year, the effects of the restrictions imposed in April have led to production shutdowns in the automotive and semiconductor sectors in Europe.

In addition to this, the Chinese economy is struggling with domestic problems such as deflation and rising unemployment. In May, the consumer price index fell by 0.1% yoy, while the producer price index fell by 3.3%. According to Robin Brooks of the Brookings Institution, the US tariffs have the potential to push China into full-blown deflation.

In response, China's central bank cut policy rates to historically low levels in May and cut reserve requirement ratios. New stimulus packages may come in the coming months.

As a result, all eyes are on the US-China talks that will start in London.