The US Federal Reserve (Fed) kept its policy rate steady, in line with expectations. However, markets' attention isn't solely on this decision; Chairman Jerome Powell's statements, Personal Consumption Expenditures (PCE) inflation data to be released on Thursday, and the White House's crypto policy signals stand out as a trio of factors that could determine the course of crypto assets.

No change in interest rates as expected

Yesterday, the Fed announced that it was keeping interest rates steady. According to CME FedWatch and Polymarket data, markets had been preparing for this decision days in advance. While keeping interest rates unchanged at 4.25% initially triggered a decline in the crypto market, these losses were quickly recouped. Bitcoin was trading at $118,000 before the decision, but afterward, it fell to $116,000 and then rebounded to $118,400. Ethereum followed a similar trend. Trump's clear message to the Fed: "Interest rates must fall"

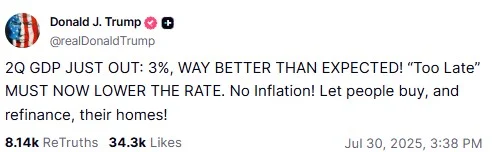

Another noteworthy element following the decision was President Donald Trump's social media post: "There's no inflation, lower interest rates now!" This call also fueled debate about the Fed's independence. Two key figures within the Fed—Trump-appointed Vice Chair Michelle Bowman and Board Member Christopher Waller—voted to cut interest rates. This was the first "vote" on an interest rate decision in 30 years.

A double-edged impact for cryptos

According to Orbit Markets co-founder Jimmy Yang, these questions about the Fed's independence could create a narrative in favor of decentralized assets like Bitcoin in the long run. "This makes crypto more attractive, especially as a hedge against inflation," Yang said, noting that the July CPI data and Trump's tariff decisions may create short-term volatility but have laid a constructive foundation for Bitcoin in the medium to long term. According to Nansen analyst Nicolai Sondergaard, call spreads for Bitcoin are seen in the $118,000-$120,000 range in the options market. This suggests that investors are anticipating an upward move but are taking positions with a risk-averse approach. The low put/call ratio also confirms an "optimistic but cautious" atmosphere in the market.

Are new highs possible?

Institutions such as QCP Capital and Sygnum Bank state that Bitcoin is stuck in the $116,000-$120,000 range. However, Sygnum analyst Katalin Tischhauser says that if the PCE data to be released on Thursday falls short of expectations and the White House takes positive steps regarding crypto policies, BTC could rise above $120,000 and enter a phase of "price discovery." Actions such as the White House's "golden age of crypto" report could particularly boost market morale. Powell's failure to provide a clear signal for September in yesterday's remarks has exacerbated market uncertainty. He placed the focus on economic data, stating, "We haven't made a decision yet for September," and highlighted the importance of the July CPI and the impact of August's tariffs. Currently, the probability of a September interest rate cut fluctuates between 40% and 60%. This rate was above 60% before the decision.

While the Fed's cautious stance has deferred expectations for a rate cut, this situation supports a "slow but strong rally" scenario in the crypto market. As long as liquidity remains plentiful, crypto investors can remain on solid ground even without a rate cut.