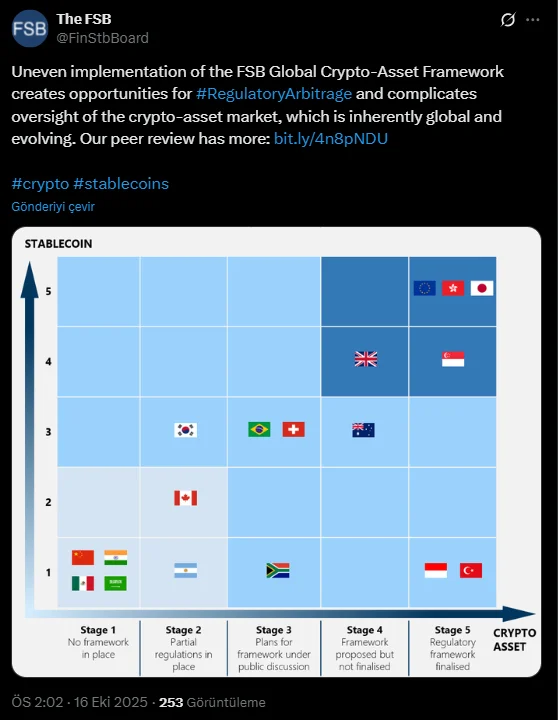

The Financial Stability Board (FSB)'s review of nearly 40 countries revealed "significant gaps and inconsistencies" in crypto asset regulations. It states that these deficiencies could pose a threat to the resilient development of the digital asset ecosystem and the overall stability of the financial system.

FSA Report on Crypto Regulation

The report notes that the geographical dispersion and inconsistency of regulations, in particular, allows crypto companies to gravitate towards countries offering the most flexible regulatory frameworks. This allows these companies to establish themselves in weaker regulatory environments and subsequently expand globally. The FSB noted that the infrastructure for cross-border supervisory cooperation remains "fragmented, inconsistent, and inadequate."

A separate assessment was included in a report by the European Banking Authority (EBA). That report alleged that crypto companies are "forum shopping" (i.e., seeking out EU member states with less stringent regulations). It emphasized that some companies are attempting to enter the EU by choosing regions with lower market entry barriers and weaker anti-money laundering controls.

According to the FSB's findings, regulatory gaps provide an advantage to crypto firms. Companies, particularly stablecoin companies, can seek out countries with the loosest regulatory structures and use them as a base. This strategy then becomes a springboard for expansion into other markets.

The report also notes that even when regulatory instruments exist, they are rarely used for "supervisory purposes" or "financial stability monitoring." This makes it difficult for regulators to timely identify potential risks in crypto markets.

The EBA's report supports this view. Within the EU, it is noted that despite new regulations (e.g., MiCA and AML/CFT legislation), some companies are attempting to evade these obligations. While the EBA text does not explicitly mention company names, it warns that "some are attempting to circumvent regulatory requirements."

Links to traditional finance are deepening

The FSB report notes that large banks are now integrating stablecoins into their payment and settlement systems, giving traditional financial institutions direct exposure to the crypto ecosystem. As this linkage grows, regulatory gaps could become even greater systemic risks. It states that activities such as leveraged trading and debt-based trading are inadequately regulated in many crypto markets. The report notes that this inadequate oversight has the “potential to lead to cascading crashes during periods of market stress.”

Nikolaos Kostopoulos, a development consultant, also notes that the EU’s MiCA regulation is an important step toward harmonization. However, he emphasizes that inconsistencies in implementation still benefit crypto companies and the lack of close cooperation and criminal sanctions that are truly necessary.

The FSB offers eight recommendations to address the identified shortcomings. These recommendations include closing regulatory gaps, strengthening data capabilities to monitor financial stability risks, and enhancing cross-border regulatory cooperation.

Nevertheless, the report points out that many regulatory efforts remain incomplete. Regulatory frameworks for global stablecoins (GSCs), in particular, remain incomplete. Even within these frameworks, implementation inconsistencies persist, leading companies to exploit these gaps.