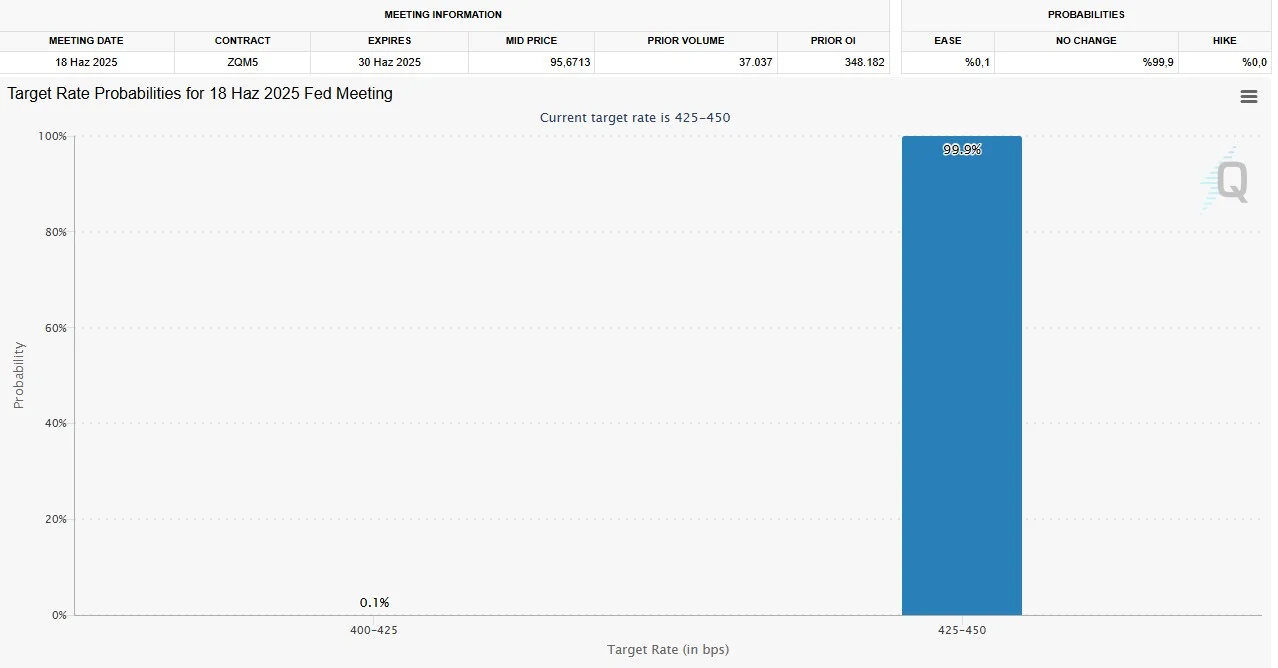

The US Federal Reserve (FED) will announce its June interest rate decision today at 22:00 Turkish time. This decision, which will come after the Federal Open Market Committee (FOMC) meeting held on June 17-18, is also of great interest to the cryptocurrency market. While investors almost certainly see interest rates as being kept constant, the messages to be given by FED Chairman Jerome Powell and the economic projections to be updated will be decisive in terms of the direction of the markets. According to CME Group's "FedWatch" tool, the probability that the FED will keep interest rates constant at 4.25-4.50 percent at this meeting is 99.9 percent. The expectation of a rate cut in June is priced at only 0.1 percent. The same policy will most likely be maintained in July; the probability that interest rates will remain constant is 85.5 percent, while the expectation of a 25 basis point cut is only 14.5 percent.

Like former Fed chairmen Greenspan, Bernanke and Yellen, Jerome Powell has taken a more cautious stance in the latter stages of his term. According to Nicholas Colas, co-founder of DataTrek Research, Powell follows in the footsteps of previous chairmen who wanted to end their term on a “hawkish” tone, reflecting both a determination to fight inflation and a desire to maintain political independence.

Impact on crypto markets: Bitcoin feels the tension

The impact of the Fed’s interest rate decisions on the cryptocurrency market has become the norm. The decision to be announced today is expected to have a significant impact, if not directly, through the economic forecasts and “dot plot” projections that will accompany it.

“Interest rates are expected to remain stable. However, markets are fixated on dot plots. If only two interest rate cuts are expected from Fed officials, the ‘high interest rates for a long time’ narrative could strengthen. This could support the dollar and suppress interest in crypto.”

Indeed, Bitcoin price, which is currently struggling to hold on above the $104,000 band, is under pressure due to the geopolitical tensions between Israel and Iran. The possibility of conflict in the Middle East is pushing investors to take a more cautious position, while also increasing the upward pressure on inflation both in the US and globally.

Could the FED decision support Bitcoin?

In the short term, “hawkish” FED policies may be suppressive for volatile assets like Bitcoin. However, the fact that high interest rates increase the borrowing cost of the US may increase interest in alternative stores of value in the long term. In this context, a positive environment may arise for assets with limited supply, such as gold and Bitcoin.