Global companies are taking their interest in Bitcoin one step further. While institutional investor interest in cryptocurrency markets has peaked again, Bitcoin (BTC) purchases by Europe-based companies have attracted attention. France-based The Blockchain Group and Norwegian crypto exchange Norwegian Block Exchange (NBX) announced their latest Bitcoin (BTC) purchases. In addition to strengthening their balance sheets with BTC purchases, companies also experienced significant increases in their shares. Let's look at the details...

The Blockchain Group adds 624 BTC to its treasury

The Blockchain Group (ALTBG), based in France and traded on Euronext Growth Paris, detailed its Bitcoin purchases in a statement released today. According to the statement, ALTBG has aggressively increased its Bitcoin investments since the beginning of the year. The France-based company raised 6.8 million euros in a private equity placement on May 20, buying 80 BTC. This was followed by a €55.3 million convertible bond issuance backed by Fulgur Ventures on May 26, with the proceeds going to buy another 544 BTC. This brings its recent BTC purchases to 624 BTC. This brings the company's total BTC holdings to 1,471, equivalent to approximately €131.9 million. The average purchase price was 89.687 euros per BTC. The company's BTC yield in 2025 currently exceeds 1.097%.

Norwegian Block Exchange also bought Bitcoin

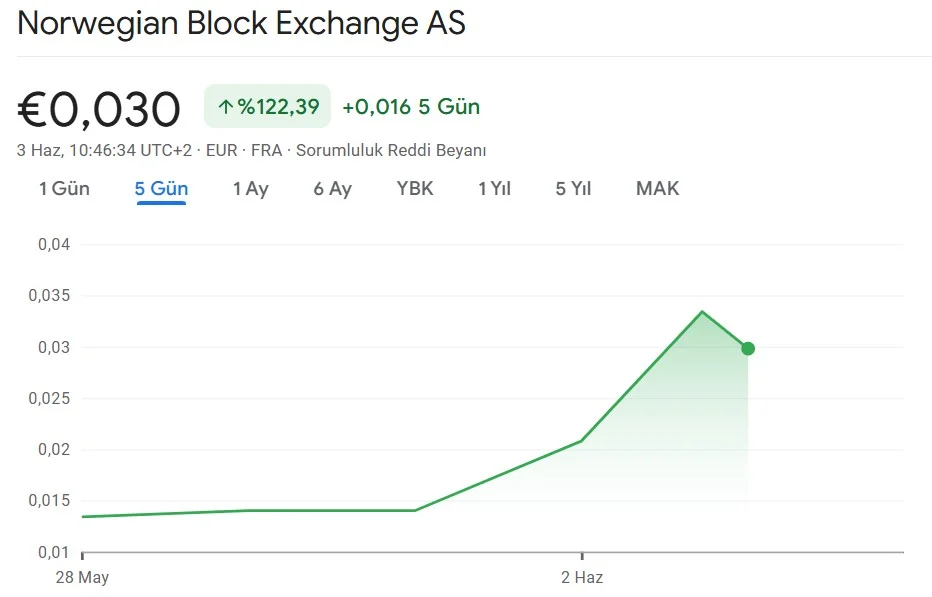

These developments are not limited to Europe. Norway-based crypto exchange Norwegian Block Exchange (NBX) recently announced that it has started buying Bitcoin. The company has invested 6 BTC in the first phase and plans to increase this amount to 10 BTC by the end of the month. NBX also announced that it will use these BTC as collateral to support USDM, a stablecoin running on the Cardano blockchain, and aims to generate returns on these assets. The company's share price rose around 120 percent after this announcement.

NBX plans to offer Bitcoin collateralized loan products in the future and move towards becoming a crypto asset bank. This takes Norway's approach to Bitcoin at the institutional level one step further. As it can be remembered, Aker ASA, Norway's largest industrial conglomerate, had previously purchased 1,170 BTC through its subsidiary called Seetee.

The impact of institutional BTC investments directly affects not only company portfolios but also share performances. According to the data, the total Bitcoin holdings of publicly traded companies exceeded 3 million BTC, while the market capitalization of this amount reached $342 billion.

Increasing institutional interest in Bitcoin is likely to gain further momentum in the coming period, driven by both regulatory clarity and the macroeconomic environment. Companies now see Bitcoin not only as an investment vehicle, but also as a strategic element in terms of efficiency and capital attraction.