Institutional interest in cryptocurrency markets continues to grow. According to CoinShares' weekly report, demand for crypto asset investment products has not weakened despite geopolitical tensions. This trend, supported by US-based entries in particular, has increased institutional interest not only in leading coins such as Bitcoin and Ethereum, but also in altcoins such as XRP, Sui, and Solana. According to the latest data, investments in cryptocurrencies have reached their highest levels of the year, with some altcoins showing signs of recovery.

CoinShares report: Net inflows into cryptocurrencies

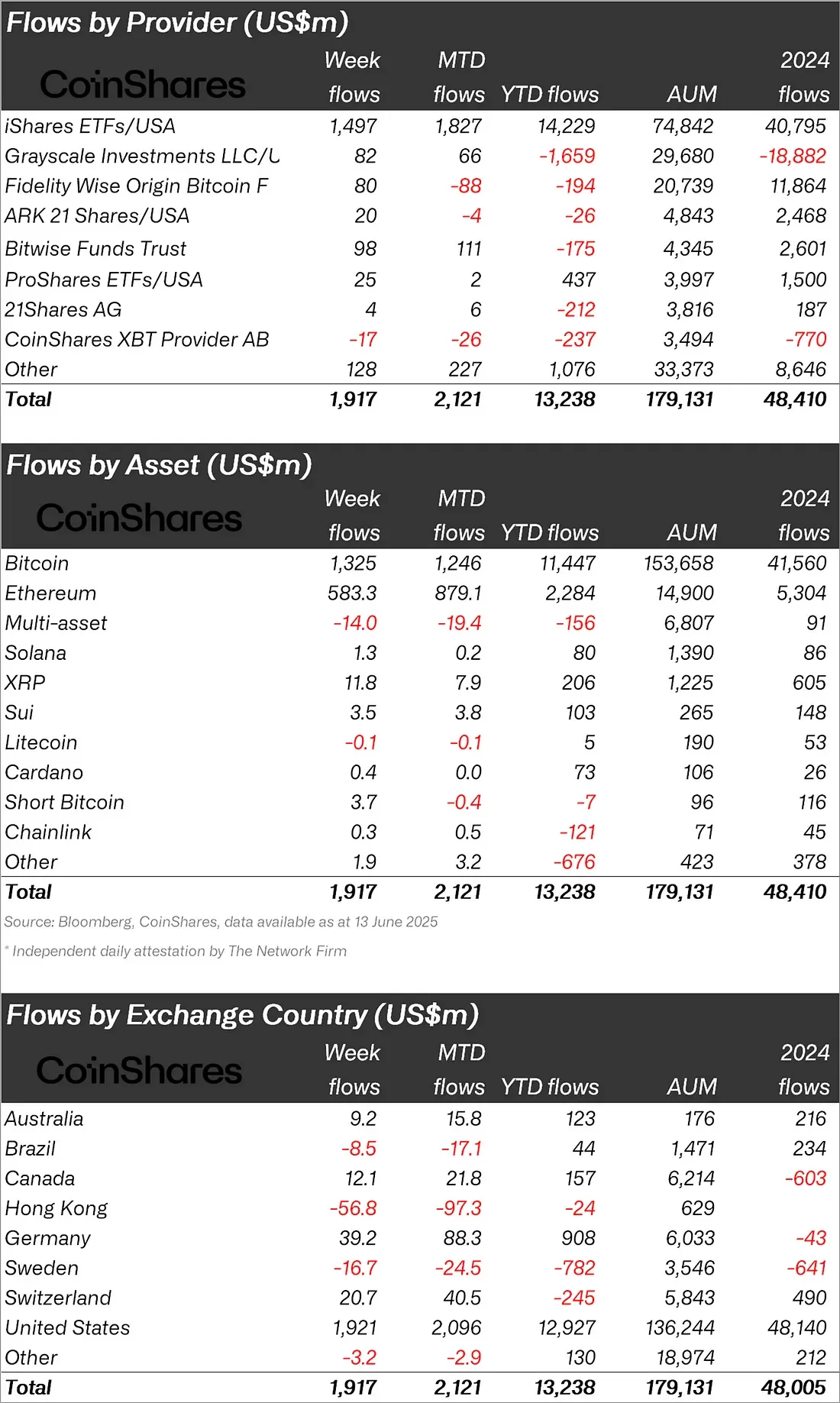

Despite geopolitical tensions dampening global risk appetite, cryptocurrency investment products maintained their steady upward trend, earning investors' confidence. According to CoinShares' report dated June 16, 2025, there was a net inflow of $1.9 billion into crypto assets last week. This marks the ninth consecutive week of inflows, with the total inflow since the beginning of the year reaching a record $13.2 billion.

When looking at regional data, the United States was, as expected, the country with the highest investor interest. The United States maintained its lead with $1.92 billion in weekly inflows, followed by Switzerland ($20.7 million), Germany ($39.2 million), and Canada ($12.1 million). In contrast, outflows of 56.8 million dollars and 8.5 million dollars were observed in countries such as Hong Kong and Brazil, respectively.

Bitcoin and Ethereum investments at the top, XRP and Sui also saw interest

Based on asset-based evaluation, Bitcoin remained the main focus of investors with a weekly inflow of 1.325 billion dollars. This strong performance further boosted Bitcoin's total inflows since the beginning of the year to 11.4 billion dollars. Additionally, 3.7 million dollars in inflows were recorded for short Bitcoin products. There was also notable activity in the Ethereum sector. The weekly inflow of 583 million dollars marked the highest level seen since February. Ethereum's total inflows over the past few weeks reached $2 billion, bringing its share of assets under management (AuM) to 14%.

In addition to these two major assets, XRP and Sui also regained investor interest with inflows of $11.8 million and $3.5 million, respectively. Solana experienced limited inflows of 1.3 million dollars, while other altcoins like Cardano and Chainlink saw low-volume activity. On the other hand, multi-asset products closed the week in negative territory with -14 million dollars, Chainlink with -0.3 million dollars, and Litecoin with -0.1 million dollars.

iShares took the lead, while Fidelity and Grayscale remained in negative territory

On the fund provider side, iShares stood out with 1.497 billion dollars in inflows from its US-based ETFs, while some major players like Fidelity (-88 million dollars) and Grayscale (-1.659 billion dollars) are still struggling with negative flows. Other providers like Bitwise, ARK 21Shares, and CoinShares XBT have also recorded negative inflows since the start of the year.