Coinbase has launched a comprehensive transformation in the financial services sector, moving beyond its identity as a crypto exchange. The company announced the official rollout of in-app stock trading for eligible users in the US. Thanks to this new feature, users can buy US stocks and select ETFs directly through the Coinbase app using USDC. This step stands out as one of the most concrete moves towards Coinbase's long-held vision of being "a single platform to buy and sell everything."

Stock purchases with USDC are now possible on Coinbase

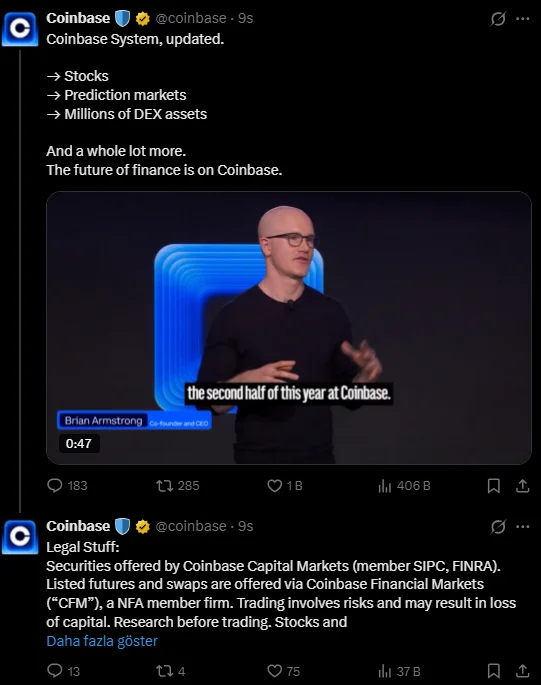

According to information shared by Coinbase, stock transactions are conducted in USDC. With this structure, the company aims to lay the foundation for a 24/7 trading market infrastructure that traditional exchanges still cannot fully offer. Settlement through the digital dollar creates a critical foundation for tokenized stocks and on-chain financial products in the future. CEO Brian Armstrong describes this process as the first step in the convergence of traditional assets with blockchain technology.

In addition to stocks, Coinbase is significantly expanding its product range. The platform is adding futures, perpetual contracts, and outcome-oriented prediction markets. The prediction markets are being implemented in collaboration with Kalshi, a regulated entity in the US. Users can access contracts for thousands of different scenarios, ranging from economic data and political developments to sports and macroeconomic events. According to Brian Armstrong, prediction markets are not just a trading platform. Armstrong argues that these markets have become a powerful tool for measuring public expectations and perceptions. In statements to CNBC, he said that many users follow these markets not as an investment vehicle, but to "see the general expectation of what will happen in the coming month." Armstrong also emphasized that prediction markets could eventually function as an alternative information and sentiment barometer to traditional media.

Coinbase's entry into this space comes amidst an increasingly competitive environment. DraftKings is acquiring its own prediction exchange, FanDuel is partnering with CME, and Polymarket is entering the US market through a newly regulated entity. Robinhood has also placed LedgerX at the center of its derivatives strategy. Armstrong describes this competition as "a race between regulated infrastructures and crypto-native liquidity." Tokenization is central to the company's long-term plans. In this context, Coinbase announced a new institutional product suite called Coinbase Tokenize. This platform allows companies and institutions to bring their real-world assets, even their own shares, onto the blockchain. Armstrong explicitly states that stock trading is only the beginning of this journey, and the ultimate goal is tokenized shares. According to him, this structure can increase global reach and make capital markets more inclusive. Coinbase is also expanding its API infrastructure for institutional clients and developers. The new API suite, covering custody, payment, trading, and stablecoin services, reflects the company's goal of going beyond retail users. Coinbase Business service is also being opened to eligible customers in the US and Singapore. In addition, private-branded stablecoins for businesses and a new payment standard called x402, which enables automated payments, are being introduced.