CME Group, the world's largest derivatives exchange, has opened a new chapter in the crypto market. The company has now added Solana (SOL) and XRP futures options to its product line, already known for its Bitcoin and Ethereum futures. These products, regulated by the US Commodity Futures Trading Commission (CFTC), could boost institutional confidence in the crypto market.

Solana and XRP options begin trading on CME

The new options began trading on October 13th. These physically delivered contracts offer investors both hedging and more flexible position management. According to CME Group, Solana and XRP options are designed for both large-scale investors and smaller players with micro-contract sizes.

This move comes at a particularly significant time, particularly after last week's flash crashes and outages on major exchanges. Leading crypto platforms like Binance and Backpack were temporarily down due to heavy trading during Friday's volatility. Some users even received compensation for liquidations caused by system errors. In this environment, CME's launch of new products on a regulated platform is a response to institutional investors' search for stability and confidence.

CME Group has been a leader in Bitcoin and Ethereum options for years. The company achieved record trading volume with 9.2 million contracts in the second quarter of 2025. With the addition of Solana and XRP, CME now offers futures and options trading across four major crypto assets. This expansion is considered one of the strongest indicators that traditional finance is establishing stronger ties with crypto.

Markets also welcomed this development. Solana rose to $197 in the hours following the news, while XRP rose to $2.55.

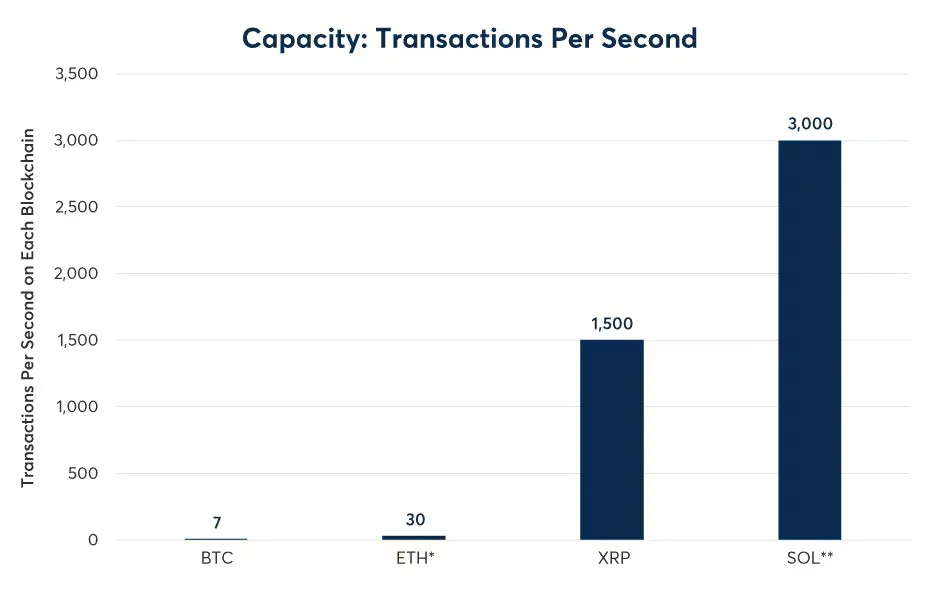

CME's move aligns with macroeconomic developments. As global interest rate cuts continue, investors are turning to alternative assets that central banks cannot "print." In an inflationary environment, digital assets, like gold and silver, stand out for their scarcity. This trend is bringing fast, scalable, and direct financial-use crypto projects like Solana and XRP to the forefront. Solana's "proof of history" structure, which supports thousands of transactions per second, and XRP's cross-border payment infrastructure, in particular, differentiate them from Bitcoin and Ethereum. Both networks can complete transactions in seconds, making them among the few blockchains capable of handling the transaction volume of financial institutions. This feature of the two coins is also illustrated in the CME report, accompanied by the following chart: