CME Group, one of the world's largest derivatives exchanges, is preparing to expand its range of cryptocurrency derivatives. According to information reported by Reuters and the company's official announcement, CME Group plans to launch futures contracts for Cardano (ADA), Chainlink (LINK), and Stellar (XLM). These products are targeted to be launched on February 9th, following the completion of regulatory approvals.

CME Group focuses on Cardano, Chainlink, and Stellar

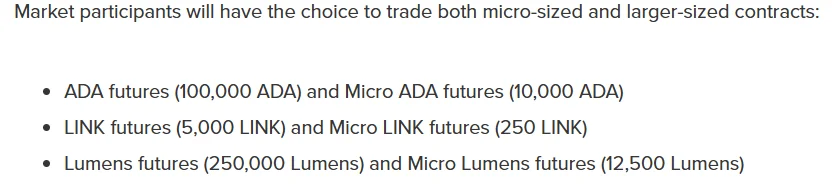

This new step represents a significant addition to CME Group's existing regulated cryptocurrency products. The company will offer both micro-scale and larger-volume futures contracts for these three altcoins. Cardano futures will be structured as standard contracts of 100,000 ADA and micro-contracts of 10,000 ADA, while Chainlink will include standard contracts of 5,000 LINK and micro-contracts of 250 LINK. For Stellar, large contracts of 250,000 Lumens and micro contracts of 12,500 Lumens will be traded.

Giovanni Vicioso, Head of Global Cryptocurrency Products at CME Group, stated that the rapid growth in the crypto market over the past year made this step inevitable. According to Vicioso, investors need reliable and regulated products to manage price risk more than ever before. The new futures contracts aim to provide market participants with greater flexibility while also increasing capital efficiency.

Bob Fitzsimmons, a manager at Wedbush Securities, emphasized that the increase in regulated crypto futures contracts is a significant development for both individual and institutional investors. Similarly, Martin Franchi, CEO of NinjaTrader, stated that digital assets are now playing a more central role in investment portfolios and that CME Group's move is a turning point for the futures market.

The new products will join CME Group's rapidly growing family of cryptocurrency products. The company's current portfolio includes Bitcoin, Ether, XRP, and Solana futures and options linked to these products. According to data shared by CME Group, 2025 was a record year for crypto derivatives. The average daily trading volume in futures and options reached 278,300 contracts, corresponding to a nominal value of approximately $12 billion. Open interest also exceeded $26 billion, marking a new peak. The launch of Cardano, Chainlink, and Stellar futures could pave the way for further institutional interest in altcoin markets. The introduction of micro-contracts will allow smaller investors to hedge and take positions in regulated markets. We will all see together whether the application will be approved in the coming period.