The U.S. Securities and Exchange Commission (SEC) has officially approved the Nasdaq Crypto Index US ETF (NCIQ), launched by Hashdex. Thanks to the new regulation, the fund will not only offer Bitcoin (BTC) and Ethereum (ETH) but will also be able to add leading altcoins such as XRP, Solana (SOL), and Stellar (XLM) to its portfolio. This decision is seen as a significant milestone in diversifying regulated crypto investment instruments.

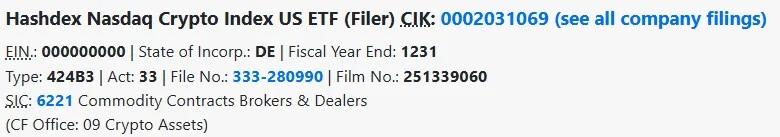

Hashdex's ETF was established in Delaware, and last week, a new trust agreement, revised for the third time, entered into force. This brings the fund into compliance with Nasdaq's current listing standards. With the SEC approval, the fund's fiscal year structure remains unchanged, but it has gained official authorization to add altcoins such as XRP, SOL, and XLM.

New Rules Bring Expedited Approval

The SEC recently adopted new rules that expedite the listing process for crypto ETFs. While it could previously take up to 270 days for an ETF to receive approval, the new standards have reduced this timeframe to 75 days. This eliminates the need for individual reviews during the application process. Now, funds that meet certain requirements can launch directly to the market much sooner.

Canary Capital Group founder Steven McClurg stated that there have already been approximately a dozen applications filed with the SEC, with more in the pipeline, adding, "We'll see a wave of launches in the last quarter of this year." DGIM Law's Jonathan Groth also stated that the crypto ETF market could experience a "boom period" starting in October.

The fund's new allocation is noteworthy.

The updated fund allocation maintains a strong emphasis on BTC and ETH, allocating 6.93% to XRP, 4.11% to Solana, and 0.33% to Stellar. Projects such as Cardano (1.22%), Chainlink (0.50%), and Uniswap (0.14%) are also included in the portfolio in small percentages. This makes the Hashdex ETF one of the first funds to officially include Stellar (XLM).

Crypto market expert Nate Geraci, in a social media post, described the SEC's approval as "a significant development that paves the way for diversification in crypto investment." While the majority of users welcomed the decision, some commentators emphasized that adding altcoins to ETFs would foster broader market acceptance.

The SEC's new standards allow funds to be approved quickly if they meet certain conditions. For example, the listed crypto asset must have at least six months of CFTC-regulated futures contracts or another ETF must directly hold 40% of that asset. This has enabled projects like XRP, SOL, and XLM to quickly become part of the regulated investment vehicle.

Grayscale also took action shortly after the SEC's announcement, converting its private fund into a publicly traded product, the CoinDesk Crypto 5 ETF. This ETF includes BTC, ETH, XRP, SOL, and ADA. Grayscale CEO Peter Mintzberg stated that the swift action stemmed from "the goal of providing greater regulatory clarity and investor access."

Crypto market analysts expect ETFs focused on XRP and Solana to launch in October. However, the real question is whether investors will genuinely show interest in these altcoins beyond Bitcoin and Ethereum. The SEC's recent decision has been noted as one of the most significant steps in the opening of altcoins to traditional markets.