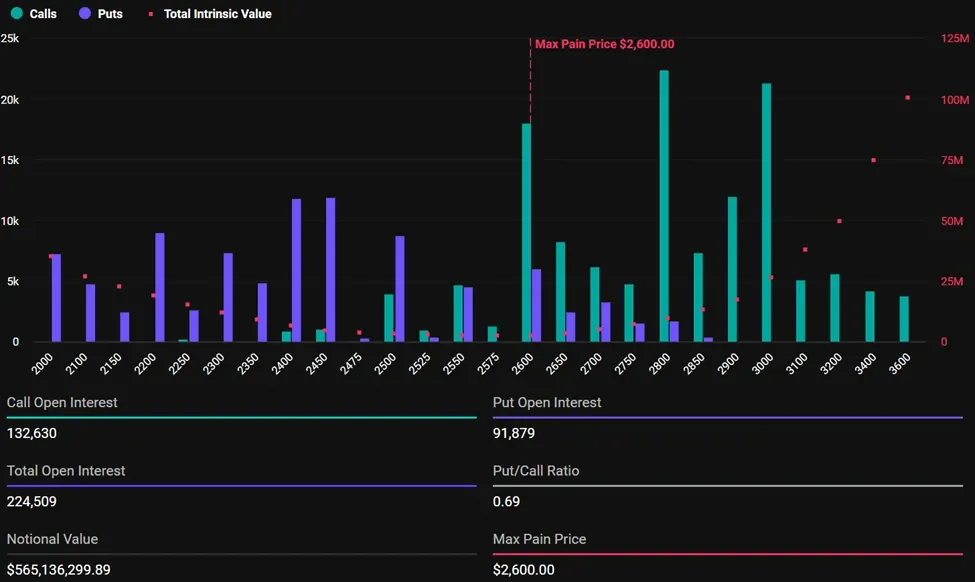

The cryptocurrency market is holding its breath as it awaits the expiration of today's massive options contract. A total of $4.11 billion worth of Bitcoin (BTC) and Ethereum (ETH) options will expire. This development could have a significant impact on the short-term price movements of both assets, which have been losing value in recent days. Bitcoin makes up the majority of the options volume: According to today's data, $3.5 billion worth of contracts are expiring on the BTC side and approximately $565 million on the ETH side. This indicates that volatility in the markets may increase. According to Deribit data, 33,972 Bitcoin options are expiring today. This number has increased compared to last week. On Ethereum, 224,509 contracts will expire. Last week, this figure was 246,849.

Balance in Bitcoin, optimism prevails in Ethereum

When looking at the options expiring for Bitcoin, the "maximum pain" price is determined as $ 105,000. The maximum pain price is known as the point where investors will suffer the most loss, and prices are generally expected to converge to this level. In addition, the put-call ratio for BTC is at 1.00; in other words, investors are almost equally distributed between bullish and bearish expectations. This situation shows that the market is indecisive or in a consolidation process in the short term.

On the Ethereum side, the picture is more optimistic. The maximum pain price for ETH is at $ 2,600. The fact that the current price is below this level shows that investors think the price will rise. The put-call ratio in ETH is 0.69, which shows that call options are the dominant. This ratio shows that investors are taking positions more in the bullish direction, in other words, the market is more positive in this asset.

Markets may enter the weekend volatile

The days when option contracts expire are usually the times when short-term fluctuations occur in the markets. According to the "maximum pain" theory, prices tend to move towards the levels where options will suffer the most losses. Therefore, the price movements to be seen in both BTC and ETH today may develop depending on the levels concentrated especially in option positions.

According to Deribit analysts, "While BTC exhibits a balanced positioning close to the maximum pain level, upward flows dominate on the ETH side. We will watch and see how the market will react this time." In other words, it was emphasized that investors should be careful.

In addition to these developments, the increasing geopolitical tensions in recent days and the statements of US Federal Reserve (Fed) Chairman Jerome Powell are also affecting investor sentiment. In particular, the possible military moves of the US in the Middle East and the increasing tension with Iran are strengthening the downward risk perception in the market.

In summary, today's high-volume options expiration could cause short-term but sharp fluctuations in the crypto market. Both macroeconomic developments and geopolitical risks continue to play an important role in investors' strategies