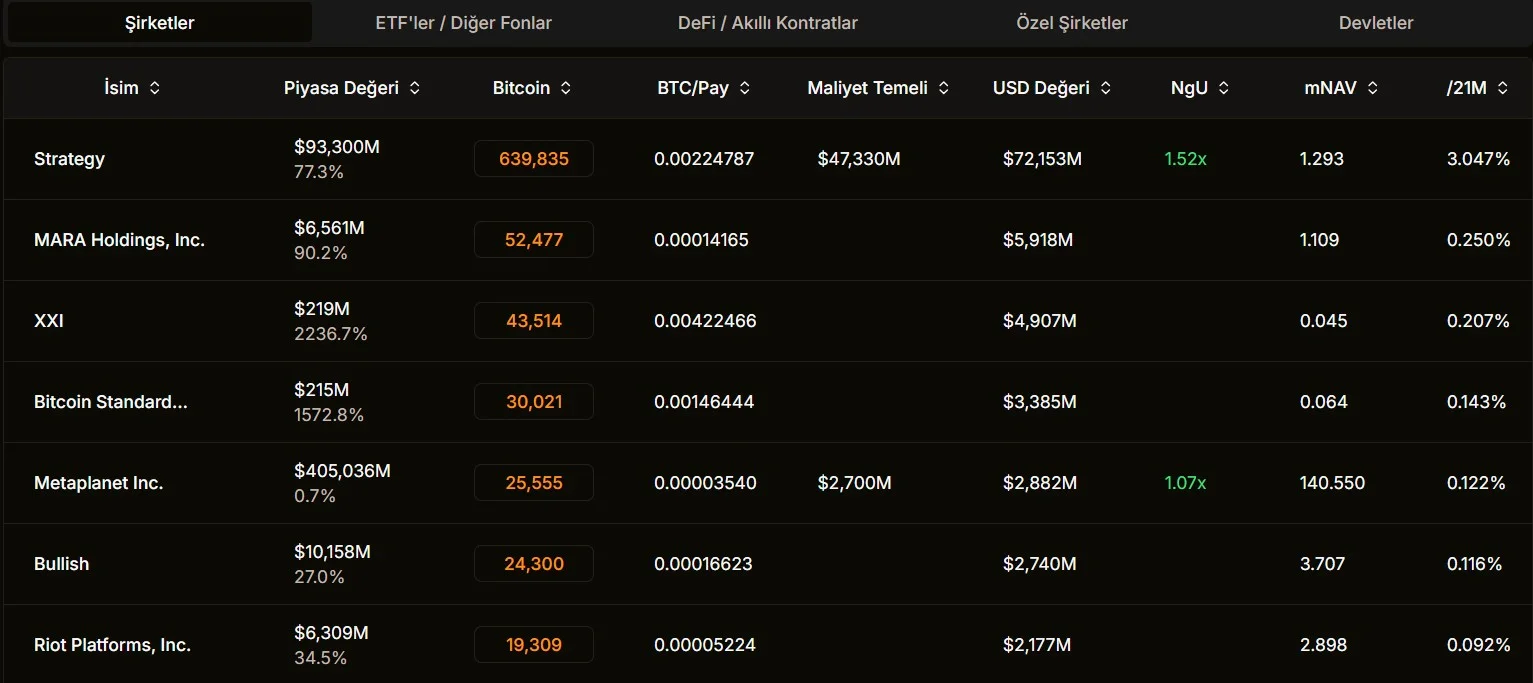

B HODL, a UK-based and recently listed Bitcoin treasury company, has announced its first major move. The company announced the purchase of 100 BTC for approximately $11.3 million. The average purchase price was $113,227 per Bitcoin. With this transaction, B HODL has entered the top 100 publicly traded Bitcoin treasury companies. According to market data, the company already ranks 98th. The top ranks are as follows:

Lots of companies prefer Bitcoin

While still a beginner, the company faces significant competition. Smarter Web, another UK-based company, maintains $284 million in reserves with 2,525 BTC and is ranked 29th on the global list. Globally, Strategy, led by Michael Saylor, is solidifying its top spot. Last week, the company added 850 BTC, bringing its total reserves to 639,835 BTC. This amount has a current market capitalization of $72 billion. In a statement, B HODL stated that its strategy is based on disciplined Bitcoin purchases. The goal is not only to build long-term reserves but also to strengthen Lightning Network operations. The company aims to provide scalable liquidity and earn routing fees from Lightning payments by building high-performance Lightning nodes. This will enable both reserve growth and revenue diversification.

The company's story is quite new. B HODL began trading on the London-based Aquis Exchange under the ticker symbol HODL earlier this week. Approximately $20.7 million was raised during the IPO. Aquis is a cost-effective alternative exchange for small and medium-sized growth-oriented companies.

B HODL's board includes well-known industry figures. Its CEO is former lawyer and co-founder of Bitcoin Policy UK, Freddie New. A key partner of the company is the UK-based crypto exchange CoinCorner. CoinCorner CEO Danny Scott also serves as B HODL's Chief Bitcoin Officer. Its most notable shareholder is Adam Back, a symbol of the Bitcoin world. Blockstream CEO Back has acquired more than 25.5% of B HODL. He is also preparing to assume the role of CEO of Bitcoin Standard Treasury Company, which is preparing to go public in the US.

Investor interest has also been reflected in the stock. HODL shares traded at $29.06 on Wednesday and have risen 34.7% since its IPO. This chart demonstrates the market's interest in the company's Bitcoin-focused strategy.

This move by B HODL could intensify competition among Bitcoin treasury companies in the UK. While the company has started with a small reserve, its goal is clear: to build a growing Bitcoin treasury through disciplined acquisitions and generate additional income through the Lightning Network.