Although Bitcoin has experienced sharp fluctuations in recent weeks, according to JPMorgan analysts, it still has significant upside potential. In its latest report, the bank stated that Bitcoin remains "cheap" compared to gold and that if it reaches fair value, its price could reach as high as $170,000. Institutional analysts emphasize that the market has regained a healthy footing with the decline in leverage ratios, increasing the likelihood of a strong recovery in the next 6 to 12 months.

JPMorgan analysts offer reassurance

Bitcoin is back on the agenda of institutional analysts. In its new report, JPMorgan predicted that the leading cryptocurrency could reach $170,000 within 6 to 12 months. The bank's analysts stated that the normalization of leverage ratios and the fact that Bitcoin remains "extremely cheap" compared to gold could support this rise. JPMorgan strategist Nikolaos Panigirtzoglou stated that leverage ratios in the futures market have largely been eliminated following the sharp decline in October, creating a "healthier platform" for price action. According to the report, Bitcoin's volatility-adjusted "fair value" relative to gold is well above current levels. Analysts argue that if this gap closes, Bitcoin should trade around $170,000.

The bank also noted that gold's recent record highs, coupled with its increased volatility, make Bitcoin more attractive on a risk-adjusted basis. According to JPMorgan data, the Bitcoin-gold volatility ratio has fallen to 1.8. This means Bitcoin is now only 1.8 times riskier than gold. The report stated, "Taking this ratio into account, Bitcoin's current market capitalization is $2.1 trillion, and this figure should increase by approximately 67%, thus equating to a theoretical price of $170,000." Meanwhile, while the sharp correction experienced by the overall market has demoralized investors, many analysts believe Bitcoin is regaining strength after the selling pressure. Crypto analyst Michaël van de Poppe noted that the $106,000 level has become a key resistance level following the recent recovery. According to Poppe, if Bitcoin can surpass this level, the market could regain positive sentiment and pave the way for a new uptrend.

Some analysts highlighted the remarkable outperformance of the Nasdaq index compared to Bitcoin. Market strategist Crypto Rover stated that the gap between the two assets has "widened to a historic level" and could close soon.

All these developments suggest that Bitcoin is beginning to show signs of recovery after one of its sharpest corrections in 2025. The 20% drop in October, combined with the $128 million Balancer attack and massive liquidations in futures, created a significant deleveraging in the market. However, JPMorgan analysts interpret this process as "the beginning of a new bullish cycle."

Consequently, the trajectory of Bitcoin in the coming months remains uncertain. However, institutional analysts' $170,000 forecast indicates that the market still believes in its long-term potential. The deleveraging and increased gold volatility are noteworthy.

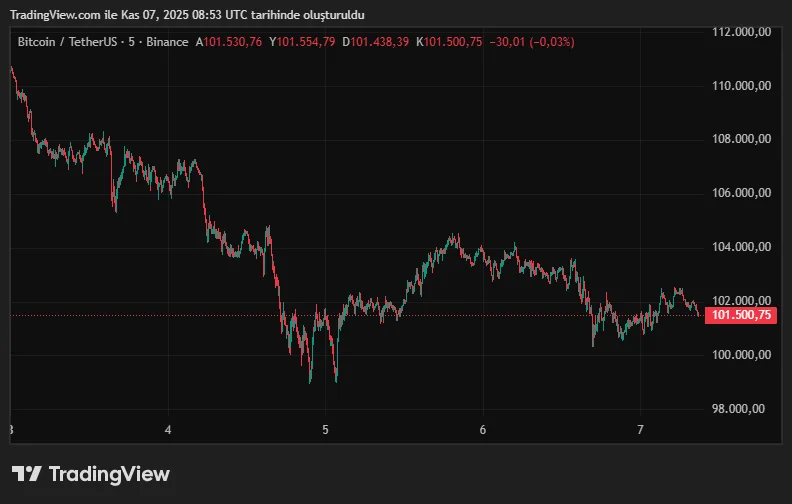

As of November 7, 2025, the Bitcoin price is around $101,531.