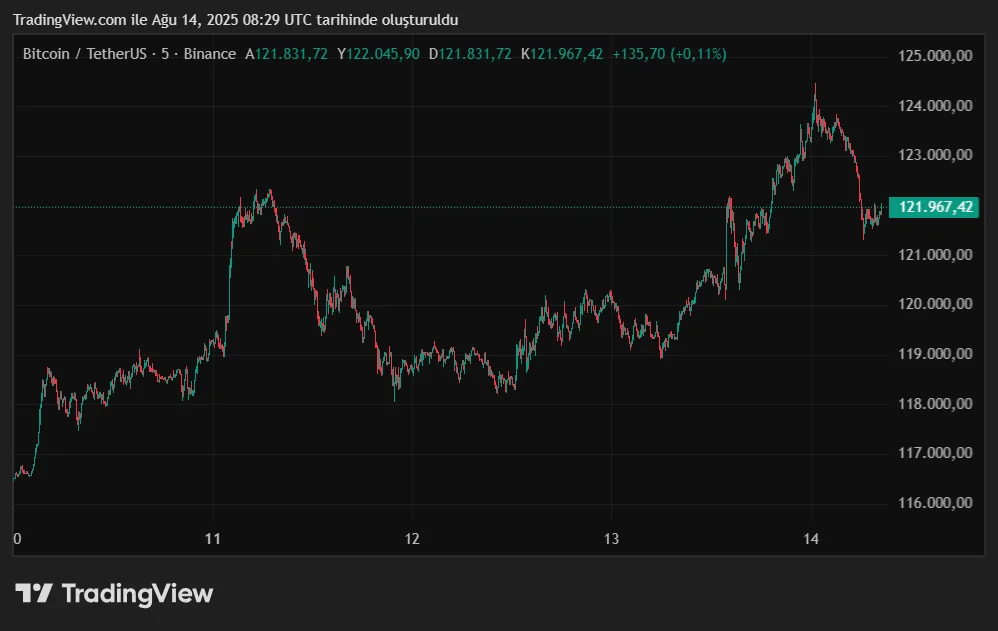

Bitcoin reached an all-time high of $124,130 in the early hours of Thursday morning. According to market data, the rally, which began from an intraday low of $119,000, surpassed the previous record of $123,300, pushing the total value of the cryptocurrency market to its highest level in history. Premium trading on some exchanges (Coinbase, Bitstamp) pushed the price even higher, with records of $124,130 also on the horizon.

BTC Markets analyst Rachael Lucas emphasized that the influx of institutional capital was driving the record highs: "Public and private companies, as well as sovereign wealth funds, currently control 3.64 million BTC, representing more than 17% of the total supply."

Ethereum and the altcoin front

Ethereum also maintained its strong performance, reaching a four-year high of $4,770. This level is only 2.5% away from its all-time high of 2021. Rekt Capital stated that Ethereum could enter a period of price discovery if the $4,630 level becomes support. Bitcoin dominance falling below 60% has been interpreted as a sign of the start of altcoin season.

Selling Pressure from Long-Term Investors

However, blockchain data shows that more than 300,000 BTC has been withdrawn from long-term wallets in the last four weeks. Some wallets that had been dormant for years have become active and profit-taking. Glassnode reported that these sales, which reached record levels in July, continued, albeit at a slower pace in August.

Sam Gaer of Monarq Asset Management said, “While supply from older wallets limited the price increase, the market largely absorbed this pressure.” Furthermore, institutional investors selling call overwriting options at high prices has pushed volatility to historic lows.

Analysts note that a strong demand base has formed at $118,000 and that macroeconomic conditions remain supportive. Sentora's Gabriel Halm stated that 1.88 million addresses bought 1.3 million BTC at an average price of $118,000, preventing sharp pullbacks. Vtrader founder Steve Gregory stated that Ethereum investors could capitalize and return to Bitcoin, which could support a sustained price above $120,000.