Bitcoin started the new week with a familiar scenario. After a brief surge on Monday morning, rising above the $90,000 level, BTC was once again sharply rejected and quickly retreated. Recent price movements reveal that upward momentum in the market remains weak and the necessary demand for a strong breakout has not yet materialized.

Bitcoin failed to stay above $90,000

Since mid-December, Bitcoin's attempts to surpass the $90,000 threshold have created a sense of déjà vu. According to data, BTC has been turned back from this critical level at least six times since December 16th. Even in the past week alone, two attempts were unsuccessful. The price, which rose to $90,500 last Monday, experienced a sharp drop of approximately $4,000 in the following days. In another attempt to rise on Friday, Bitcoin failed to even reach $90,000.

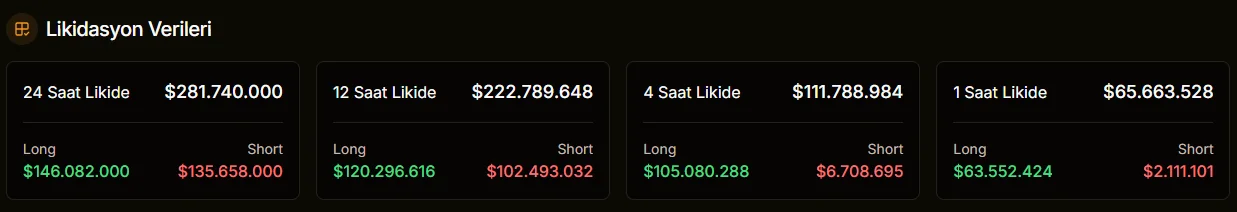

Following these unsuccessful attempts, the market traded sideways between $87,000 and $88,000 for several days. At the start of the week, buyers re-entered the market, pushing BTC up to $90,400. However, the situation remained unchanged. This short-lived rise ended with a "dead cat bounce," as many analysts have pointed out, and Bitcoin quickly fell below $88,000. In the latest price movements, BTC is trading around $86,800, with its market capitalization having fallen to approximately $1.75 trillion. Bitcoin's dominance over altcoins hovers slightly above 57%. This sharp price fluctuation has also led to significant liquidations in the futures market. In the last 24 hours, a total of $281.2 million in positions have been liquidated in the cryptocurrency markets. Approximately 51.9% of these liquidations were from long positions. In the last 12 hours alone, $234.3 million in liquidations occurred, with 52.2% of this being the liquidation of long positions. Looking at shorter timeframes, it's noteworthy that $111 million worth of positions were liquidated in the last 4 hours, and $65 million in the last hour alone.

Liquidations are striking

Exchange-based data also reveals the extent of volatility. In the last 12 hours, approximately $60.3 million was liquidated on Bybit, with the majority coming from short positions. On Binance, approximately $54.4 million was liquidated, with long positions predominating. The overall picture shows that the market is aggressively opening positions in both directions, but there is no clear consensus on the direction.

Similar weakness is observed in the altcoin market. Ethereum rose above $3,000 during the day, approaching $3,050, but could not maintain this level and fell back to $2,960. BNB retreated to around $856, while XRP dropped below the critical support level of $1.90. On a daily basis, Solana, Zcash, and Dogecoin recorded limited gains, while Bitcoin Cash was the biggest loser among large-cap altcoins. CC, however, stood out positively with a rise of approximately 4%. During all these movements, the total cryptocurrency market capitalization experienced increases and decreases of approximately $70 billion within hours before returning to the $3.06 trillion level.

On-chain and institutional data also support the cautious picture. The apparent demand indicator for Bitcoin turned negative, falling to approximately -3,491 BTC, the lowest level seen since October. The fact that the Coinbase premium index, reflecting US investor behavior, remains in negative territory also indicates that selling pressure has not completely ended. In addition, a net outflow of approximately $782 million from spot Bitcoin ETFs last week shows a weakening risk appetite on the institutional side.