Recent data shared by the cryptocurrency analysis platform CryptoQuant reveals a striking picture in the Bitcoin market. According to on-chain metrics, Bitcoin recorded a realized loss of $2.3 billion on average over 7 days. This level indicates a capitulation on a scale similar to major breaking periods such as the sharp declines in 2021 and the FTX and Terraform Labs-related crash in 2022.

Short-term investors are selling at a loss, long-term investors are waiting

The realized loss (Net Realized Profit/Loss - NRPL) metric measures whether investors have locked in profit or loss when moving or selling Bitcoin on-chain. A sharply negative figure indicates that a significant amount of BTC changed hands below the purchase price. The $2.3 billion figure reveals that billions of dollars worth of Bitcoin were sold at a loss, indicating serious panic among short-term investors.

According to the data, the main source of selling pressure was short-term investors. In the last few months, this group, which bought at higher levels, is closing its positions at a loss as the price pulls back. This behavior is frequently seen during periods of sharp correction. In contrast, long-term investors largely maintain their positions and do not significantly contribute to the increase in losses.

On-chain analytics company Glassnode states that the inability to recover significant cost-below levels makes the market fragile. As the price remains below the average cost of investor groups, more supply enters the loss zone; this increases the risk of additional selling pressure in new declines. Therefore, it is not enough to look only at the amount of loss; it is also critically important to know which investor group is at which cost level.

It is stated that the daily NRPL data has fallen to approximately minus $2 billion on some days. This magnitude is comparable to the Luna crash of 2022. However, there is a significant difference between the current situation and that period. In 2022, prices fell below $20,000 and a systemic collapse occurred. Today, similar losses are occurring at much higher price levels. This situation indicates that the market structure and investor composition have changed compared to the past.

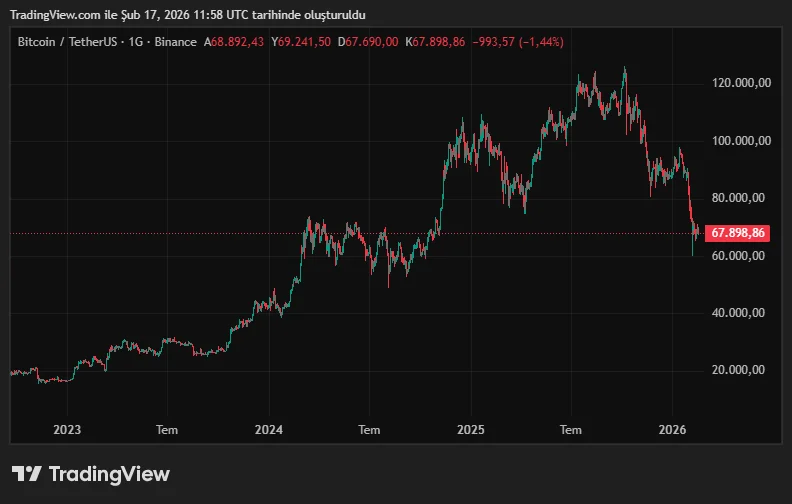

The increase in loss-making sales by short-term investors, while long-term investors remain relatively calm, points to a "weak hands elimination" process in the market. Historically, such periods of intense losses are often seen near local lows. Indeed, after the recent sharp sell-off, the Bitcoin price reacted from around $60,000 to over $70,000. However, such jumps do not always signify a permanent trend reversal; temporary relief rallies can also occur within a broader downtrend. In the coming period, whether the price can regain the cost basis of short-term investors will be decisive. A sustained settlement above these levels could reduce the pressure of loss-making sales and initiate a stabilization process in the market. Otherwise, negative NRPL data may continue for some time, and volatility may remain high.