Cryptocurrency markets started the last trading day of the week with sharp declines. The markets experienced a serious sell-off due to rising geopolitical tensions in the Middle East and inflation data from the US. Almost all major cryptocurrencies, especially Bitcoin and Ethereum, lost value. The total market value of cryptocurrencies fell by more than 2 percent, from $3.37 trillion to $3.32 trillion. The value of positions liquidated daily exceeded $1.1 billion. Let's take a look at the market details of the day...

Major decline in the market: Bitcoin, ETH and other cryptocurrencies in the top 10 declined

Dogecoin (DOGE) was one of the assets most affected by the general decline in the market. The popular meme coin lost nearly 7 percent in value in just 24 hours, falling to $0.181. While Bitcoin fell 4 percent to below $103,000, Ethereum fell 9 percent to $2,500. Solana lost more than 6%, while XRP lost nearly 4%.

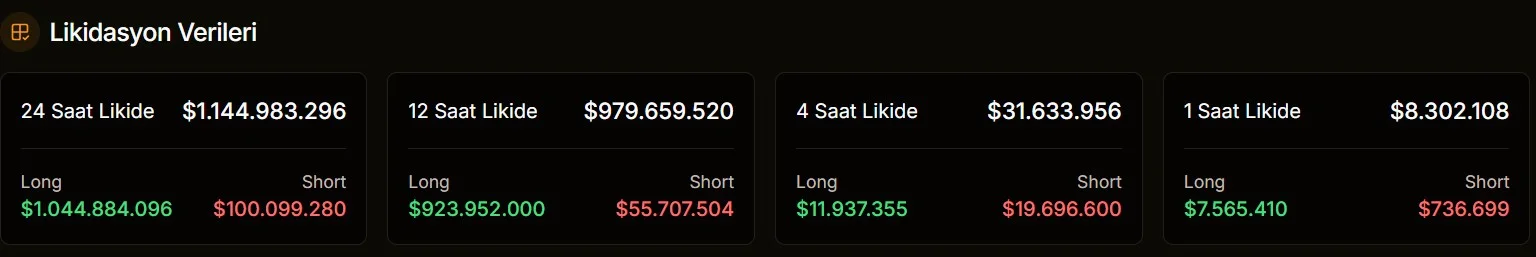

According to JrKripto.com data, a total of $1.04 billion worth of positions were liquidated in the last 24 hours, the vast majority of which were long (bullish) positions. A $317 million long position was liquidated on Bitcoin alone. Liquidations in Ethereum totaled $151 million.

Tension between Iran and Israel

Two main developments stand out behind this decline in crypto markets. The first is Israel's airstrike on a nuclear facility in Iran. With this news coming around 03:30 Turkish time, investors quickly exited risky assets and headed for safe havens. This move pushed the price of gold above $3,410 per ounce, while causing a sharp 13% increase in oil prices. As investors rushed to safe havens, the exit from Bitcoin and altcoins, which are considered "risky assets", increased.

US inflation also affected the market

The second factor affecting the market is the May CPI data announced in the US on Wednesday. Although the data indicating that inflation is slowing was perceived positively in the markets at first glance, many investors used this opportunity to make profits and turned to sell-side transactions. This correction, especially for Bitcoin, which exceeded the $ 110,000 level at the beginning of the week, was a turning point where excessive optimism was broken.

The impact of geopolitical tensions and economic data on the markets seems to continue in the coming days. Considering the high volatility of crypto assets, investors are expected to act cautiously and give more importance to risk management. In particular, the Fed's interest rate policy and developments in the Middle East will play a critical role in determining the direction of crypto markets.