The new week started with volatility in the cryptocurrency market. Bitcoin and leading altcoins, which gained upward momentum following the recent 25 basis point interest rate cut by the US Federal Reserve (Fed), came under renewed selling pressure after the weekend. So, what was behind this decline? Here are the triggers of the decline and the latest market conditions.

Bitcoin and altcoins are experiencing a sharp decline

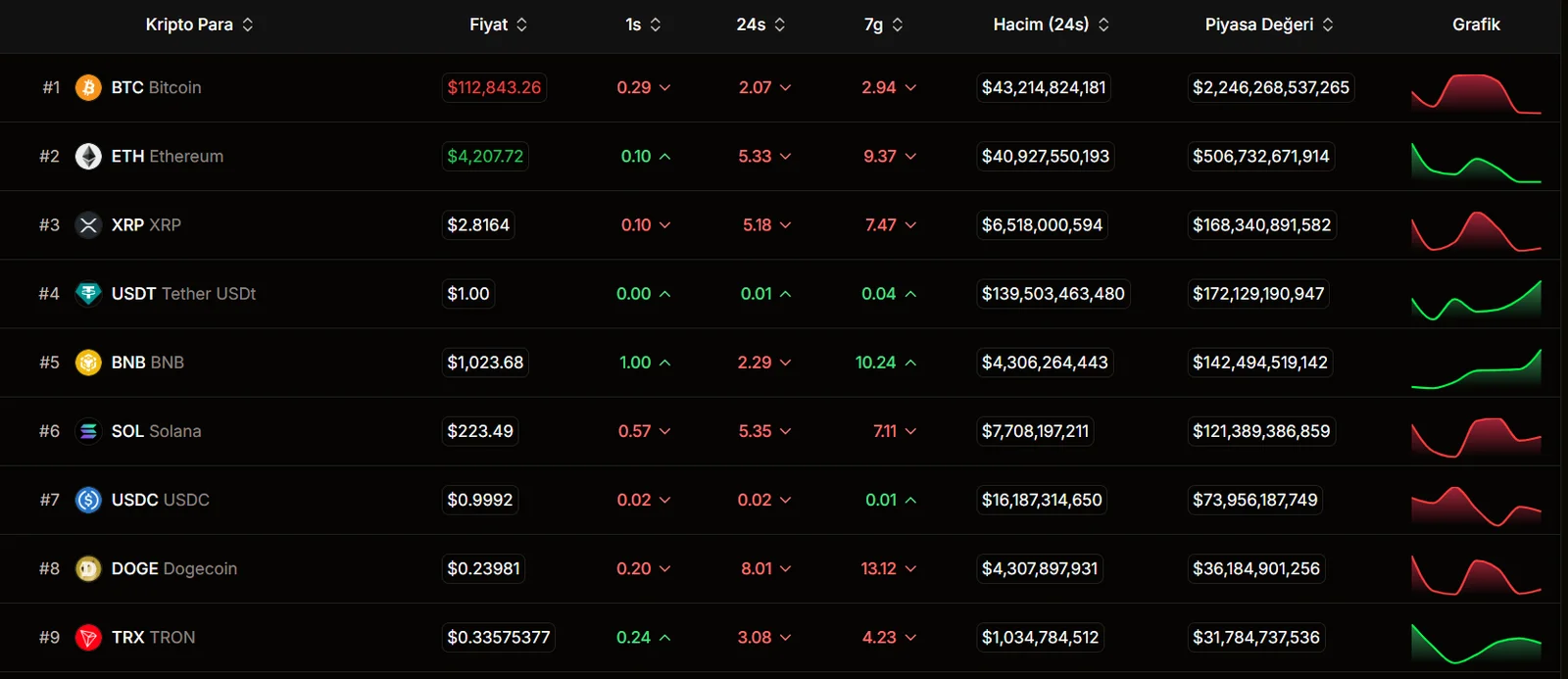

As of Monday morning, Bitcoin had fallen nearly 3 percent to the $112,700 range. Ethereum, on the other hand, experienced an even steeper decline, losing more than 5 percent to $4,190. Solana fell 5.3 percent to trade around $222, while XRP fell 5 percent to $2.8. The acceleration of selling was notable with the opening of European markets on the first trading day of the week. Within minutes, Bitcoin had fallen more than 2 percent to $111,900; Losses reached 5% and 7%, respectively, in Ethereum and Solana.

Fed's interest rate decision impacts

Analysts note that this rapid pullback isn't tied to a clear trigger, but rather can be explained by short-term selling and breaks in technical levels. BTSE COO Jeff Mei said, "The market retreated slightly over the weekend because investors are being cautious in the uncertain macroeconomic environment. The Fed stated that it will evaluate interest rate decisions on a meeting-by-meeting basis, meaning it won't initiate an aggressive rate cut."

Fed Chair Jerome Powell also described the rate cut as a "risk management" step in his press conference, emphasizing that there was no need for rapid action. These statements limited investors' expectations and created a cautious atmosphere in the crypto market.

In terms of market capitalization, the total capitalization of crypto assets has fallen below $4 trillion. Major altcoins like Ethereum and Solana led the way, while Dogecoin experienced one of the sharpest declines, falling 7.8%. Cardano fell 5.7 percent, and Chainlink fell 6 percent. Meanwhile, Avalanche saw a positive outperformance with a 4 percent gain.

Investors cautious

According to BTC Markets analyst Rachael Lucas, the crypto market's "fireworks" of the first half of the year have faded. Lucas said, "Investors are cautious; long-term holders aren't panicking, but short-term investors are uneasy. On-chain data suggests that large investors aren't selling. This suggests the market is more 'uneasy optimism' than fear." Lucas also noted that a break above $124,000 for Bitcoin could trigger a new upward wave, while the current price action suggests more consolidation.

Among the critical developments for the markets in the coming days is the PCE data, the Fed's preferred inflation indicator. It's being argued that if there are signs of easing inflation, the crypto market could rebound. Meanwhile, regulatory approvals for new spot Bitcoin ETFs from various regions or increased institutional demand are also among the potential factors that could revive price momentum.

Consequently, the crypto market exhibited a volatile outlook in September, consistent with historical trends. While investors appear to be acting more cautiously considering short-term uncertainties, there is currently no panic affecting the long-term outlook. However, during this period of renewed volatility, the market's fragile nature necessitates strong catalysts.