Binance Futures announced two new futures contracts on December 10, 2025, along with an update to its multi-asset mode. The platform expanded its token diversity and increased margin options, strengthening the flexibility of professional traders in the leveraged trading space.

WET Futures Contract Coming Soon

The first announcement of the day came for WET, the native asset of Humidifi, described as the largest DEX in the Solana ecosystem. The WETUSDT futures contract opened for trading on December 10 at 07:00 UTC (10:00 GMT+3) and offers leverage up to 50x. According to Binance, the contract is collateralized with USDT, a funding fee is calculated every four hours, and the tick size is set at 0.00001. The contract address and technical information for WET were also shared; it was particularly noteworthy that Humidifi, which stands out with its prop AMM architecture, has a strong position in terms of volume on the Solana network. The contract has been included in the new listing fee campaign and will also be activated for copy trading within 24 hours.

USD1 Added as Margin

Binance's second move was an addition to Multi-Assets Mode. As of December 11, 2025 at 09:00 UTC (12:00 GMT+3), World Liberty Financial USD (USD1) will be available as a margin asset in futures trading. Users will be able to open positions in different contracts by using their USD1 balances as collateral in multi-asset mode. The announcement also shared transfer limits that vary according to VIP levels and the 1% haircut rate set for USD1. Binance left a flexible framework, stating that it may change the limits and rates depending on market conditions. The reflection of the USD1 price index in real-time collateral calculations will offer institutional users a more balanced risk management.

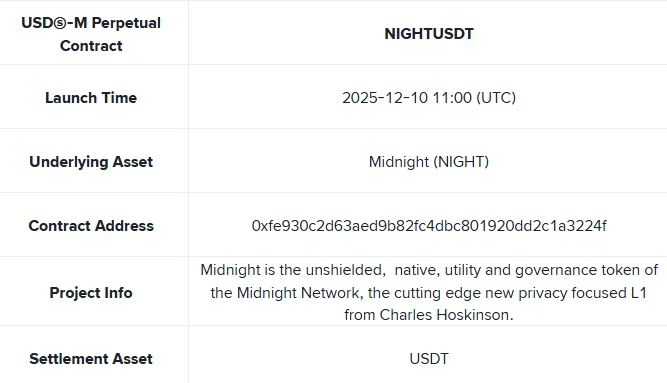

There is also an announcement for NIGHT

The last announcement of the day was for NIGHT, the native token of the Midnight Network, led by Cardano founder Charles Hoskinson. The NIGHTUSDT perpetual contract began trading on December 10th at 11:00 UTC (14:00 GMT+3) with leverage up to 50x. Midnight is positioned as a new privacy-focused L1 contract, with the NIGHT token at the center of both governance and on-network usage. The contract's funding mechanism, margin requirements, and 24/7 trading schedule are structured similarly to WET. This contract is also included in the campaign, and it was announced that Copy Trading support will be added shortly.

Binance reiterated this important reminder in all its announcements: Listing futures contracts does not mean the token is added to Binance Spot. The platform also stated that it may update funding rate caps, leverage levels, and margin requirements from time to time based on market risk. While both large ecosystem tokens with high liquidity and next-generation L1 projects are finding a place in futures trading on the exchange, the addition of alternative margin assets like USD1 makes portfolio management more modular for professional investors.