Altcoin

This page lists the latest Altcoin news and market analysis. Browse articles, expert insights, and updates in this category on JrKripto. Stay informed with in-depth coverage of cryptocurrency trends and developments.

News

Altcoin News

Altcoin News

Browse all Altcoin related articles and news. The latest news, analysis, and insights on Altcoin.

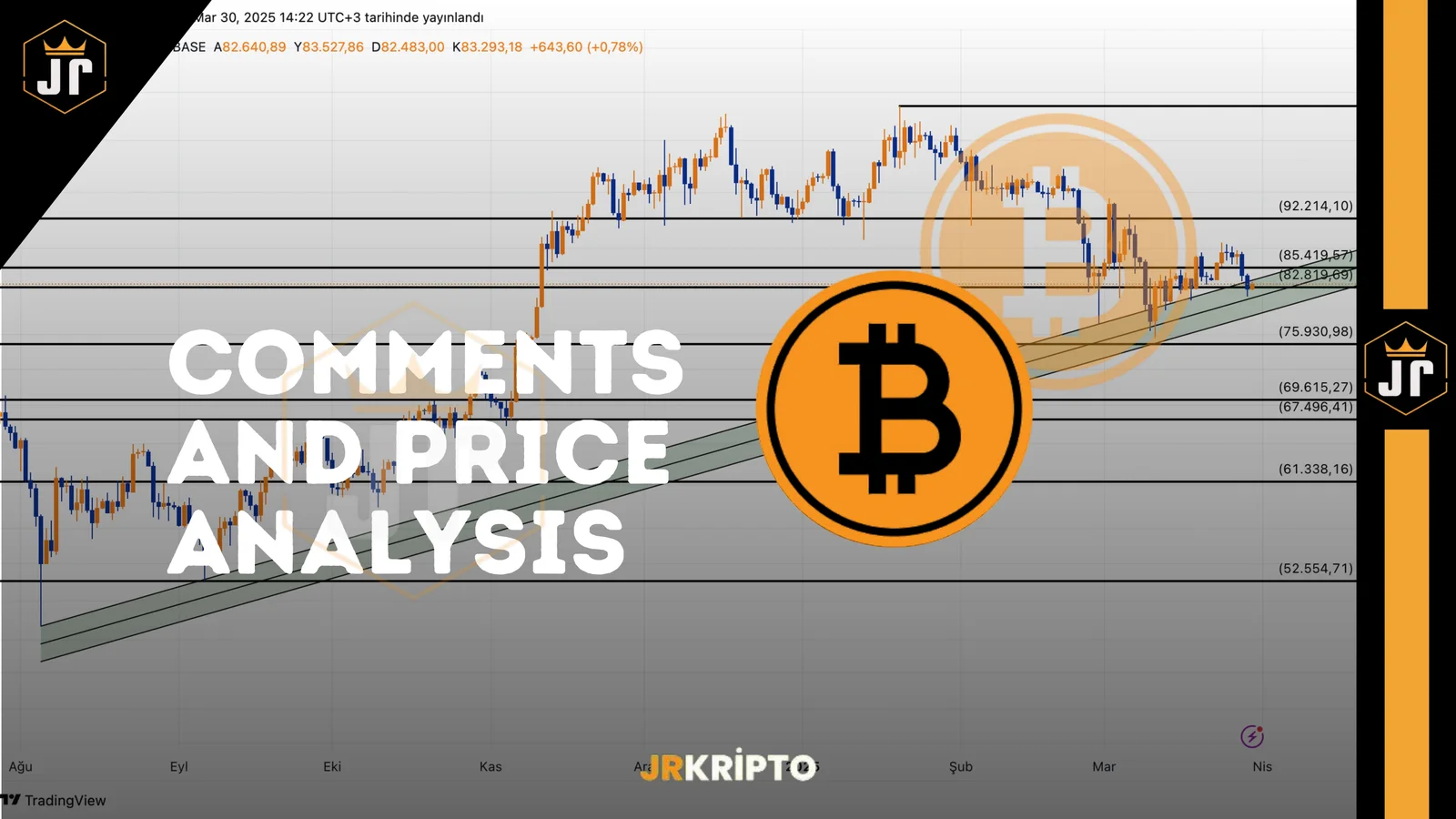

BTC, USDT.D and TOTAL: Comments and Price Analysis 30.03.2025

Bitcoin (BTC) and the Crypto Market In-Depth Analysis – Key Levels and Possible ScenariosThe cryptocurrency markets continue to fluctuate in parallel with Bitcoin's (BTC) movements. Especially at a time when we are questioning whether we are on the verge of a bull market, analyzing critical levels becomes extremely important. Global developments, macroeconomic factors, and technical indicators all play a crucial role in determining BTC's direction.In this analysis, we will thoroughly examine Bitcoin’s main support and resistance levels, the impact of USDT Dominance (USDT.D), the TOTAL market cap, and how macroeconomic factors influence BTC's price. BTC Support and Resistance Zones Key Support and Resistance Levels for BitcoinTo maintain its upward trend, Bitcoin must hold certain support levels. At the same time, for upward movements to be sustainable, key resistance levels must be broken.BTC Support Zones (Areas of Strong Buying Interest)$82,300 – $83,100 Range: A strong short-term support zone. This area stands out as one of the regions with intense buyer interest.$80,691 Level: The main support zone where Bitcoin has received strong buying reactions. If the price continues to hold above this level, the uptrend is expected to continue.$73,336 Macro Support Level: A critical intersection where BTC began its rise from $15,500. After this zone, BTC previously saw over 150% gains. If the price pulls back to this level, we may see renewed buying pressure.Holding above $80,691 is positive for Bitcoin, but if this level is lost, the $73,336 scenario may come into play.BTC Resistance Zones (Areas of Strong Selling Interest)$87,500 Level: One of the most critical resistance zones for Bitcoin. This level was previously a support and now acts as resistance. If BTC breaks above, the bullish scenario strengthens.$92,591 Level: One of the major resistance points that could define Bitcoin’s direction. If this level is broken to the upside, BTC could move toward the $95,745 – $97,213 zone.$95,745 – $97,213 (NPOC) Zone: A zone of high previous trading volume with unbalanced activity (NPOC). Breaking this area could lead BTC toward $110,000.$110,000 Main Target: Reaching this level could open the door to new all-time highs. Technically, once price enters discovery mode, upward momentum is likely to accelerate.A break above $87,500 strengthens the bull trend; sustained movement above $95,745 makes $110,000 the next target.Macroeconomic Factors Impacting BitcoinBitcoin’s price is not solely determined by technical levels. Global economic developments, U.S. Federal Reserve policies, inflation data, and political events all play major roles in price action.April 2 Trump Tariff Announcement:If the U.S. announces exemptions in trade policies, global risk appetite may increase, potentially allowing BTC to test $95,000.Otherwise, market uncertainty may rise, leading to short-term selling pressure on BTC.FED Interest Rate Policies and BTC:A signal of a rate cut in May by the Fed would create a positive scenario for Bitcoin.A low-interest environment increases market liquidity and accelerates inflows into risk assets like BTC.To sustain its upward move, Bitcoin must be monitored not only through technical levels but also macroeconomic developments.USDT Dominance (USDT.D) and Its Market ImpactUSDT Dominance is a key indicator showing investors’ inclination toward stablecoins. If USDT.D rises, it signals increasing risk aversion; if it falls, it indicates capital inflow into crypto assets. USDT.D Critical Levels 6.06% – Panic Selling Level:When USDT.D reaches this level, it signals investor flight from risk.A pullback from here could accelerate fund inflows into Bitcoin and altcoins.4.98% – Start of Crypto Fund Inflow:Falling below this level indicates the beginning of new capital entering the crypto market.Supports BTC staying strong around the $82,300 level.4.68% – Accumulation Zone:A zone where large investors accumulate BTC and altcoins.As long as USDT.D stays below 5.38%, $82,300 remains a strong support for Bitcoin.TOTAL Market Cap Analysis: General State of the Crypto MarketTo understand the general direction of the crypto market, we need to look at TOTAL market cap movements. TOTAL Important Levels 2.51T – Demand Zone & Strong Support:As long as we stay above this level, the crypto market maintains a positive outlook.A breakdown here could lead to sharp sell-offs in the altcoin market.2.68T – Buyer Strength Test:If buyers dominate this level, the uptrend continues.Otherwise, we could see a return to the 2.51T zone.2.84T – Main Resistance Level:A breakout here could open the door to new market highs.3.16T – Profit-Taking Zone:If the 2.86T level is broken with volume, TOTAL could climb to 3.16T.This zone may trigger a pullback, but a breakout with strong volume could lead to new all-time highs in the crypto market.If TOTAL stays above 2.51T, the market remains in a positive trend. A breakout above 2.84T confirms a bull market.Roadmap for BTC and the Crypto MarketAs long as BTC holds above $80,691, the uptrend remains intact.A break above $87,500 signals the start of a bull trend.As long as USDT.D remains below 5.38%, $82,300 remains a strong support for BTC.Macroeconomic developments (especially Trump’s April 2 announcement and Fed interest rate decisions) will determine market direction.As long as TOTAL holds above 2.51T, the market outlook remains positive.Disclaimer: This analysis does not constitute investment advice. It focuses on support and resistance zones that may present trading opportunities under current market conditions in the short and medium term. All trading and risk management decisions are the sole responsibility of the user. The use of stop-loss orders is strongly recommended.

SEC: Meme Coins Are Generally Not Securities!

There has been a major development in the cryptocurrency world. The US Securities and Exchange Commission (SEC) has announced that most meme coins will not be considered securities under federal law. This decision could be a significant turning point for crypto investors and especially the meme coin community.What Does the SEC's Statement Mean?According to the SEC's statement, popular meme coins such as Dogecoin (DOGE), Shiba Inu (SHIB) and Pepe (PEPE) generally do not fall under the definition of a security. The Commission stated that such assets are not managed by a central organization or company by nature and investors do not act directly based on a company's profit.However, the SEC also emphasized that there may be some exceptions. If a meme coin is launched by a certain group or company and investors are guaranteed a profit, it stated that such assets can be considered a security. In other words, as a general rule, meme coins are not securities, but some may be subject to scrutiny.What Will Its Impact on the Market?This statement by the SEC is considered a positive development, especially for meme coin investors. This decision may reduce the concerns investors have experienced due to regulatory uncertainty. It may also allow such assets to reach a wider adoption rate.On the other hand, this situation can also be read as a signal of softening in the SEC's approach to crypto assets in general. Recently, the SEC has concluded its investigations into crypto companies such as Gemini, OpenSea, Uniswap and Robinhood. Now, it seems to be reducing its pressure on the sector by taking a more flexible stance on meme coins.The SEC's decision not to consider meme coins as securities could be a significant turning point for the cryptocurrency market. This decision means a decrease in regulatory pressure and eliminates uncertainty in the sector to some extent. We will continue to follow the developments to see whether there will be more flexibility in the SEC's regulatory approach to crypto in the coming period.