Bitcoin (BTC) and the Crypto Market In-Depth Analysis – Key Levels and Possible Scenarios

The cryptocurrency markets continue to fluctuate in parallel with Bitcoin's (BTC) movements. Especially at a time when we are questioning whether we are on the verge of a bull market, analyzing critical levels becomes extremely important. Global developments, macroeconomic factors, and technical indicators all play a crucial role in determining BTC's direction.

In this analysis, we will thoroughly examine Bitcoin’s main support and resistance levels, the impact of USDT Dominance (USDT.D), the TOTAL market cap, and how macroeconomic factors influence BTC's price.

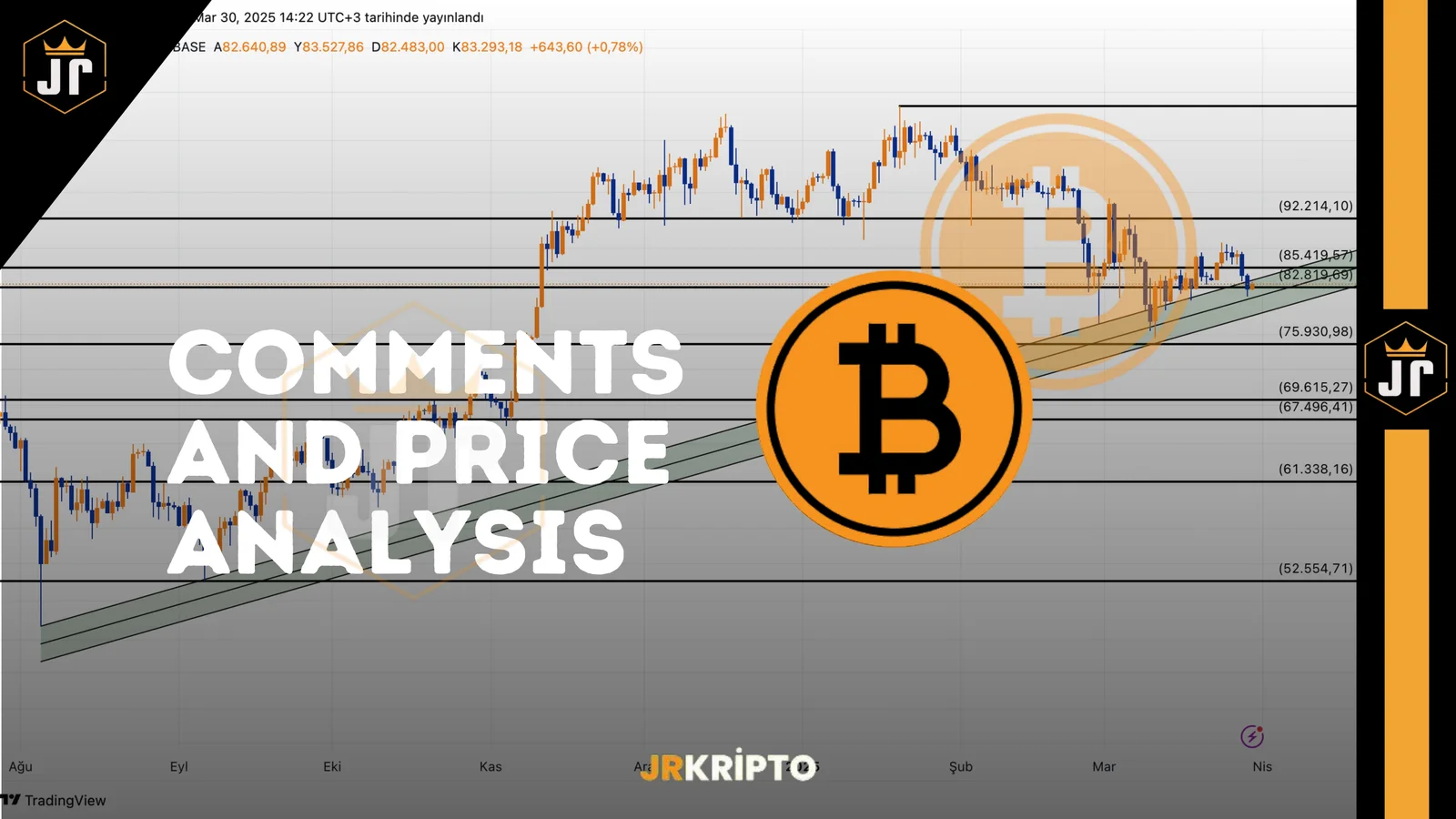

Key Support and Resistance Levels for Bitcoin

To maintain its upward trend, Bitcoin must hold certain support levels. At the same time, for upward movements to be sustainable, key resistance levels must be broken.

BTC Support Zones (Areas of Strong Buying Interest)

- $82,300 – $83,100 Range: A strong short-term support zone. This area stands out as one of the regions with intense buyer interest.

- $80,691 Level: The main support zone where Bitcoin has received strong buying reactions. If the price continues to hold above this level, the uptrend is expected to continue.

- $73,336 Macro Support Level: A critical intersection where BTC began its rise from $15,500. After this zone, BTC previously saw over 150% gains. If the price pulls back to this level, we may see renewed buying pressure.

Holding above $80,691 is positive for Bitcoin, but if this level is lost, the $73,336 scenario may come into play.

BTC Resistance Zones (Areas of Strong Selling Interest)

- $87,500 Level: One of the most critical resistance zones for Bitcoin. This level was previously a support and now acts as resistance. If BTC breaks above, the bullish scenario strengthens.

- $92,591 Level: One of the major resistance points that could define Bitcoin’s direction. If this level is broken to the upside, BTC could move toward the $95,745 – $97,213 zone.

- $95,745 – $97,213 (NPOC) Zone: A zone of high previous trading volume with unbalanced activity (NPOC). Breaking this area could lead BTC toward $110,000.

- $110,000 Main Target: Reaching this level could open the door to new all-time highs. Technically, once price enters discovery mode, upward momentum is likely to accelerate.

A break above $87,500 strengthens the bull trend; sustained movement above $95,745 makes $110,000 the next target.

Macroeconomic Factors Impacting Bitcoin

Bitcoin’s price is not solely determined by technical levels. Global economic developments, U.S. Federal Reserve policies, inflation data, and political events all play major roles in price action.

April 2 Trump Tariff Announcement:

- If the U.S. announces exemptions in trade policies, global risk appetite may increase, potentially allowing BTC to test $95,000.

- Otherwise, market uncertainty may rise, leading to short-term selling pressure on BTC.

FED Interest Rate Policies and BTC:

- A signal of a rate cut in May by the Fed would create a positive scenario for Bitcoin.

- A low-interest environment increases market liquidity and accelerates inflows into risk assets like BTC.

To sustain its upward move, Bitcoin must be monitored not only through technical levels but also macroeconomic developments.

USDT Dominance (USDT.D) and Its Market Impact

USDT Dominance is a key indicator showing investors’ inclination toward stablecoins. If USDT.D rises, it signals increasing risk aversion; if it falls, it indicates capital inflow into crypto assets.

- 6.06% – Panic Selling Level:When USDT.D reaches this level, it signals investor flight from risk.A pullback from here could accelerate fund inflows into Bitcoin and altcoins.

- 4.98% – Start of Crypto Fund Inflow:Falling below this level indicates the beginning of new capital entering the crypto market.Supports BTC staying strong around the $82,300 level.

- 4.68% – Accumulation Zone:A zone where large investors accumulate BTC and altcoins.As long as USDT.D stays below 5.38%, $82,300 remains a strong support for Bitcoin.

TOTAL Market Cap Analysis: General State of the Crypto Market

To understand the general direction of the crypto market, we need to look at TOTAL market cap movements.

- 2.51T – Demand Zone & Strong Support:As long as we stay above this level, the crypto market maintains a positive outlook.A breakdown here could lead to sharp sell-offs in the altcoin market.

- 2.68T – Buyer Strength Test:If buyers dominate this level, the uptrend continues.Otherwise, we could see a return to the 2.51T zone.

- 2.84T – Main Resistance Level:A breakout here could open the door to new market highs.

- 3.16T – Profit-Taking Zone:If the 2.86T level is broken with volume, TOTAL could climb to 3.16T.This zone may trigger a pullback, but a breakout with strong volume could lead to new all-time highs in the crypto market.

If TOTAL stays above 2.51T, the market remains in a positive trend. A breakout above 2.84T confirms a bull market.

Roadmap for BTC and the Crypto Market

- As long as BTC holds above $80,691, the uptrend remains intact.

- A break above $87,500 signals the start of a bull trend.

- As long as USDT.D remains below 5.38%, $82,300 remains a strong support for BTC.

- Macroeconomic developments (especially Trump’s April 2 announcement and Fed interest rate decisions) will determine market direction.

- As long as TOTAL holds above 2.51T, the market outlook remains positive.

Disclaimer: This analysis does not constitute investment advice. It focuses on support and resistance zones that may present trading opportunities under current market conditions in the short and medium term. All trading and risk management decisions are the sole responsibility of the user. The use of stop-loss orders is strongly recommended.