All eyes are on the US labor market this week. The ADP Employment Change report, which measures private sector employment, is expected to show that 68,000 new jobs were created in August. The data, to be released on Thursday, could directly impact not only the employment landscape but also the interest rate decision of the Federal Reserve (Fed), the US central bank. The data is expected to be released around 3:30 PM Turkish time.

A critical threshold after July's shock

Weak nonfarm payrolls (NFP) data released in July shook markets, sharply depressing the dollar and raising questions about the Fed's ability to maintain its tight monetary policy. The unexpected decline even led to the dismissal of a senior official at the Department of Labor. Therefore, investors will be more sensitive to the ADP's projections.

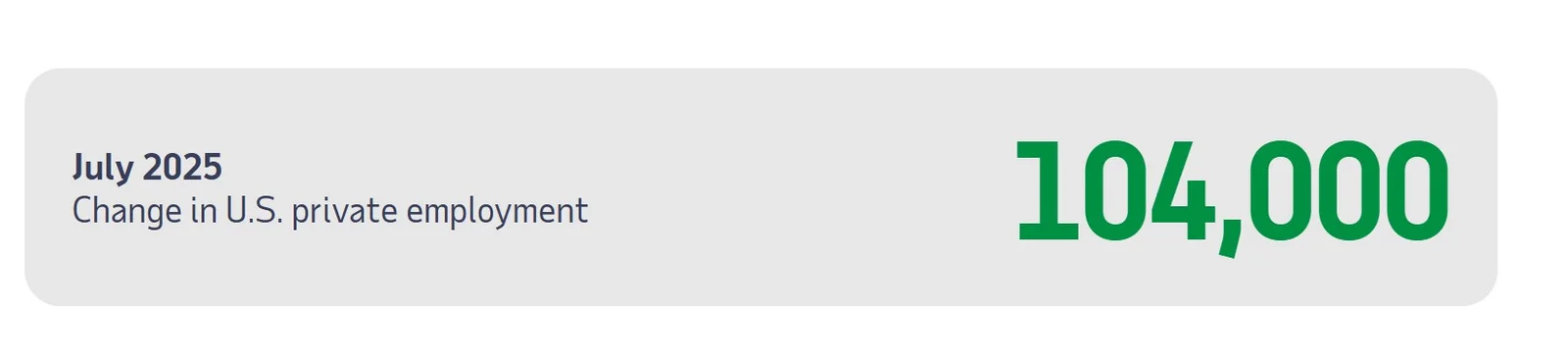

Expectations point to a job gain of only 68,000 in August, following a 104,000 increase in July.

This downward trend could reinforce signs of a cooling in the US economy.

Fed and Trump Pressure

This data will be the final employment report before the FOMC meeting on September 16-17. Chairman Jerome Powell had signaled that inflation is relatively easing and the impact of trade tariffs will be limited. This has increased the likelihood of a rate cut.

Meanwhile, President Donald Trump continues to harshly criticize the Fed for cutting interest rates more rapidly. According to data from the CME Group's Fed Watch Tool, markets are pricing in a 25 basis point rate cut in September at over 90%. A second cut before the end of the year is also a possibility.

If the ADP data falls short of expectations, the Fed could consider a more aggressive rate cut. In this scenario, selling pressure on the US dollar could intensify. Conversely, while stronger-than-expected data may support the dollar in the short term, it appears unlikely the Fed will change its policy direction on its own. Markets will be determined by the nonfarm payrolls (NFP) data, to be released on Friday.

How might cryptocurrencies be affected?

Labor market data is also indirectly critical for cryptocurrency markets. A Fed interest rate cut could suppress the value of the dollar and increase the appetite for risky assets. This could strengthen liquidity flows in cryptocurrencies, particularly Bitcoin and Ethereum. However, very weak data could increase concerns about an economic slowdown and reduce risk appetite. In such a scenario, crypto markets could also be negatively affected by volatility.

Ultimately, the ADP report will shape both the Fed's short-term roadmap and global market risk appetite. On the crypto side, the impact will be felt not directly, but through the dollar's course and investor psychology.