AAVE Technical Outlook

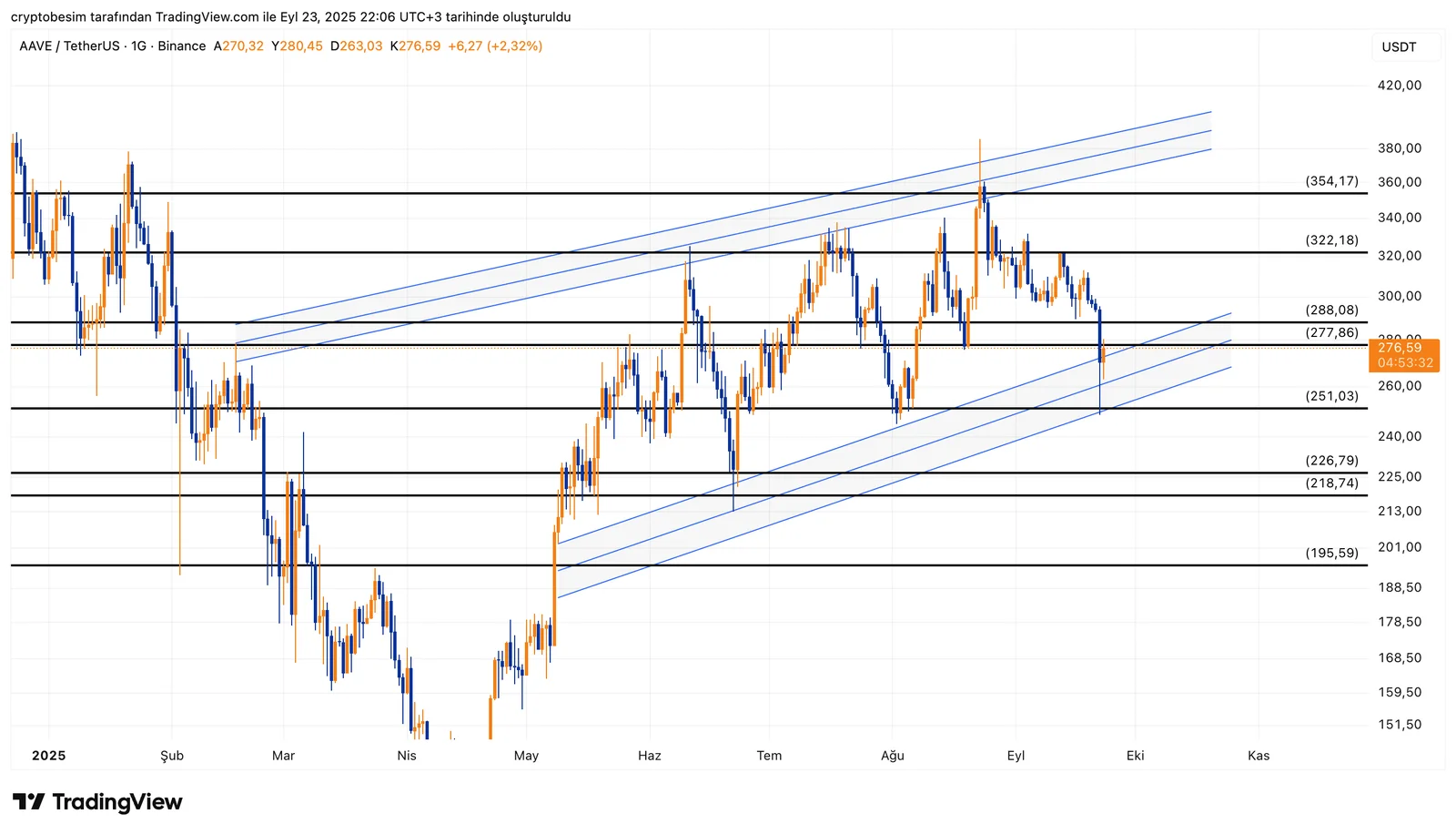

When we analyze the AAVE chart on a daily timeframe, we can see that the coin is still trading inside an ascending channel. The price, bouncing from the mid-border of the channel, is trying to recover. The overall structure remains positive, with the price still trading in an uptrend.

AAVE is currently trading around the level $276, while the first important resistance stands at $288. The price has the potential to surge to $322, followed by the upper border of the channel around $354, if this first important resistance level gets broken. Based on the channel height, there is a potential for the price to move to the level at $380 in the medium term.

We should be following the support levels as follows:

- $277 → the most important short-term support.

- $251 → the middle line of the channel, critical for maintaining the uptrend.

- $226–$218 → support zone near the lower band of the channel.

Summary:AAVE is still trading inside an ascending channel on the daily timeframe. Holding above the level $288 means that the targets above are still in play; however, a deeper pullback is possible if the price closes below $277.

These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, the user is responsible for their own actions and risk management. Moreover, it is highly recommended to use stop loss (SL) during the transactions.