AAVE Technical Analysis

AAVE has announced a new strategic roadmap for 2026. After the U.S. SEC officially ended its four-year review, the founder stated that AAVE will focus on three main areas: the V4 protocol upgrade, expansion of the Horizon RWA market, and the launch of a mobile app. These steps show that AAVE aims to grow not only in DeFi lending, but also in real-world assets and broader financial tools.

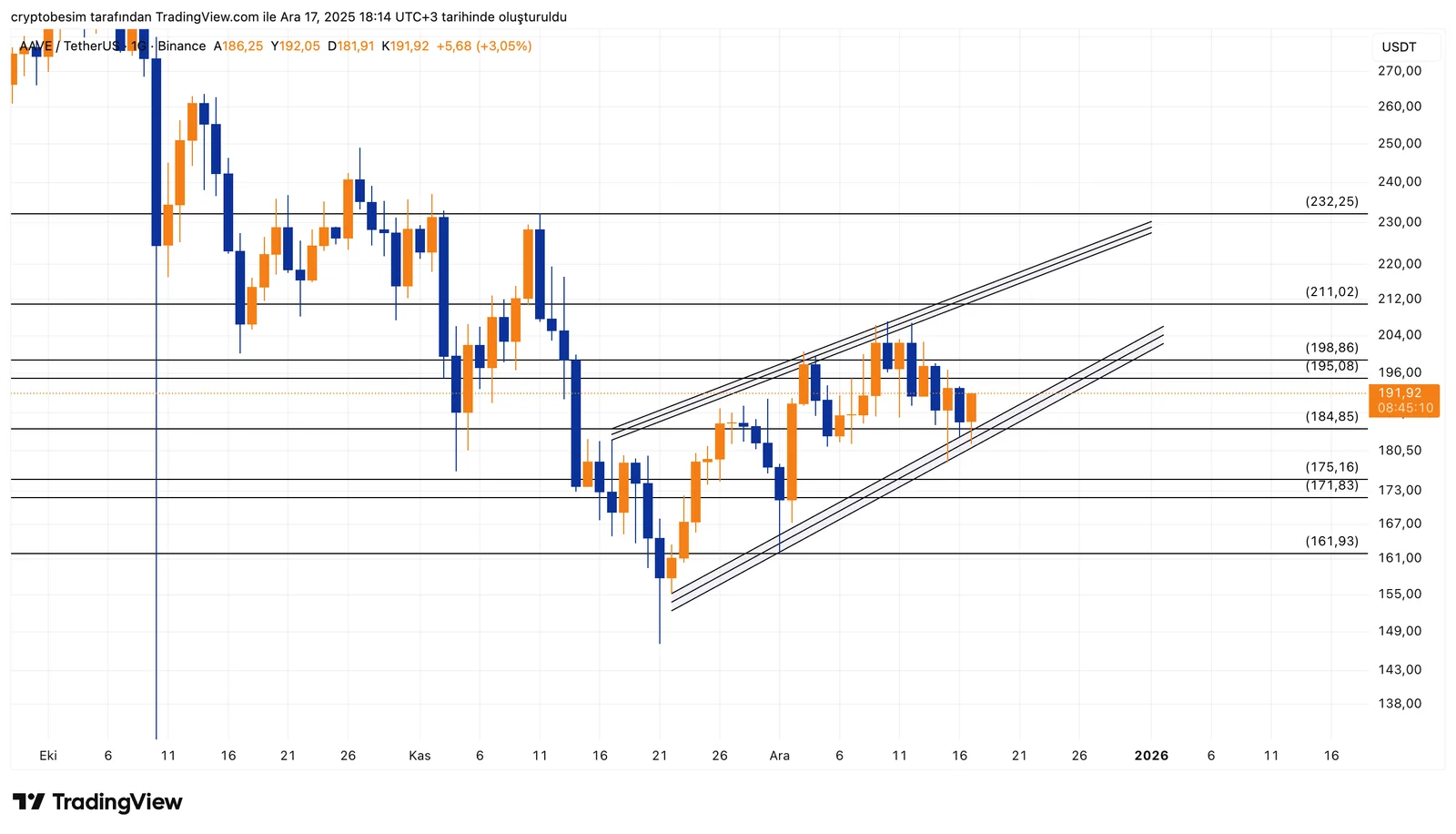

Analyzing the chart on a daily time frame, we see that AAVE is forming a clear descending wedge. Price action shows increasing pressure toward the lower boundary of this pattern. Though short-term bounces occur, they remain weak, and each recovery attempt is rejected at the upper trend line. This suggests that the risk of a downward breakout is currently higher.

The $184–$180 zone is a critical support area in the short term. The price is trying to hold above this level. If daily closes fall below this zone, selling pressure could accelerate. In that case, $175–$172 would be the first target, followed by $162–$155 if the decline deepens.

The key resistance zone is $198–$205. As long as the price stays below this area, downward pressure continues. A strong breakout above it could open the way toward $211 and later $230.

In summary, AAVE is at a key decision point within a descending wedge. The direction will largely depend on whether the $180 support holds.

These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, the user is responsible for their own actions and risk management. Morover, it is highly recommended to use stop loss (SL) during the transactions.