It's one of the busiest days of the year in the crypto derivatives market. According to Deribit data, over $16 billion worth of Bitcoin and Ethereum options are reaching maturity on October 31, 2025. Both BTC and ETH are experiencing a massive position closure, paving the way for sharp intraday price fluctuations.

$100,000 Critical for Bitcoin Options

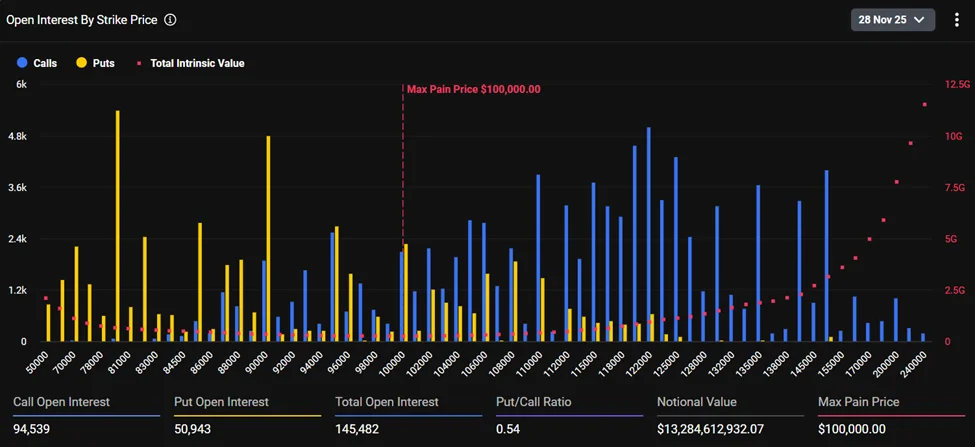

More than 145,000 contracts are expiring on the Bitcoin side with a notional value of approximately $13 billion. The market is trading around $91,000, but the maximum pain level is $100,000. In the options market, the maximum pain level refers to the price range where the greatest investor losses occur at expiration, and prices are frequently observed retreating towards this level. Therefore, upward pressure is likely to be felt as the price approaches expiration.

According to Deribit's analyst team, the sharp pullback in recent weeks has significantly reshaped BTC options positions. As Bitcoin fell from $126,000 to the $80,000 range, many investors holding long puts took profits. Despite this, a significant portion of investors remain cautious; put positions held in the $80,000-$85,000 range remain on the table.

Another factor closely watched by the market is the large-sized call condor strategy launched for the "year-end bull run." Analysts note that this structure, approximately $6.5 million targeting the $100,000-$106,000-$112,000 range, was the most dominant trade throughout the week. This structure points to the expectation of a strong upward movement in Bitcoin at the end of the year.

On the other hand, the persistent use of call overwriting strategies (i.e., investors selling calls at high strike prices against their holdings of BTC) is somewhat dampening the upside potential. This situation has led to a slight softening of implied volatility (IV) and suggests that the market has not yet committed to a one-way trend. On the Ethereum side, 574,000 contracts with a nominal value of approximately $1.7 billion are closing today. ETH is trading around $3,000, with maximum pain at $3,400. The put-call ratio, at 0.48, suggests a call bias, similar to Bitcoin. However, ETH's positioning isn't as aggressive as BTC's; it's more balanced and less bearish.

Market volatility is higher for both assets compared to the previous month. Bitcoin's IV average for major futures is around 45%, while Ethereum's is just below 70%. The main factors fueling this volatility are increasing macro uncertainty in the last quarter, the three-month price pressure, and the divergence among investors regarding direction. Analysts reiterate the need for caution in leveraged trading.

Today's major expiration close could lead to increased volatility. A price move toward Bitcoin's maximum pain level, or conversely, a sharp increase in volatility, could rapidly alter liquidity conditions for both BTC and ETH for the remainder of the day. In short, the market is experiencing a two-way tension, caught between strong year-end expectations and short-term caution.