Another critical threshold is being passed in the futures and options market on Friday; contracts totaling over $4 billion in value for Bitcoin and Ethereum are expiring. Derivatives volumes have increased significantly in recent weeks, particularly in Binance futures, suggesting the market is preparing for impending volatility. Today's chart reflects both cautious and selective risk appetite.

Bitcoin and ETH options expiring

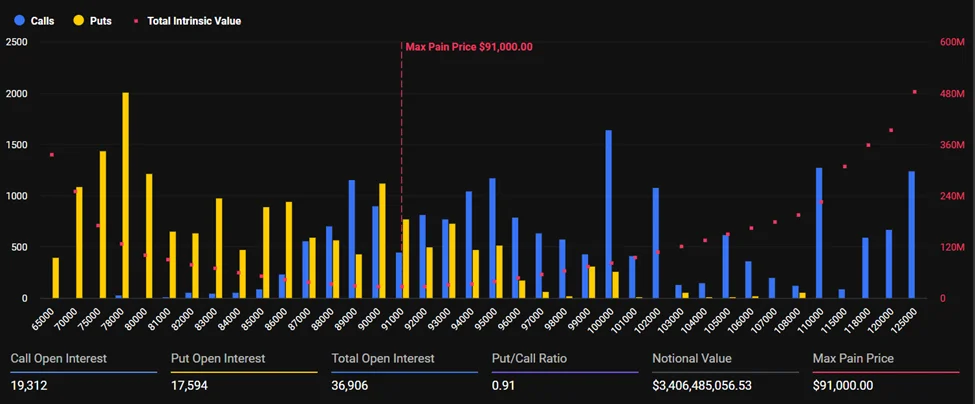

According to Deribit data, the total notional value of BTC and ETH options expiring today is around $4.07 billion. Bitcoin accounts for $3.4 billion of this. Total open interest stands at 36,906 contracts. The Put/Call ratio for Bitcoin is 0.91, meaning there are slightly more put options than calls in the market, suggesting a balanced, slightly defensive position. The "maximum pain" level for BTC is $91,000; if the price approaches this level, most contracts are expected to expire worthless. Bitcoin is currently trading slightly above this level.

There's clearer optimism on the Ethereum side. The notional value of ETH options expiring today is $668.9 million. Open interest stands at 210,304 contracts. The put/call ratio is 0.78, meaning demand for call options on ETH is stronger. The maximum pain point is at $3,050, slightly below the current price. This ratio and price structure suggest a more positive outlook for Ethereum compared to Bitcoin in the short term.

Today's expiration represents much smaller volume compared to last week. During the massive event on November 28th, over $15 billion worth of BTC and ETH options expired, meaning the current contract volume is less than a third of that day. This is due to institutional investors increasingly expanding their positions over longer periods. In Bitcoin, in particular, there's a significant accumulation of call options with expiration dates extending into mid-2026. This trend is consistent with institutional views that interest rate cut expectations, ETF demand, and liquidity conditions will be more supportive next year.

Derivatives analysis platform Laevitas highlights the steady increase in open interest in recent weeks, highlighting fresh capital inflows into the derivatives market. This suggests investors are preparing for a multi-quarter recovery. As professional movements gain traction, price discovery in the market becomes more systematic.

However, the short-term outlook remains mixed. Greeks.live's December 2nd update describes the market as "cautiously optimistic." Analysts say investors are searching for a bottom, but volatile price movements are eroding confidence. The put skew, in particular, remains elevated, meaning the market continues to price in short-term downside risk. Because the sharp moves in February are still fresh in memory, many professionals are avoiding "chasing calls on dips."

Amidst this uncertainty, another significant shift is the cooling of volatility. While volatility in Bitcoin has tightened, ETH options have become relatively more attractively priced. This is leading some to turn to Ethereum. Institutional investors are focused on capital preservation and generating sustainable returns rather than seeking quick profits. Deribit also notes that the general trend is toward "controlled and rational strategies rather than chasing 5-10x returns."