In the crypto derivatives markets, attention is focused on the high-volume Bitcoin and Ethereum options expiring on Friday, December 12th. With a total nominal value of approximately $4.3–$4.5 billion, these options are expected to expire, creating a cautious atmosphere across the market. The approaching end of the year, weakening liquidity, and recent macroeconomic developments are causing investors to avoid taking directional positions.

Bitcoin and Ethereum options expire today.

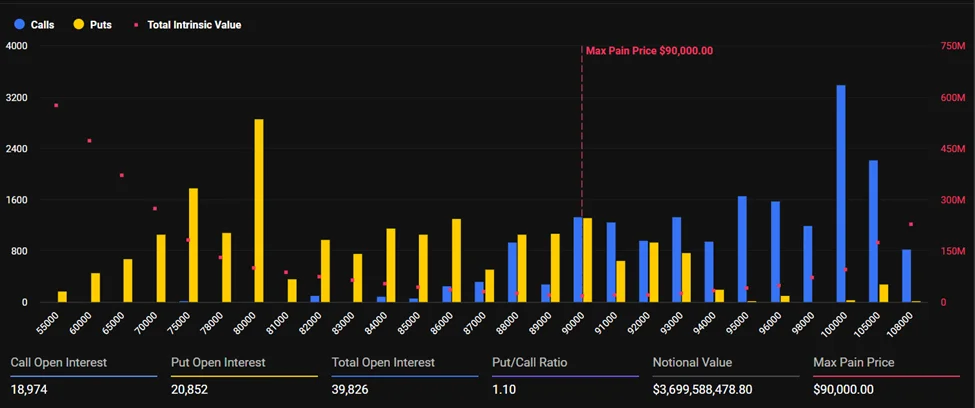

According to data, approximately 39,000 Bitcoin option contracts are expiring today. The total nominal value of these contracts is around $3.6-$3.7 billion. The put/call ratio in Bitcoin options is around 1.1, indicating a slight advantage of short positions over long positions. The "max pain" level in the market is around $90,000. The current price hovering near this level suggests that the option expiration may have a limited impact on the spot market.

The highest level of open interest in the options market is at $100,000. At this strike price, there are approximately $2.7 billion in open positions. Additionally, there are significant open positions totaling around $2 billion at the $80,000 and $85,000 levels. According to Coinglass data, the total Bitcoin options open interest across all exchanges has reached $54.6 billion. Deribit notes that pricing is largely stuck around $90,000 and that there is no clear directional expectation in the market. Deribit's assessment indicates that the balance between call and put options shows that investors expect limited volatility for this expiration date. It is emphasized that the market tends to maintain its current range until a new catalyst emerges. A similar picture is observed on the Ethereum front. Approximately 247,000 ETH options contracts expire today. The total nominal value of these contracts is around $768-770 million. In Ethereum options, the maximum pain level is calculated at $3,100, while the put/call ratio is fluctuating between 1.22 and 1.24. This ratio indicates that demand for selling hedging is relatively stronger on the Ethereum side as well. The total open position for ETH options across all exchanges is approximately $12 billion.

Deribit analysts note that positioning in Ethereum options has shifted towards a more neutral structure, but the concentration seen in call options above $3,400 reveals that investors are willing to price in sharper price movements should volatility increase again.

On the macro side, the 25 basis point interest rate cut by the US Federal Reserve this week has largely been priced in by the markets. Greeks Live analysts emphasize that it is premature to view this step as the beginning of a monetary expansion cycle. They point out that liquidity in the crypto markets has fallen to historically weakest levels as the year-end and Christmas period approach. This situation poses an obstacle to a strong and sustained rally in the short term. Looking at the spot markets, the total cryptocurrency market capitalization is hovering around $3.2 trillion. Bitcoin briefly rose above $93,000 but encountered resistance at that level and retreated back to the $92,000 range. Ethereum traded in a narrow range around $3,200 in the last 24 hours. While the altcoin market generally shows a sideways trend, limited gains were observed in privacy-focused projects such as Solana, Bitcoin Cash, Monero, and Zcash. The overall picture suggests that the market remains calm for now, despite high-volume options expiry times.