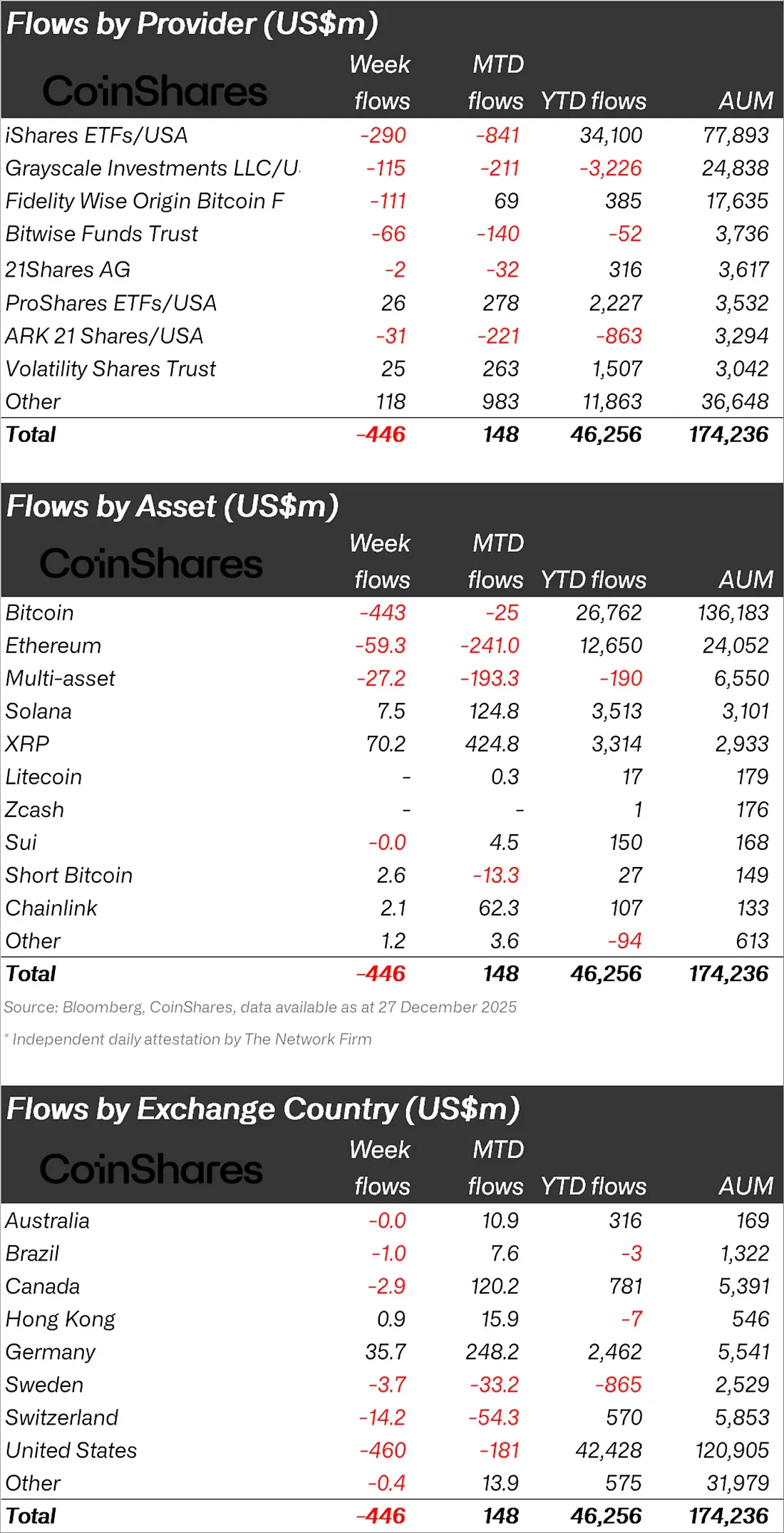

Data from CoinShares' Digital Asset Fund Flows Weekly Report shows that investor sentiment in digital asset investment products remains fragile. In the last week, there was a net outflow of $446 million from crypto investment funds, bringing the total outflow since the sharp price drop on October 10th to $3.2 billion. This indicates that even though the year as a whole appears strong, market confidence has not fully recovered in the short term.

Looking at the situation since the beginning of the year, the picture is more balanced. The total amount that entered digital asset funds throughout 2025 is $46.3 billion. This figure is quite close to the $48.7 billion inflow recorded in 2024. However, the fact that total assets under management (AUM) increased by only 10 percent during the year suggests that returns have remained limited for the average investor. When fund flows are taken into account, it appears that the year has not been a year of net gains for many investors.

The US is at the center of outflows, while Germany stands out positively

Looking at regional changes, it is seen that outflows are predominantly from the US. Last week, $460 million in outflows were recorded from listed products in the US. Switzerland also recorded a relatively limited outflow of $14.2 million. In contrast, Germany stood out with a weekly inflow of $35.7 million. The total inflow in Germany since the beginning of the month reached $248 million. This indicates that German investors are viewing the recent price pullbacks as buying opportunities. According to country-specific data, risk appetite is weak in the US, while a more selective and opportunity-oriented approach is emerging in some parts of Europe.

Pressure continues on Bitcoin and Ethereum

Looking at assets, outflows from Bitcoin and Ethereum dominated the week. Net outflows of $443 million were recorded from Bitcoin investment products and $59.3 million from Ethereum funds. Total outflows from Ethereum since the beginning of the month reached $241 million, while the monthly net inflow from Bitcoin was recorded at -$25 million. Despite this, year-to-date figures are still high. Bitcoin funds have attracted net inflows of $26.7 billion throughout 2025, while Ethereum funds have seen net inflows of $12.6 billion. However, recent weeks indicate that investors are acting cautiously in these two major assets and preferring to reduce their positions.

The difference is more pronounced in altcoins.

The altcoin data shown in the image more clearly reveals the divergence within the market. XRP was the strongest performing asset last week with inflows of $70.2 million. The total amount that entered XRP products since the beginning of the month is $424.8 million. The total inflow into XRP funds since the beginning of the year has exceeded $3.3 billion.

Solana also performed positively. Last week, Solana funds saw inflows of $7.5 million, bringing the total monthly inflow to $124.8 million. Year-to-date Solana inflows stand at $3.5 billion. In contrast, the outflow trend continues in multi-asset funds and some smaller products. While multi-asset products saw weekly outflows of $27.2 million, total outflows since the beginning of the month reached $193 million. Although there were limited inflows into Chainlink and some niche products, the overall picture shows that investors are selectively taking positions in certain altcoins.