Mt. Gox, once the largest Bitcoin exchange, has once again postponed debt payments to its investors. According to a new statement, the deadline for repayments to creditors has been extended to October 31, 2026. The distribution, previously scheduled for 2025, has been brought forward by one year with court approval.

Nobuaki Kobayashi, the trustee overseeing Mt. Gox's liquidation process, stated, "Since some creditors were unable to complete the necessary documents, it was deemed appropriate to extend the deadline to allow for a reasonable completion of payments." This indicates that there are still a large number of investors who have not received payments.

34,000 BTC Not Yet Distributed

The exchange currently holds 34,689 Bitcoins in its wallets. The current market value of this amount is over $4 billion. After the approximately 24,000 BTC transferred in 2024, the majority of the remaining balance remains. Past distribution rounds consisted of a "basic payment," an "early lump sum payment," and an "interim payment." However, because not all creditors could participate in the process, the payment schedule was extended.

This new postponement adds a new link to an eleven-year chain of uncertainty that has persisted since the 2014 collapse of the Mt. Gox process. As is well known, the exchange went bankrupt after 850,000 BTC were stolen at the time. Approximately 127,000 users have been waiting to recover their losses ever since.

Positive Reception for the Market

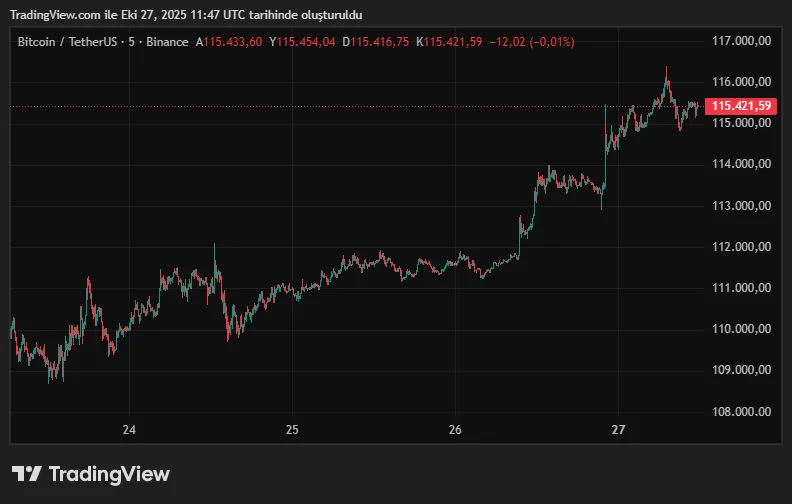

The news of the postponement had a positive impact on the Bitcoin market in the short term. The BTC price rose by approximately 4 percent in the last 24 hours, reaching $115,500. Experts believe this development is reducing selling pressure in the markets.

The sudden release of Mt. Gox's Bitcoin holdings has caused panic among investors in the past. However, with the gradual payments made in recent years, many creditors have preferred to hold their coins long-term rather than sell them. Despite transferring 47,000 BTC to existing investors during the distribution via Kraken in the summer of 2024, prices did not drop significantly.

The Mt. Gox case is now seen as a turning point in crypto history. Each new delay both tests investors' patience and postpones selling pressure in the market. According to analysts, a sudden sell-off could have shaken the market in 2025 due to weakened liquidity in OTC (over-the-counter) markets; this risk has been mitigated by this decision.

In short, Mt. Gox's new plan, which will last until 2026, will keep a significant portion of the Bitcoin supply off the market for a while longer. This could have a positive impact on both price stability and investor psychology. However, as 2026 approaches, the "Mt. Gox effect" may resurface.