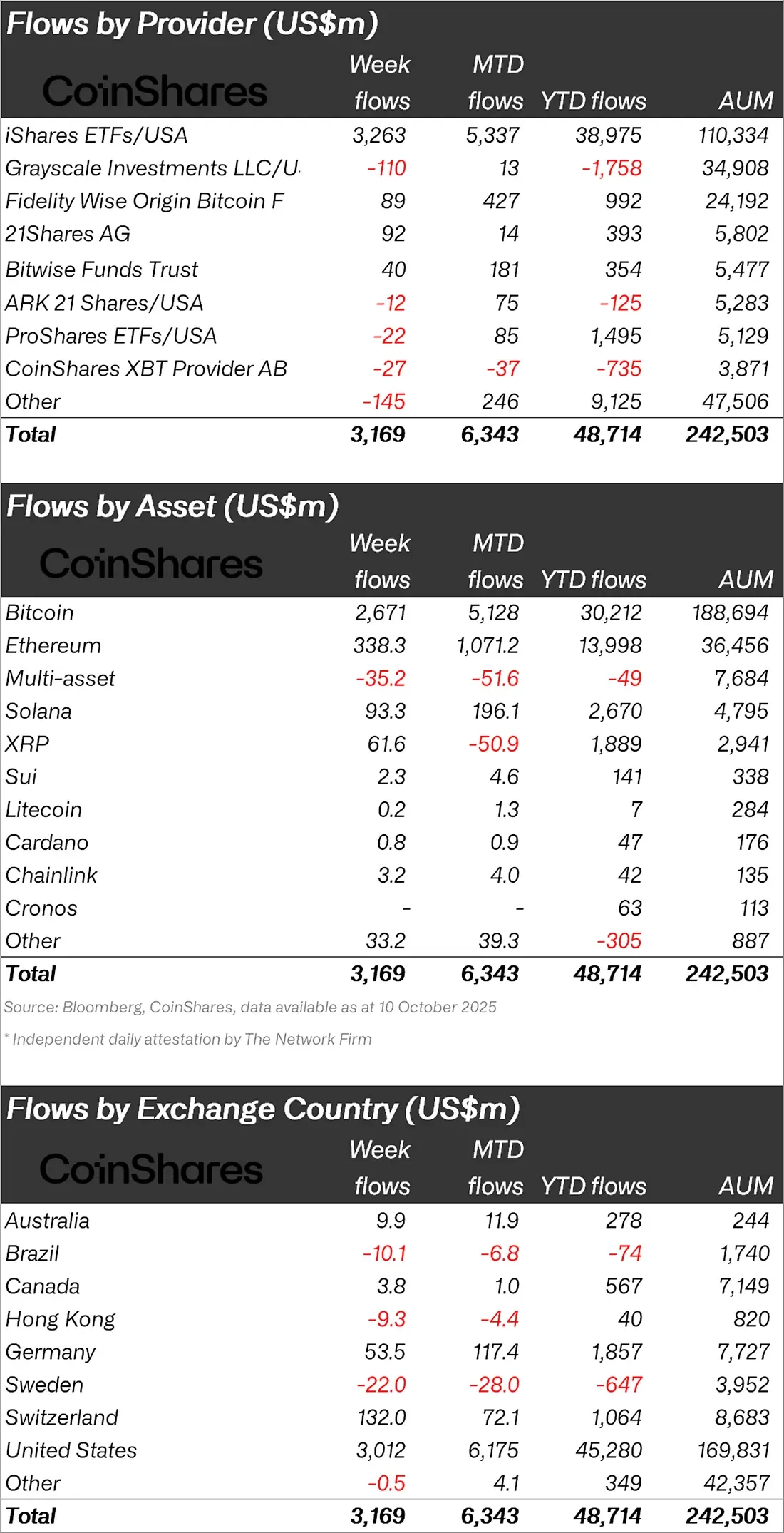

Despite last Friday's major market crash, crypto investment products had a strong week. According to CoinShares data, digital asset investment funds recorded a total net inflow of $3.17 billion over the last seven days. This brings the total amount of money entering funds throughout 2025 to $48.7 billion, surpassing last year's record.

US President Donald Trump's announcement of new tariffs on China was the driving force behind the sharp market fluctuations. This triggered a global sell-off, quickly liquidating over $20 billion in positions. However, James Butterfill, Head of Research at CoinShares, stated that Friday's panic selling had limited impact on funds: "Despite the sharp market correction, there was only a weak outflow of $159 million on Friday."

Trading volumes hit records

Another noteworthy piece of data in the report was the record increase in trading volume. Weekly trading volume for crypto investment products reached $53 billion, with $15.3 billion in transactions on Friday alone. This figure is twice the 2025 average. However, total assets under management (AUM) decreased by 7% on a weekly basis, falling from $254 billion to $242 billion.

Bitcoin funds took the lead

The highest inflows throughout the week occurred in Bitcoin-focused investment products. $2.67 billion flowed into Bitcoin funds, bringing the total inflow since the beginning of the year to $30.2 billion. However, this figure is still approximately 30% below the $41.7 billion total in 2024. Butterfill also emphasized that trading volumes reached an all-time high of $10.4 billion during Friday's price correction.

Ethereum investment products also managed to close the week positively. ETH funds saw $338 million inflows, while Ethereum also experienced the largest individual loss of the week, with a single-day outflow of $172 million on Friday. Butterfill stated that investors considered Ether products "the most vulnerable asset" during the market crash.

Altcoin funds slowed

A significant slowdown was observed in leading altcoin investment products like Solana and XRP. Solana funds saw inflows of $93.3 million, while XRP funds saw inflows of $61.6 million. These figures were significantly lower than the previous week's massive inflows of $706.5 million and $219 million, respectively.

Despite this decline, experts believe that the expected Solana and XRP ETF approvals in the US could generate new momentum in the market. However, as long as the current government shutdown continues, these approvals are likely to be delayed. Currently, at least 16 crypto ETF applications are awaiting approval from the US Securities and Exchange Commission (SEC). According to Nate Geraci, President of NovaDius Wealth Management, "a flood of spot crypto ETFs will be expected" as the government reopens.