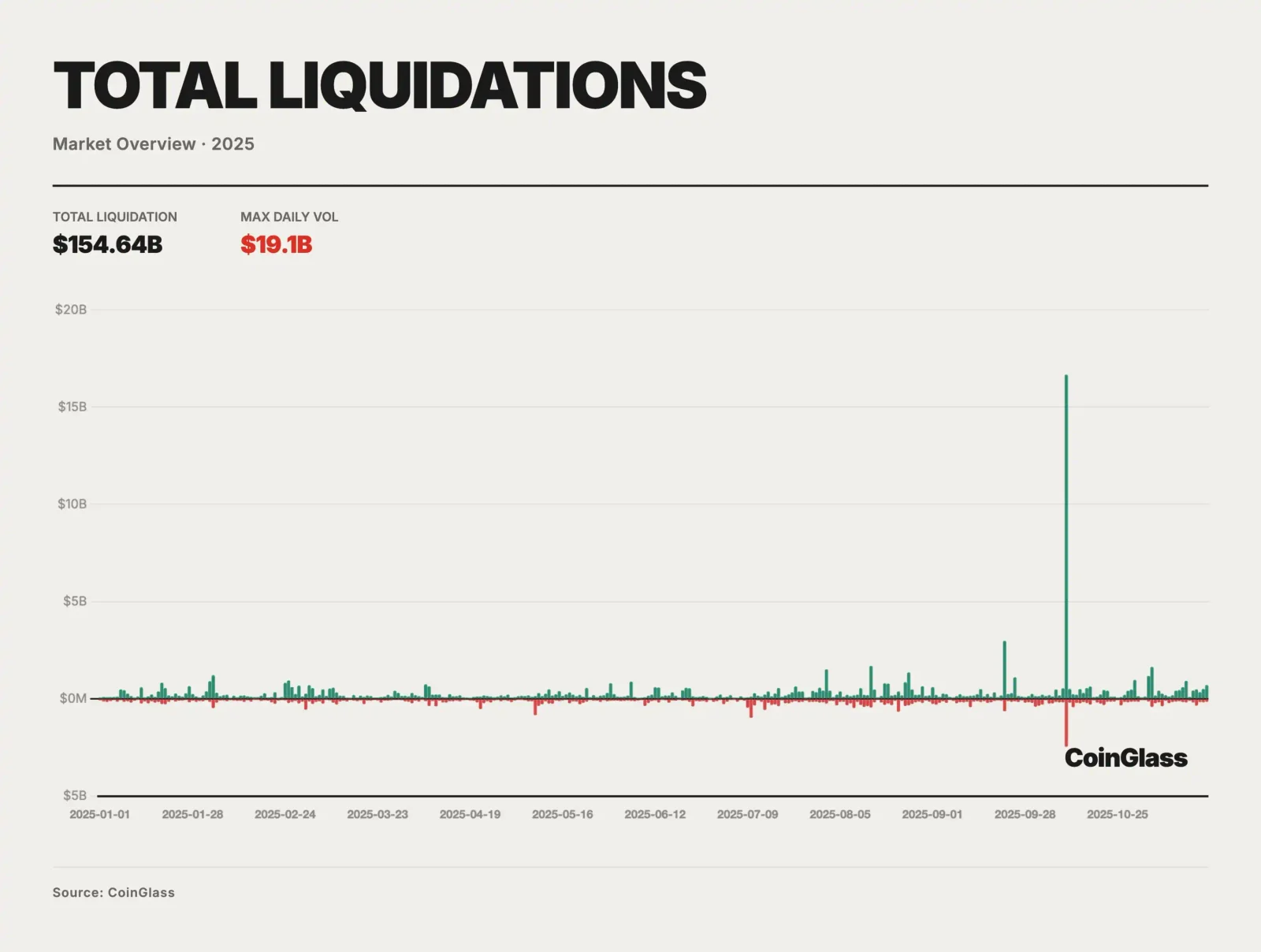

The cryptocurrency markets experienced an intense and turbulent period throughout 2025, both in terms of price movements and market structure. According to CoinGlass data, the total amount of liquidations in the crypto market throughout the year exceeded $150 billion. The average daily liquidation amount ranged between $400 and $500 million.

The high volume liquidations of both long and short positions throughout the year showed that the uncertainty in the market was two-sided. The sharp price fluctuations, especially led by Bitcoin and Ethereum, brought about on-chain liquidations in the futures market. While the liquidation volume approached the billion-dollar level on some days, these sudden liquidations also triggered short-term panic selling in the spot markets.

What happened in the crypto markets in 2025?

One of the most notable developments of 2025 was the impact of macroeconomic fluctuations on crypto prices. Inflation and interest rate data from the US strengthened the search for direction in risky assets throughout the year. While expectations of interest rate cuts occasionally fueled buying in the crypto market, the climate of uncertainty led to a rapid increase in leveraged positions, followed by sharp liquidations.

Regulation was also a key factor shaping market dynamics in 2025. Draft regulations on digital assets in the US and Europe directly impacted investor sentiment. In particular, regulatory steps targeting stablecoins, decentralized finance (DeFi) protocols, and cryptocurrency exchanges occasionally generated sudden price movements in the market. Following such news flows, leveraged positions were rapidly unwinded, and liquidation volumes increased significantly.

On the institutional side, a cautious but steady interest was observed throughout the year. Spot ETFs and portfolio adjustments by large funds shaped the medium-to-long-term outlook of the market. However, even these institutional moves were not enough to curb the tendency of short-term traders to use high leverage. On the contrary, increased liquidity and trading volume paved the way for more aggressive positions in futures markets. The altcoin market also experienced high volatility in 2025. While projects focused on AI, gaming, and real-world assets (RWA) saw periodic rallies, these increases were followed by sharp corrections. This cycle led to significant liquidations, particularly for small and medium-sized investors. The consistent liquidation bars in CoinGlass data show that this volatile structure extended throughout the year. Overall, 2025 was a year where high risk and high volatility intertwined for the crypto markets. The total liquidation amount exceeding $150 billion reveals the weight of leveraged trading on the market, while the average daily liquidation figure of $400-500 million points to the persistence of this risk.