Hyperliquid Strategies has taken a notable step into the cryptocurrency market. With its S-1 filing with the US Securities and Exchange Commission (SEC), it aims to raise up to $1 billion in capital. This funding will focus on the acquisition of the company's native token, HYPE, and expanding its institutional crypto assets.

HYPE has been filed with the SEC

Hyperliquid Strategies is the result of the ongoing merger between biotechnology company Sonnet BioTherapeutics and special purpose acquisition company (SPAC) RorschachILLC. Upon completion, the company will be led by former Barclays CEO Bob Diamond as Chairman, and David Schamis as CEO. The filing also states that the company holds 12.6 million HYPE tokens and approximately $305 million in cash reserves. According to the document filed with the SEC, the company plans to conduct this capital raising process by issuing 160 million shares. It also emphasizes that the funds will be allocated not only for general corporate expenses but also for systematically purchasing HYPE tokens. The filing clearly states a plan to generate yield by staking the tokens extensively.

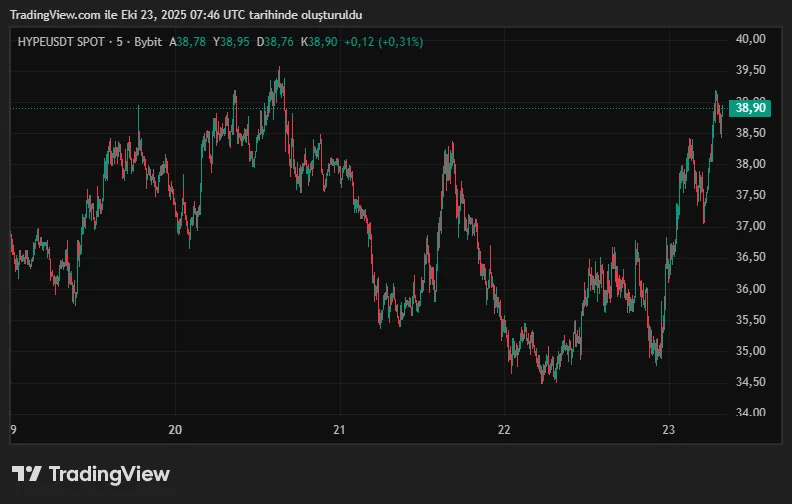

This development was a positive catalyst for the HYPE token. Following the announcement, the token gained approximately 10% in value. However, the overall crypto market is experiencing a stagnation and correction trend. In this context, the company's capital raising move can be perceived as a sign of confidence among investors.

Why are "Hyperliquid Strategies" important?

This development is critical. The company is bringing the capital raising process and share issuance methods commonly used in the traditional finance world to the decentralized finance (DeFi) space. It's rumored that this strategy, which focuses specifically on the HYPE token, could cause temporary fluctuations in the token supply, as it also means a decrease in the circulating amount of staked assets. Therefore, it is expected to have a certain impact on price stability.

Furthermore, the Hyperliquid ecosystem is quite strong in terms of volume. The platform holds a significant share of perpetual futures contracts. According to market data, decentralized futures trading volume approached $1 trillion in the first 23 days of October.

While such corporate moves are perceived positively, there are some important points to consider. First, raising capital through share issuance could pose a risk of dilution for existing shareholders. Furthermore, volatility in the altcoin markets and macroeconomic uncertainties remain significant risks. The company's token accumulation strategy requires a long-term perspective. Therefore, fluctuations are expected in the short term.

HYPE price on the rise

Following these developments, the HYPE price rebounded strongly in the last 24 hours, rising 11.47 percent to $38.57. The intraday trading range was between $34.63 and $39.06. On the weekly chart, the token continues its gradual upward trend with a 2.3% increase. However, it appears to have lost over 20% of its value in the last 30 days.