World Liberty Financial (WLFI), a crypto startup linked to the Trump family, is preparing to launch its new platform, “World Swap,” which focuses on cross-border money transfers and currency exchange transactions. With this move, the company aims to reduce global remittance costs and create an alternative to traditional financial institutions.

The announcement of World Swap was made at the Consensus Hong Kong event. WLFI co-founder Zak Folkman pointed out that the global volume of currency transfers exceeds $7 trillion annually, emphasizing that intermediary institutions charge significant commissions in the current system.

An alternative to high remittance fees

According to Folkman, commission rates applied to cross-border money transfers worldwide range from 2% to 10%. WLFI plans to reduce these costs to a level “far below existing providers” thanks to its blockchain-based infrastructure.

World Swap aims to offer an interface where users can conduct transactions without dealing with crypto wallet details. The platform is said to simplify the processes of sending and receiving digital dollars by providing an experience similar to traditional financial applications. According to the company's statement, the system; It will work directly integrated with bank accounts and debit cards. Thus, users will be able to transfer money between different countries with almost instantaneous reconciliation.

USD1 stablecoin at the center

The World Swap ecosystem will be based on the USD1 stablecoin issued by WLFI. The company defines USD1 as a "cash-backed digital dollar". This asset will be used as a liquidity base, medium of exchange, and consensus layer.

Thanks to the stablecoin-centric structure, the aim is to minimize price volatility. With this model, WLFI plans to both benefit from the speed and cost advantages of blockchain and increase user confidence with a dollar-pegged structure.

The company's previously launched World Liberty Markets lending platform also stands out as a step towards increasing the use of USD1. WLFI announced that this platform reached a lending volume of $320 million and a borrowing amount of over $200 million within four weeks of its launch.

Political and Ethical Debates on the Agenda

WLFI's growth initiatives are also bringing about political and ethical debates in the US. The activities of the crypto startup, supported by the Trump family, coincide with the period in which President Donald Trump's influence on US crypto policy is increasing.

Although the White House argues that there is no conflict of interest, the company's ownership structure and foreign investment connections, in particular, have raised questions in the public eye. It is reported that the US House of Representatives has launched an investigation into some foreign investments allegedly linked to the company.

Despite all these controversies, WLFI is pursuing an aggressive growth strategy in the field of blockchain-based financial infrastructure. The launch of World Swap means a new revenue stream for the company; it could also intensify competition in stablecoin-based payment systems.

In the coming weeks, the platform's fee structure, supported currencies, and technical details are expected to be shared with the public. World Swap's success will depend on regulatory clarity, price advantage, and the adoption rate of the USD1 stablecoin.

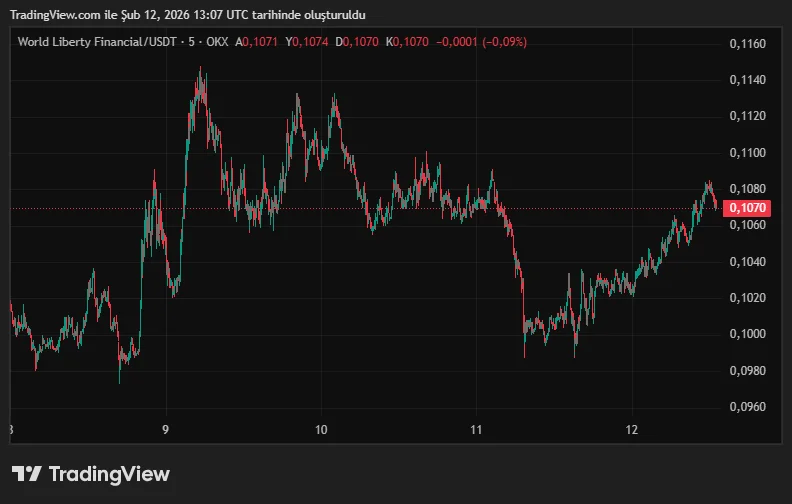

Meanwhile, it's worth noting that the WLFI token is currently trading at $0.1071619.