WLD

Worldcoin has recently gone through a recovery process that has drawn attention in the crypto markets. The price, which had long been under pressure, has not only broken its short-term descending trend, but also made a strong bounce from the lower band of its long-term channel structure. These two technical developments suggest that a brand-new chapter may have opened for WLD.

The current price is at $1.097, and the charts indicate that important resistances are being tested in the short term, while in the long term, we are facing signals of a structural transformation.

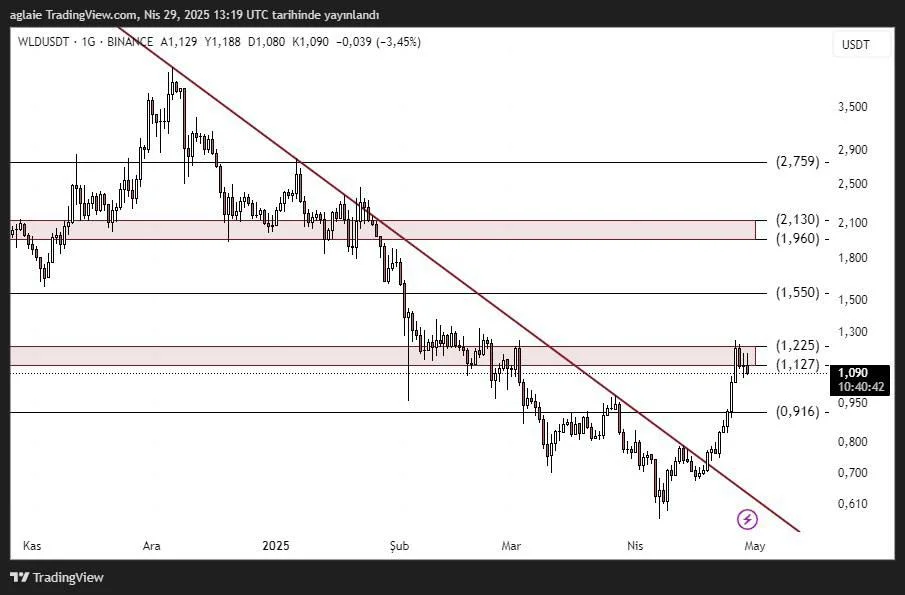

Short-Term Outlook: Downtrend Broken

With the uptrend that began from the $0.60 level, WLD has clearly broken the descending trendline, which previously acted as a strong resistance multiple times. After this breakout, the price quickly tested the $1.22 level, where a short-term pause occurred. However, if this zone is broken with strong volume, it would be a technical confirmation that the rally could deepen for WLD.

Support Zones:

- $0.916: The level where the trend breakout occurred; currently acting as the main support

- Below $0.750: Liquidity support

Resistance Zones:

- $1.127–$1.225: Current resistance, facing rejection here

- $1.550: Mid-term major resistance

- $1.960 – $2.130: Zone with broad-based selling pressure

- $2.759: Long-term target level

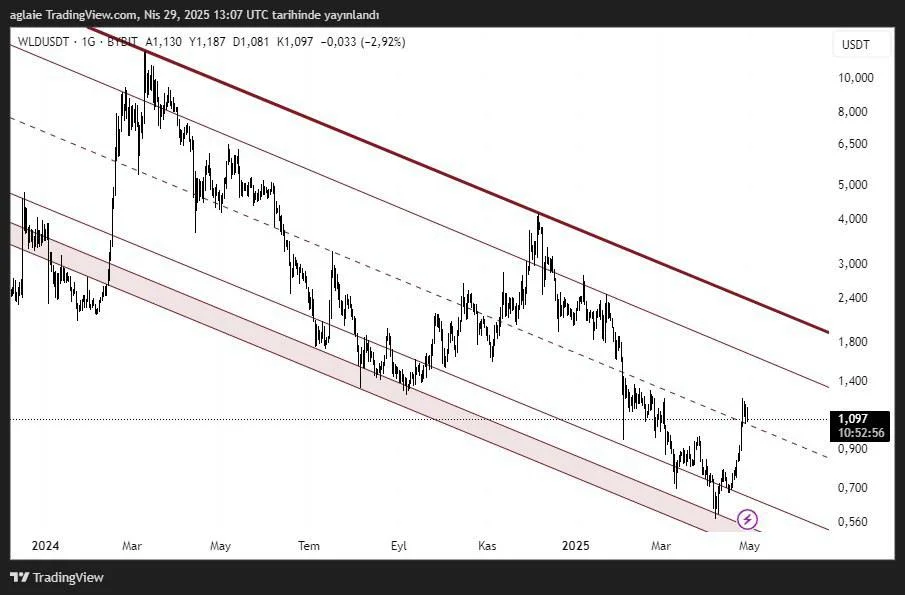

Long-Term Channel: Strong Reaction from the Lower Band

In the long-term view, as noted in our WLD analysis shared on April 11, we had indicated a potential bounce from the lower support of the fib channel shown on the chart. We are now witnessing a strong upward movement with momentum toward the middle of that channel.

What’s more remarkable is that this breakout also occurred at the lower band of a long-term descending channel. With strong buying pressure from the bottom of this channel, WLD climbed toward the middle band and is now consolidating in this region. This is one of the clearest examples of a "healthy reversal structure" in technical analysis.

Long-Term Support Zones:

- $0.700 – $0.900: Lower band of the channel

- $0.560: Oversold zone

Long-Term Targets:

- $1.550: Middle band of the channel

- $2.400 – $2.700: Expansion targets toward the upper band

- $3.500 – $5.000: Major resistance zones that could be considered if investor sentiment shifts

If WLD breaks through the resistance around $1.22, technical targets would be $1.55, followed by the $1.96 – $2.13range. Such a move would also indicate that the middle band of the long-term channel has been surpassed, which could lead to a faster acceleration of the uptrend.

On the other hand, if the price decides to pause at these levels, a retest of the $0.91 – $1.09 band could create a healthy "new bottom" — showing that the positive structure remains intact.

Summary:

WLD has both broken its short-term downtrend, sparking a bullish move, and formed a significant reversal structurewith buying from the bottom of the long-term descending channel.If this move gains sustained strength, a new uptrend could replace the sharp declines seen in 2023 and 2024.

These analyses do not constitute investment advice. They focus on support and resistance levels that are believed to present short- and medium-term trading opportunities depending on market conditions.All trading decisions and risk management are the sole responsibility of the user.Use of stop-loss orders is strongly recommended for any positions mentioned.