The World Liberty Financial (WLFI) project, backed by the Donald Trump family, made a move that sparked controversy in the crypto market. The project team blacklisted the wallet of one of its biggest supporters, Tron founder Justin Sun, and froze billions of dollars in WLFI tokens. This decision caused a sharp drop in the token's price and sparked debates within the community about decentralization and transparency.

Why was Sun's wallet blocked?

According to on-chain data, the decision followed a transfer of approximately $9 million worth of WLFI from Sun's wallet. Arkham Intelligence data revealed that addresses affiliated with Sun sent large amounts of tokens to exchanges, fueling allegations of "insider selling" within the community. The price of WLFI plummeted immediately before these developments, falling 24 percent in a single day.

While the World Liberty team did not officially comment on the matter, they maintained in a post on Sun X that the transfers were merely "small-scale exchange tests." "We didn't make any purchases or sales. It's impossible for these amounts to influence the market," Sun said, adding that he found the blacklisting decision unfair.

Sun: "Our rights are being violated"

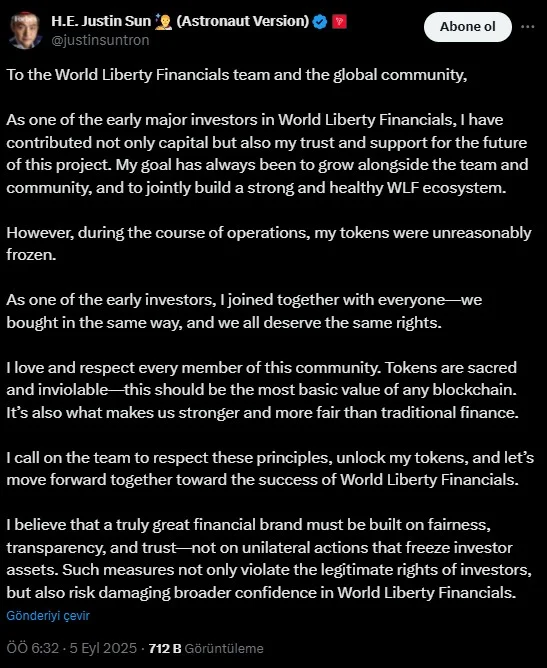

Sun, one of WLFI's advisors who invested in the project with a $75 million purchase, called on the team to freeze the 540 million unlocked and 2.4 billion locked WLFI tokens. "These arbitrary freezes, which violate investor rights, undermine confidence in the project," Sun said, demanding the decision be overturned. Sun stated:

“As an early major investor in World Liberty Financials, I invested not only my capital in this project, but also my trust and support for its future. My goal has always been to grow alongside the team and community and jointly build a strong and healthy WLF ecosystem.

However, during this process, my tokens were unjustly frozen.

As an early investor, I bought in the same way as everyone else; we all have equal rights and deserve the same rights.

I love and respect every member of this community. Tokens are sacred and inviolable—this should be the most fundamental value of any blockchain. This is what makes us stronger and more equitable than traditional finance.

I urge the team to respect these principles, unlock my tokens, and move forward together for the success of World Liberty Financials.

In my belief, a truly great financial brand is built on fairness, transparency, and trust—not on decisions that unilaterally freeze investor assets. Such actions not only violate investors' legitimate rights, It also risks undermining public trust in World Liberty Financials.”

Sun emphasized that he supports the project's future and expects fair governance, stating, “A true financial brand is built on fairness, transparency, and trust, not unilateral decisions.”

Growing Concerns in the Community

WLFI's launch was met with considerable hype. Trading volume exceeded $1 billion in the first few hours, while the price fell from $0.46 to $0.25. However, after Sun's wallet was blacklisted, the price briefly dropped to $0.16, losing half its value. At the time of writing, it was trading at $0.18.

There are two distinct viewpoints within the community. One group argues that the development team is taking a justified step to prevent potential manipulation by large investors. The other group harshly criticizes such unilateral decisions for a project promoted with the claim of “decentralization.”